Antero Midstream Partners Mergers and Acquisitions Presentation Deck

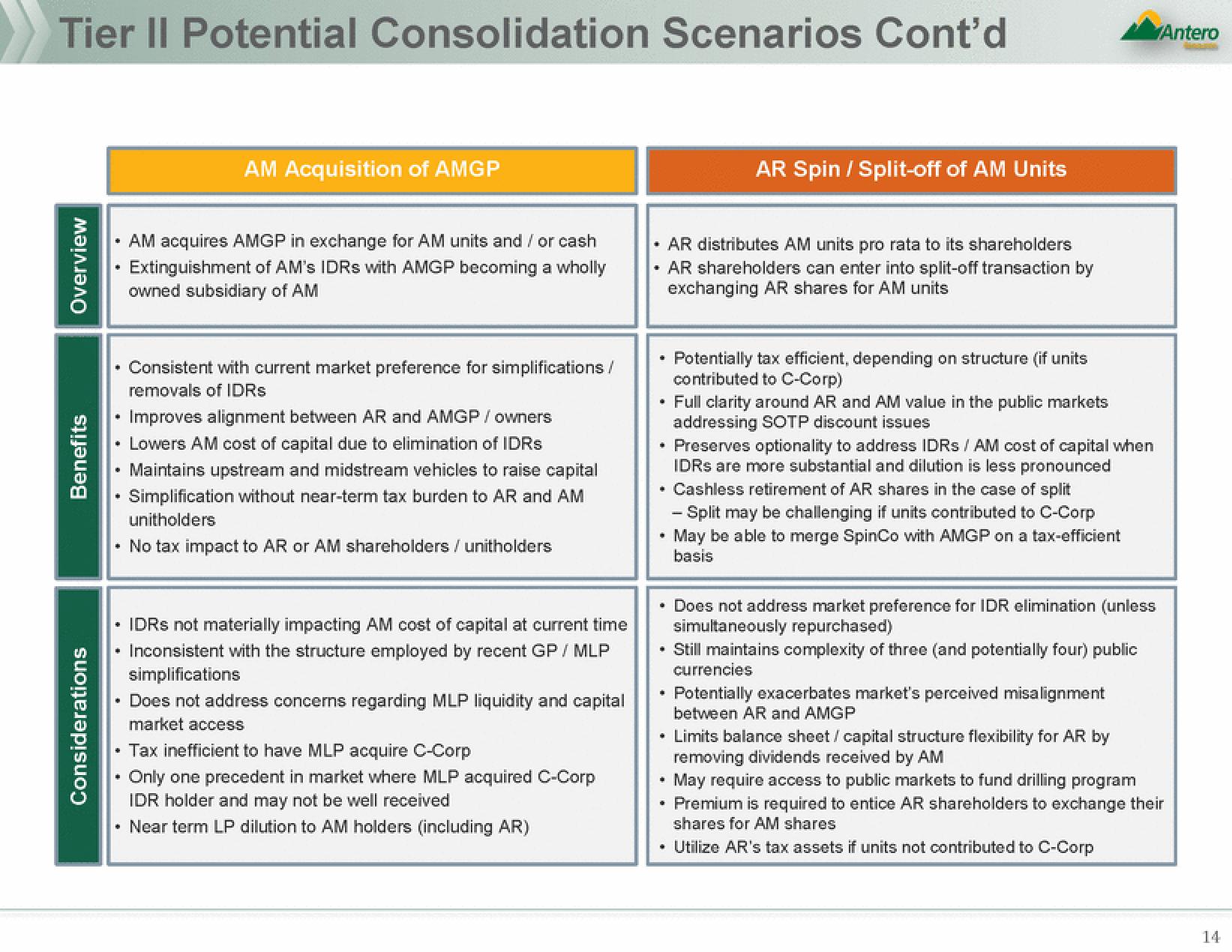

Tier II Potential Consolidation Scenarios Cont'd

Overview

Benefits

Considerations

• AM acquires AMGP in exchange for AM units and / or cash

Extinguishment of AM's IDRs with AMGP becoming a wholly

owned subsidiary of AM

•

.

M

Improves alignment between AR and AMGP / owners

Lowers AM cost of capital due to elimination of IDRs

Maintains upstream and midstream vehicles to raise capital

Simplification without near-term tax burden to AR and AM

unitholders

• No tax impact to AR or AM shareholders / unitholders

+

✔

+

AM Acquisition of AMGP

• IDRs not materially impacting AM cost of capital at current time

• Inconsistent with the structure employed by recent GP/ MLP

simplifications

Does not address concerns regarding MLP liquidity and capital

market access

*

.

Consistent with current market preference for simplifications/

removals of IDRs

+

Tax inefficient to have MLP acquire C-Corp

Only one precedent in market where MLP acquired C-Corp

IDR holder and may not be well received

Near term LP dilution to AM holders (including AR)

■

·

.

i

AR Spin / Split-off of AM Units

AR distributes AM units pro rata to its shareholders

AR shareholders can enter into split-off transaction by

exchanging AR shares for AM units

* Cashless retirement of AR shares in the case of split

- Split may be challenging if units contributed to C-Corp

May be able to merge SpinCo with AMGP on a tax-efficient

basis

•

Potentially tax efficient, depending on structure (if units

contributed to C-Corp)

*

Full clarity around AR and AM value in the public markets

addressing SOTP discount issues

* Does not address market preference for IDR elimination (unless

simultaneously repurchased)

. Still maintains complexity of three (and potentially four) public

currencies

Potentially exacerbates market's perceived misalignment

between AR and AMGP

Preserves optionality to address IDRS / AM cost of capital when

IDRS are more substantial and dilution is less pronounced

Limits balance sheet / capital structure flexibility for AR by

removing dividends received by AM

May require access to public markets to fund drilling program

Premium is required to entice AR shareholders to exchange their

shares for AM shares

• Utilize AR's tax assets if units not contributed to C-Corp

Antero

14View entire presentation