Flutter Results Presentation Deck

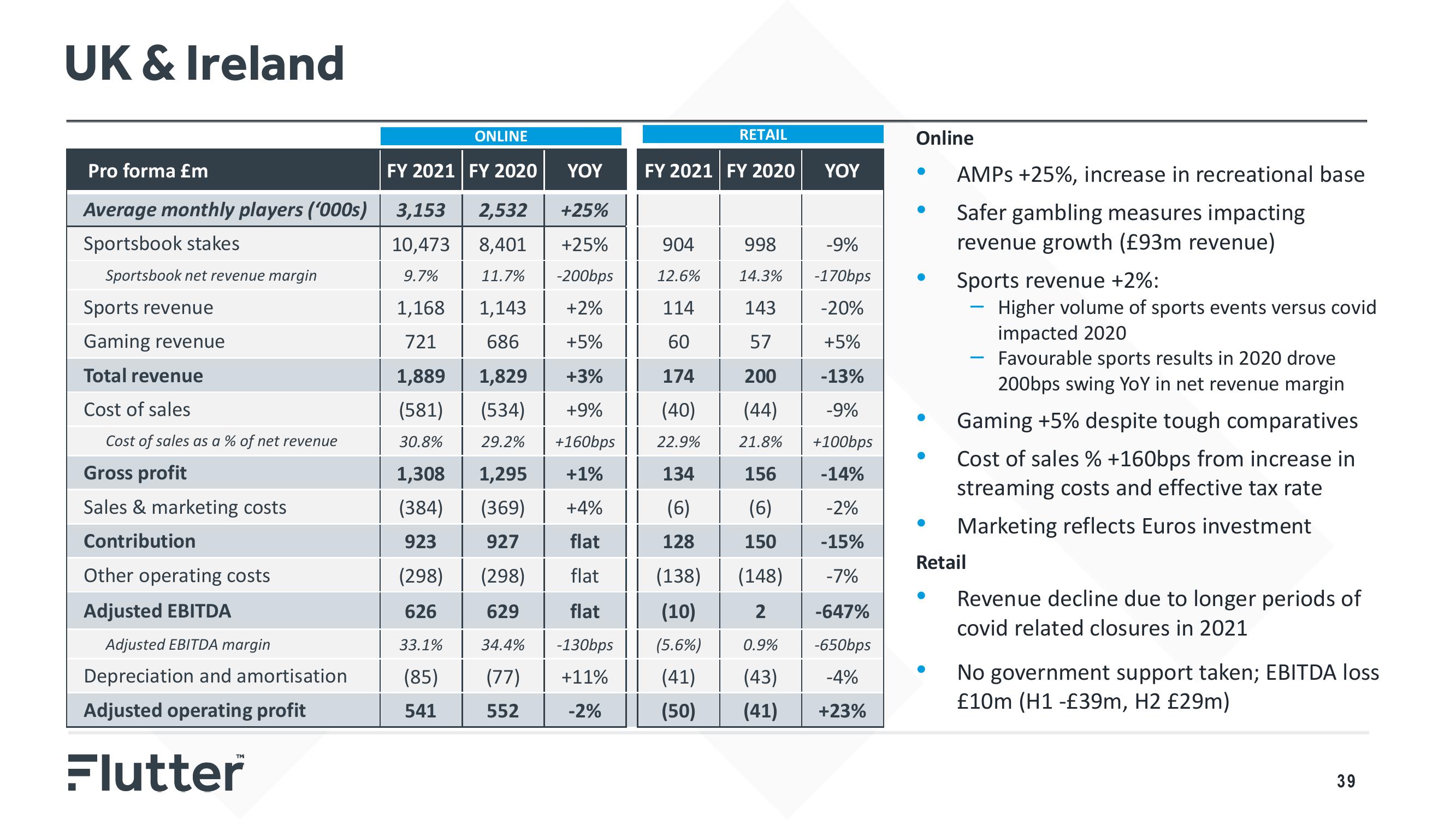

UK & Ireland

Pro forma £m

Average monthly players ('000s)

Sportsbook stakes

Sportsbook net revenue margin

Sports revenue

Gaming revenue

Total revenue

Cost of sales

Cost of sales as a % of net revenue

Gross profit

Sales & marketing costs

Contribution

Other operating costs

Adjusted EBITDA

Adjusted EBITDA margin

Depreciation and amortisation

Adjusted operating profit

Flutter

FY 2021

3,153

10,473

9.7%

1,168

721

1,889

(581)

30.8%

YOY

2,532

+25%

8,401

+25%

11.7% -200bps

+2%

+5%

1,829

+3%

(534) +9%

29.2% +160bps

1,308

1,295

+1%

(384)

(369)

+4%

923

927

flat

(298) (298)

flat

626

629

flat

34.4%

-130bps

(77) +11%

552

-2%

ONLINE

33.1%

(85)

541

FY 2020

1,143

686

RETAIL

FY 2021 FY 2020

904

12.6%

114

60

174

(40)

22.9%

134

(6)

128

(138) (148)

(10)

2

0.9%

(5.6%)

(41)

(43)

(50)

(41)

YOY

998

-9%

14.3%

-170bps

143

-20%

57

+5%

200

-13%

(44)

-9%

21.8% +100bps

-14%

-2%

-15%

-7%

-647%

-650bps

-4%

+23%

156

(6)

150

Online

AMPS +25%, increase in recreational base

Safer gambling measures impacting

revenue growth (£93m revenue)

Sports revenue +2%:

Higher volume of sports events versus covid

impacted 2020

Favourable sports results in 2020 drove

200bps swing YoY in net revenue margin

Gaming +5% despite tough comparatives

Cost of sales % +160bps from increase in

streaming costs and effective tax rate

Marketing reflects Euros investment

Retail

-

-

Revenue decline due to longer periods of

covid related closures in 2021

No government support taken; EBITDA loss

£10m (H1 -£39m, H2 £29m)

39View entire presentation