Vroom Results Presentation Deck

year-end liquidity

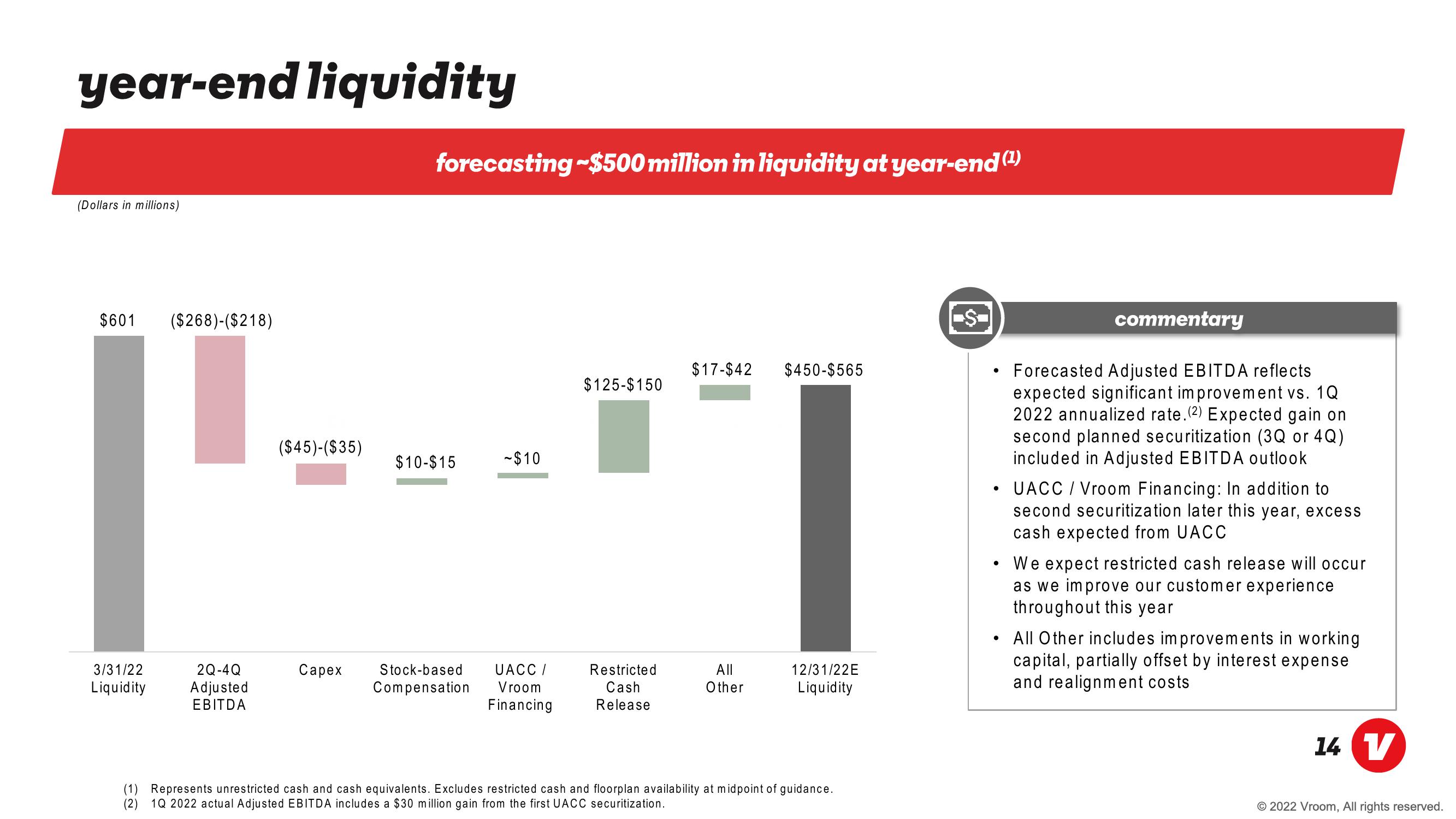

(Dollars in millions)

$601 ($268)-($218)

3/31/22

Liquidity

2Q-4Q

Adjusted

EBITDA

($45)-($35)

Capex

forecasting~$500 million in liquidity at year-end (¹)

$10-$15

-$10

Stock-based UACC /

Compensation Vroom

Financing

$125-$150

Restricted

Cash

Release

$17-$42 $450-$565

All

Other

12/31/22E

Liquidity

(1) Represents unrestricted cash and cash equivalents. Excludes restricted cash and floorplan availability at midpoint of guidance.

(2) 1Q 2022 actual Adjusted EBITDA includes a $30 million gain from the first UACC securitization.

is

●

●

commentary

• UACC / Vroom Financing: In addition to

second securitization later this year, excess

cash expected from UACC

●

Forecasted Adjusted EBITDA reflects

expected significant improvement vs. 1Q

2022 annualized rate. (2) Expected gain on

second planned securitization (3Q or 4Q)

included in Adjusted EBITDA outlook

We expect restricted cash release will occur

as we improve our customer experience

throughout this year

All Other includes improvements in working

capital, partially offset by interest expense

and realignment costs

14 V

© 2022 Vroom, All rights reserved.View entire presentation