Pearson Investor Presentation Deck

Assessment & Qualifications

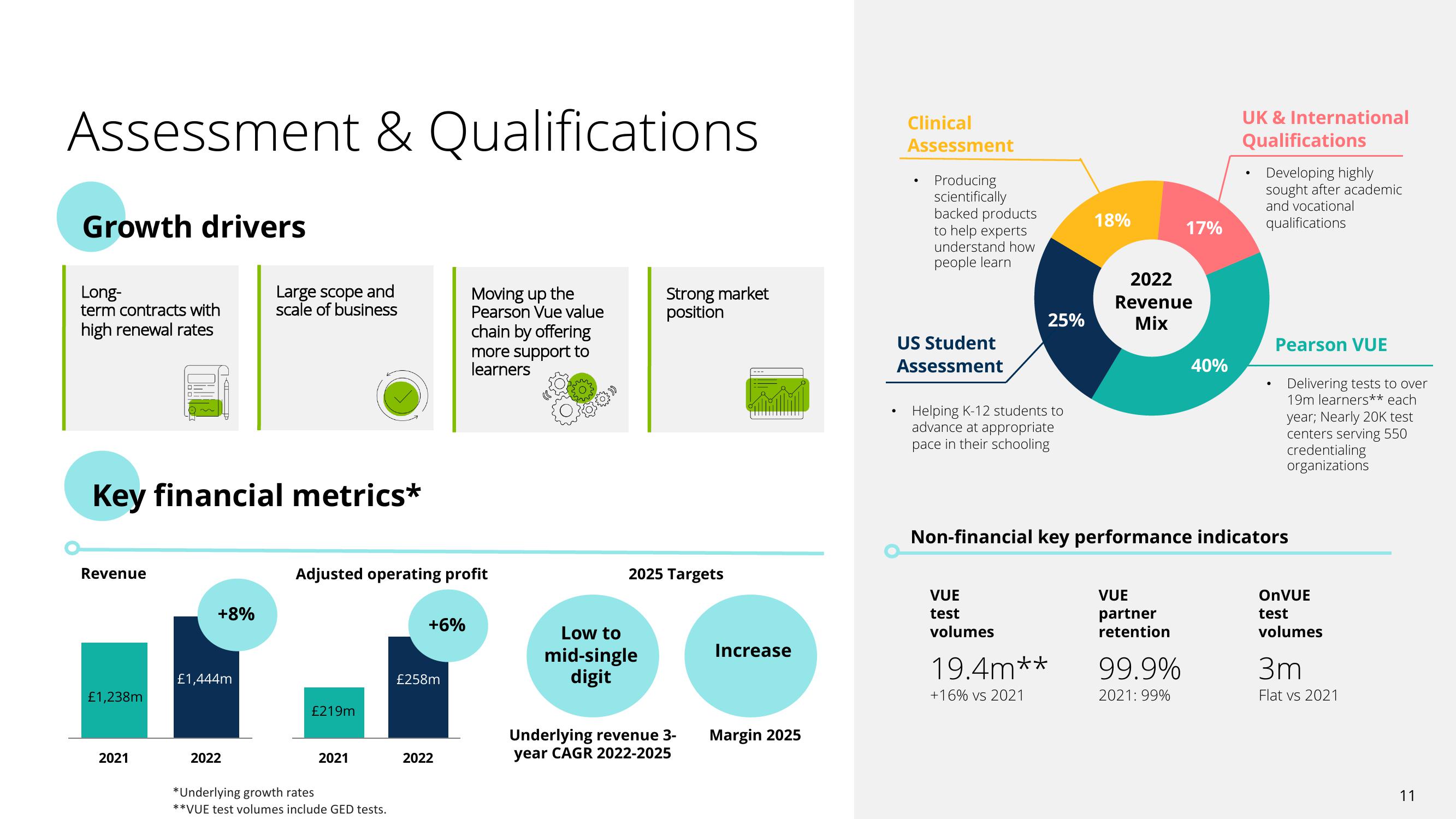

Growth drivers

Long-

term contracts with

high renewal rates

Key financial metrics*

Revenue

£1,238m

2021

+8%

£1,444m

Large scope and

scale of business

2022

Adjusted operating profit

£219m

2021

*Underlying growth rates

**VUE test volumes include GED tests.

+6%

£258m

Moving up the

Pearson Vue value

chain by offering

more support to

learners

2022

Strong market

position

2025 Targets

Low to

mid-single

digit

Underlying revenue 3-

year CAGR 2022-2025

Increase

Margin 2025

Clinical

Assessment

.

.

Producing

scientifically

backed products

to help experts

understand how

people learn

US Student

Assessment

25%

Helping K-12 students to

advance at appropriate

pace in their schooling

VUE

test

volumes

18%

19.4m**

+16% vs 2021

2022

Revenue

Mix

17%

VUE

partner

retention

99.9%

2021: 99%

40%

Non-financial key performance indicators

UK & International

Qualifications

Developing highly

sought after academic

and vocational

qualifications

Pearson VUE

Delivering tests to over

19m learners** each

year; Nearly 20K test

centers serving 550

credentialing

organizations

OnVUE

test

volumes

3m

Flat vs 2021

11View entire presentation