3Q24 Investor Update

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

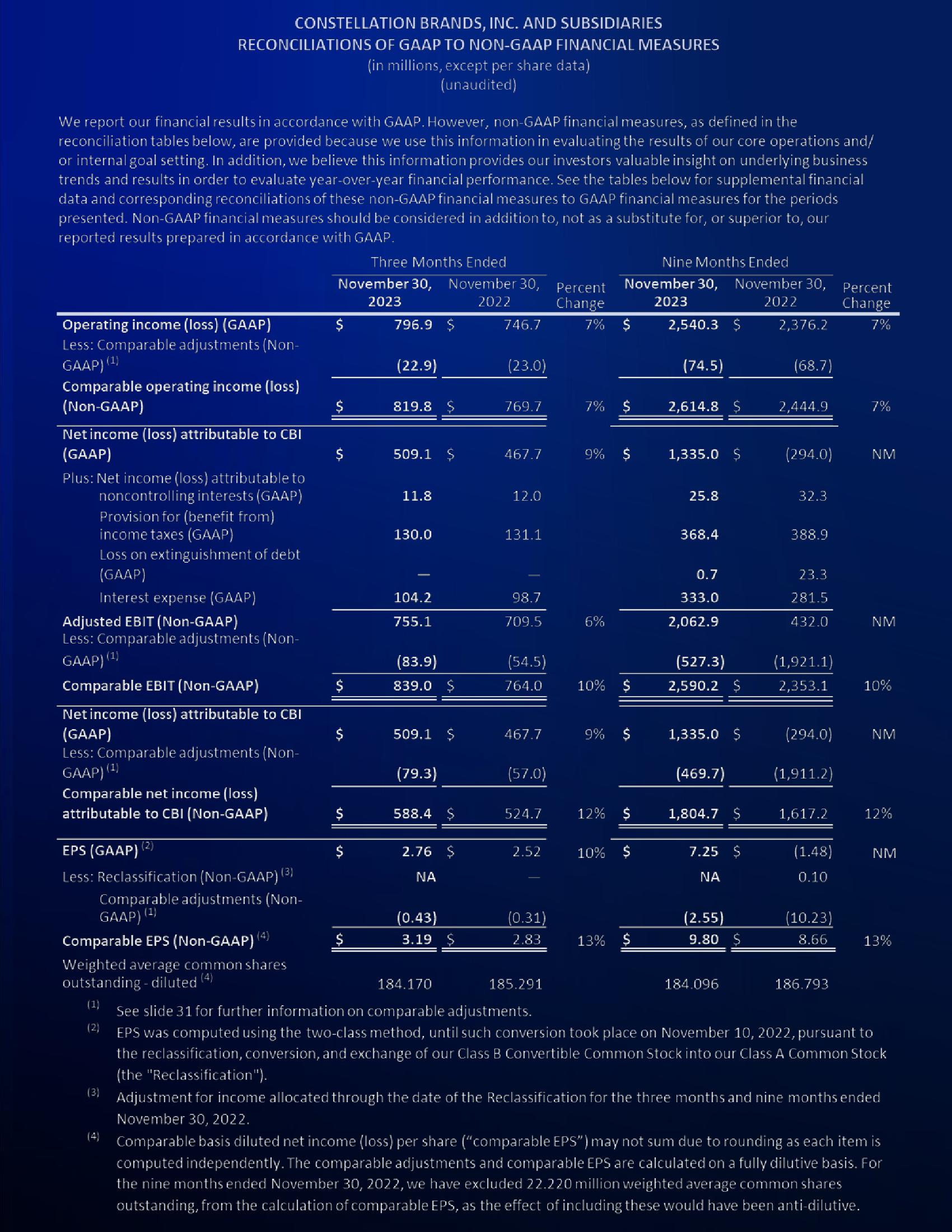

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES

(in millions, except per share data)

(unaudited)

We report our financial results in accordance with GAAP. However, non-GAAP financial measures, as defined in the

reconciliation tables below, are provided because we use this information in evaluating the results of our core operations and/

or internal goal setting. In addition, we believe this information provides our investors valuable insight on underlying business

trends and results in order to evaluate year-over-year financial performance. See the tables below for supplemental financial

data and corresponding reconciliations of these non-GAAP financial measures to GAAP financial measures for the periods

presented. Non-GAAP financial measures should be considered in addition to, not as a substitute for, or superior to, our

reported results prepared in accordance with GAAP.

Operating income (loss) (GAAP)

Less: Comparable adjustments (Non-

GAAP) (¹)

Comparable operating income (loss)

(Non-GAAP)

Net income (loss) attributable to CBI

(GAAP)

Plus: Net income (loss) attributable to

noncontrolling interests (GAAP)

Provision for (benefit from)

income taxes (GAAP)

Loss on extinguishment of debt

(GAAP)

Interest expense (GAAP)

Adjusted EBIT (Non-GAAP)

Less: Comparable adjustments (Non-

GAAP) (¹)

Comparable EBIT (Non-GAAP)

Net income (loss) attributable to CBI

(GAAP)

Less: Comparable adjustments (Non-

GAAP) (¹)

Comparable net income (loss)

attributable to CBI (Non-GAAP)

EPS (GAAP) (2)

Less: Reclassification (Non-GAAP) (3)

Comparable adjustments (Non-

(1)

GAAP) (3

Comparable EPS (Non-GAAP) (4)

Weighted average common shares

outstanding-diluted (4)

(1)

(2)

Three Months Ended

November 30, November 30, Percent

2023

2022

Change

7% $

$

S

796.9

(22.9)

819.8 $

509.1 $

11.8

130.0

104.2

755.1

(83.9)

839.0 $

509.1 $

(79.3)

588.4

2.76 $

ΝΑ

(0.43)

3.19

746.7

(23.0)

769.7

467.7

12.0

131.1

98.7

709.5

(54.5)

764.0

467.7

(57.0)

2.52

(0.31)

2.83

7%

185.291

Nine Months Ended

November 30, November 30,

2023

2022

2,540.3 $

2,376.2

9% $

6%

10%

524.7 12% $

$

9% $

10% $

13% $

(74.5)

2,614.8 $

1,335.0 $

25.8

368.4

0.7

333.0

2,062.9

(527.3)

2,590.2 $

1,335.0 $

(469.7)

1,804.7 $

7.25 $

ΝΑ

(2.55)

9.80

(68.7)

184.096

2,444.9

(294.0)

32.3

388.9

23.3

281.5

432.0

(1,921.1)

2,353.1

(294.0)

(1,911.2)

1,617.2

(1.48)

0.10

(10.23)

8.66

Percent

Change

7%

186.793

7%

NM

NM

10%

NM

184.170

See slide 31 for further information on comparable adjustments.

EPS was computed using the two-class method, until such conversion took place on November 10, 2022, pursuant to

the reclassification, conversion, and exchange of our Class B Convertible Common Stock into our Class A Common Stock

(the "Reclassification").

(3) Adjustment for income allocated through the date of the Reclassification for the three months and nine months ended

November 30, 2022.

12%

NM

13%

(4) Comparable basis diluted net income (loss) per share ("comparable EPS") may not sum due to rounding as each item is

computed independently. The comparable adjustments and comparable EPS are calculated on a fully dilutive basis. For

the nine months ended November 30, 2022, we have excluded 22.220 million weighted average common shares

outstanding, from the calculation of comparable EPS, as the effect of including these would have been anti-dilutive.View entire presentation