Pathward Financial Results Presentation Deck

COMMERCIAL FINANCE MIX ¹

●

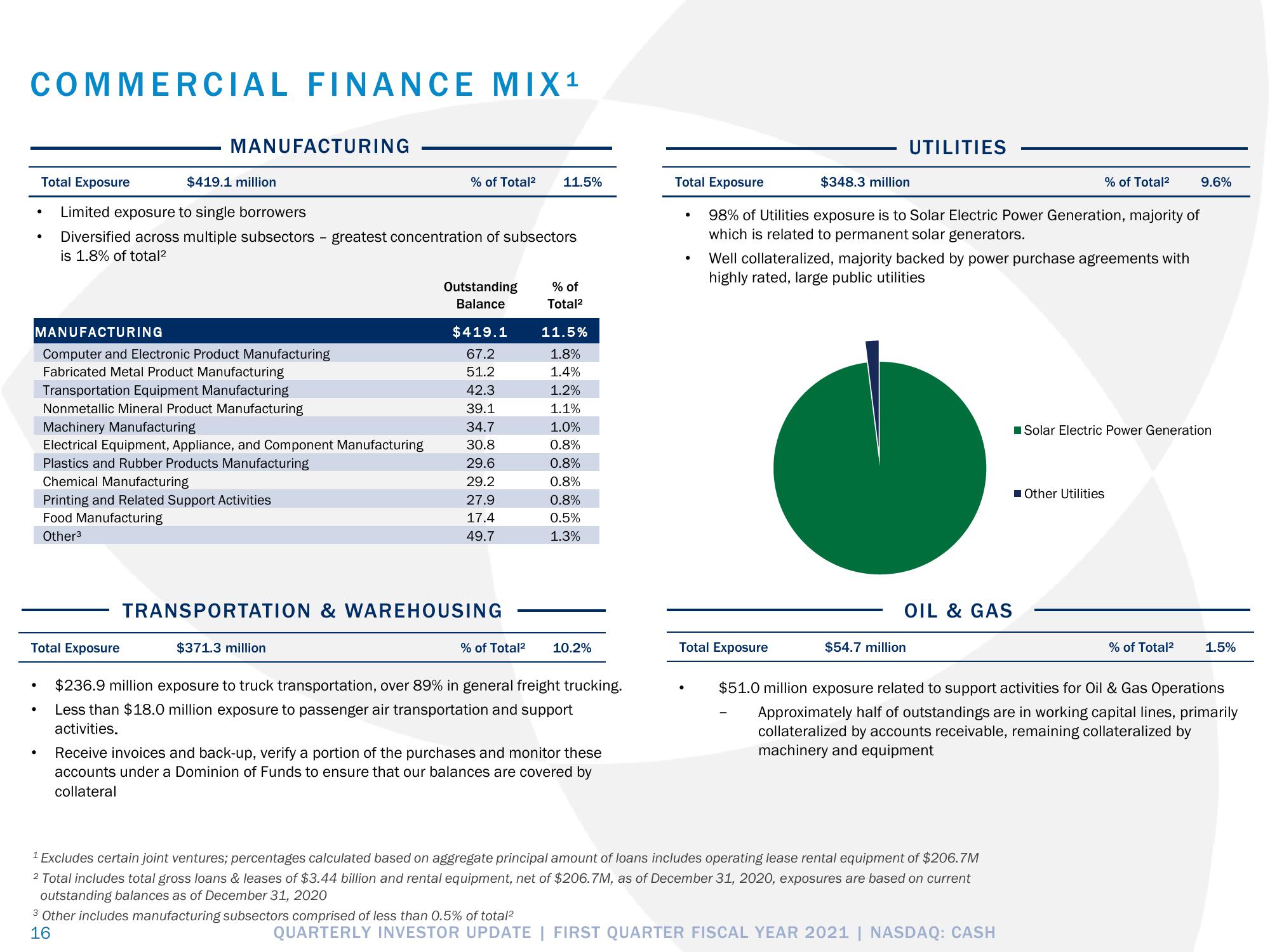

MANUFACTURING

Computer and Electronic Product Manufacturing

Fabricated Metal Product Manufacturing

Transportation Equipment Manufacturing

Nonmetallic Mineral Product Manufacturing

Machinery Manufacturing

Electrical Equipment, Appliance, and Component Manufacturing

Plastics and Rubber Products Manufacturing

Chemical Manufacturing

Printing and Related Support Activities

Food Manufacturing

Other³

Total Exposure

●

●

Total Exposure

$419.1 million

Limited exposure to single borrowers

Diversified across multiple subsectors - greatest concentration of subsectors

is 1.8% of total²

●

MANUFACTURING

% of Total² 11.5%

$371.3 million

Outstanding

Balance

$419.1

67.2

51.2

42.3

39.1

34.7

30.8

29.6

29.2

27.9

17.4

49.7

TRANSPORTATION & WAREHOUSING

% of

Total²

11.5%

1.8%

1.4%

1.2%

1.1%

1.0%

0.8%

0.8%

0.8%

0.8%

0.5%

1.3%

% of Total² 10.2%

$236.9 million exposure to truck transportation, over 89% in general freight trucking.

Less than $18.0 million exposure to passenger air transportation and support

activities.

Receive invoices and back-up, verify a portion of the purchases and monitor these

accounts under a Dominion of Funds to ensure that our balances are covered by

collateral

3 Other includes manufacturing subsectors comprised of less than 0.5% of total²

16

Total Exposure

98% of Utilities exposure is to Solar Electric Power Generation, majority of

which is related to permanent solar generators.

●

.

$348.3 million

Total Exposure

UTILITIES

Well collateralized, majority backed by power purchase agreements with

highly rated, large public utilities

OIL & GAS

$54.7 million

Excludes certain joint ventures; percentages calculated based on aggregate principal amount of loans includes operating lease rental equipment of $206.7M

2 Total includes total gross loans & leases of $3.44 billion and rental equipment, net of $206.7M, as of December 31, 2020, exposures are based on current

outstanding balances as of December 31, 2020

% of Total²

QUARTERLY INVESTOR UPDATE | FIRST QUARTER FISCAL YEAR 2021 | NASDAQ: CASH

■Solar Electric Power Generation

Other Utilities

9.6%

% of Total²

$51.0 million exposure related to support activities for Oil & Gas Operations

Approximately half of outstandings are in working capital lines, primarily

collateralized by accounts receivable, remaining collateralized by

machinery and equipment

1.5%View entire presentation