Lazard Investor Presentation Deck

INVESTOR PRESENTATION

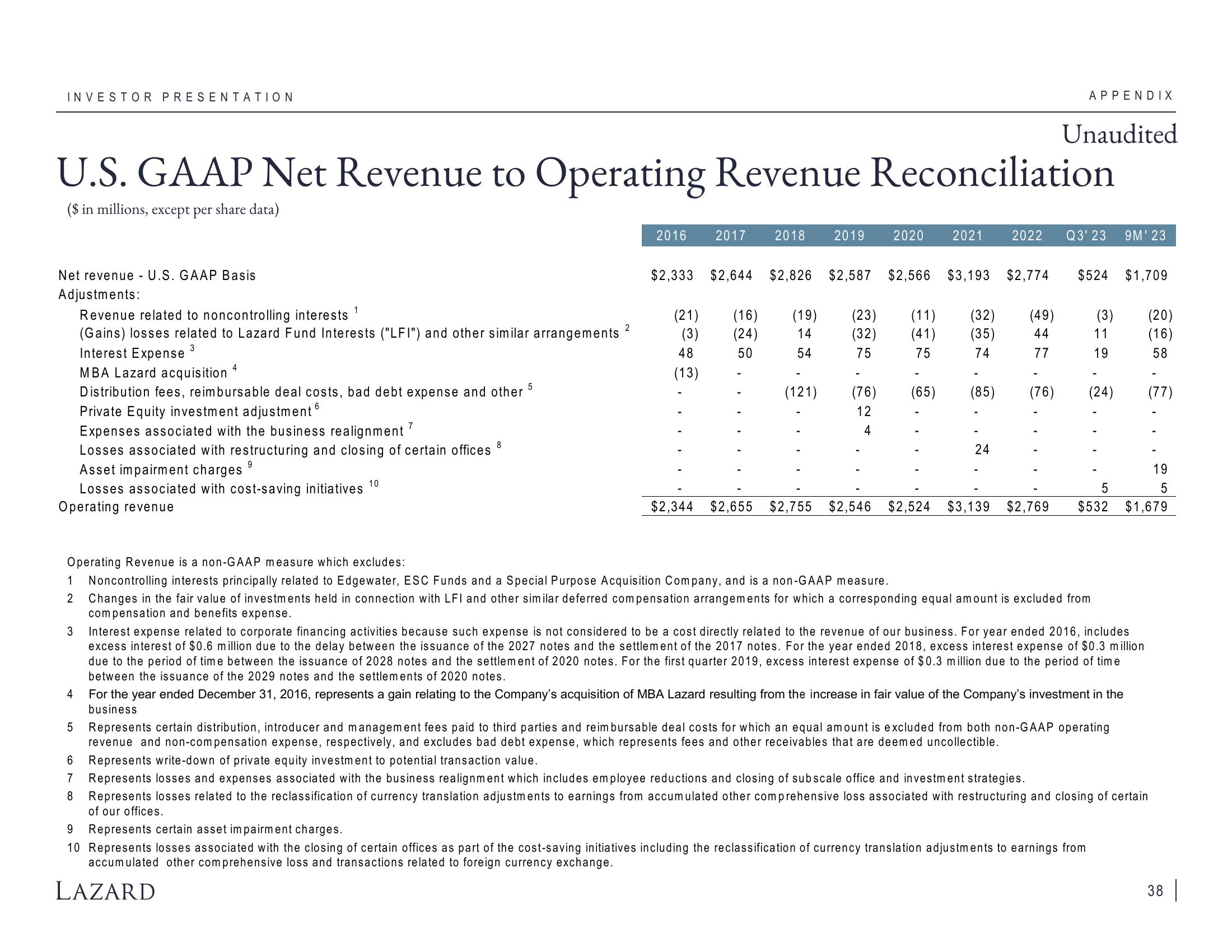

Net revenue - U.S. GAAP Basis

Adjustments:

Revenue related to noncontrolling interests

(Gains) losses related to Lazard Fund Interests ("LFI") and other similar arrangements

Interest Expense

3

MBA Lazard acquisition 4

Distribution fees, reimbursable deal costs, bad debt expense and other

U.S. GAAP Net Revenue to Operating Revenue Reconciliation

($ in millions, except per share data)

Private Equity investment adjustment

Expenses associated with the business realignment

Losses associated with restructuring and closing of certain offices

9

Asset impairment charges

Losses associated with cost-saving initiatives

Operating revenue

3

1

4

5

10

7

8

5

2

2016 2017 2018 2019 2020

(21)

(3)

48

(13)

(16)

(24)

50

(19) (23)

(32)

75

14

54

$2,333 $2,644 $2,826 $2,587 $2,566 $3,193 $2,774 $524 $1,709

(121)

(76)

12

4

$2,344 $2,655 $2,755 $2,546

2021

(65)

(11) (32) (49)

(41)

(35)

75

74

44

77

(85)

24

2022 Q3' 23

APPENDIX

Unaudited

(76)

$2,524 $3,139 $2,769

Operating Revenue is a non-GAAP measure which excludes:

2

1 Noncontrolling interests principally related to Edgewater, ESC Funds and a Special Purpose Acquisition Company, and is a non-GAAP measure.

Changes in the fair value of investments held in connection with LFI and other similar deferred compensation arrangements for which a corresponding equal amount is excluded from

compensation and benefits expense.

(24)

(3) (20)

11

(16)

19

58

9M' 23

5

$532 $1,679

Interest expense related to corporate financing activities because such expense is not considered to be a cost directly related to the revenue of our business. For year ended 2016, includes

excess interest of $0.6 million due to the delay between the issuance of the 2027 notes and the settlement of the 2017 notes. For the year ended 2018, excess interest expense of $0.3 million

due to the period of time between the issuance of 2028 notes and the settlement of 2020 notes. For the first quarter 2019, excess interest expense of $0.3 million due to the period of time

between the issuance of the 2029 notes and the settlements of 2020 notes.

For the year ended December 31, 2016, represents a gain relating to the Company's acquisition of MBA Lazard resulting from the increase in fair value of the Company's investment in the

business

9

Represents certain asset impairment charges.

10 Represents losses associated with the closing of certain offices as part of the cost-saving initiatives including the reclassification of currency translation adjustments to earnings from

accumulated other comprehensive loss and transactions related to foreign currency exchange.

LAZARD

Represents certain distribution, introducer and management fees paid to third parties and reimbursable deal costs for which an equal amount is excluded from both non-GAAP operating

revenue and non-compensation expense, respectively, and excludes bad debt expense, which represents fees and other receivables that are deemed uncollectible.

6 Represents write-down of private equity investment to potential transaction value.

7

Represents losses and expenses associated with the business realignment which includes employee reductions and closing of subscale office and investment strategies.

8 Represents losses related to the reclassification of currency translation adjustments to earnings from accumulated other comprehensive loss associated with restructuring and closing of certain

of our offices.

(77)

19

5

38 |View entire presentation