Ample Organics Announcement

Strategic Rationale

Deal Terms:

• Akerna is acquiring 100% of Ample Organics for a total

consideration of up to CAD$60M

- CAD$50M upfront (CAD$7.5M cash and CAD$42.5M stock)

- Up to CAD$10M deferred consideration based on 2020

recurring revenue, paid in stock

Ample shareholders will receive 3.295 million Akerna shares

priced at $9.80 (CAD$12.90) per share(¹)

Projected CY2020 revenue = C$11.5M, resulting in an

acquisition multiple of 5.2x, assuming deferred consideration

is achieved in full.

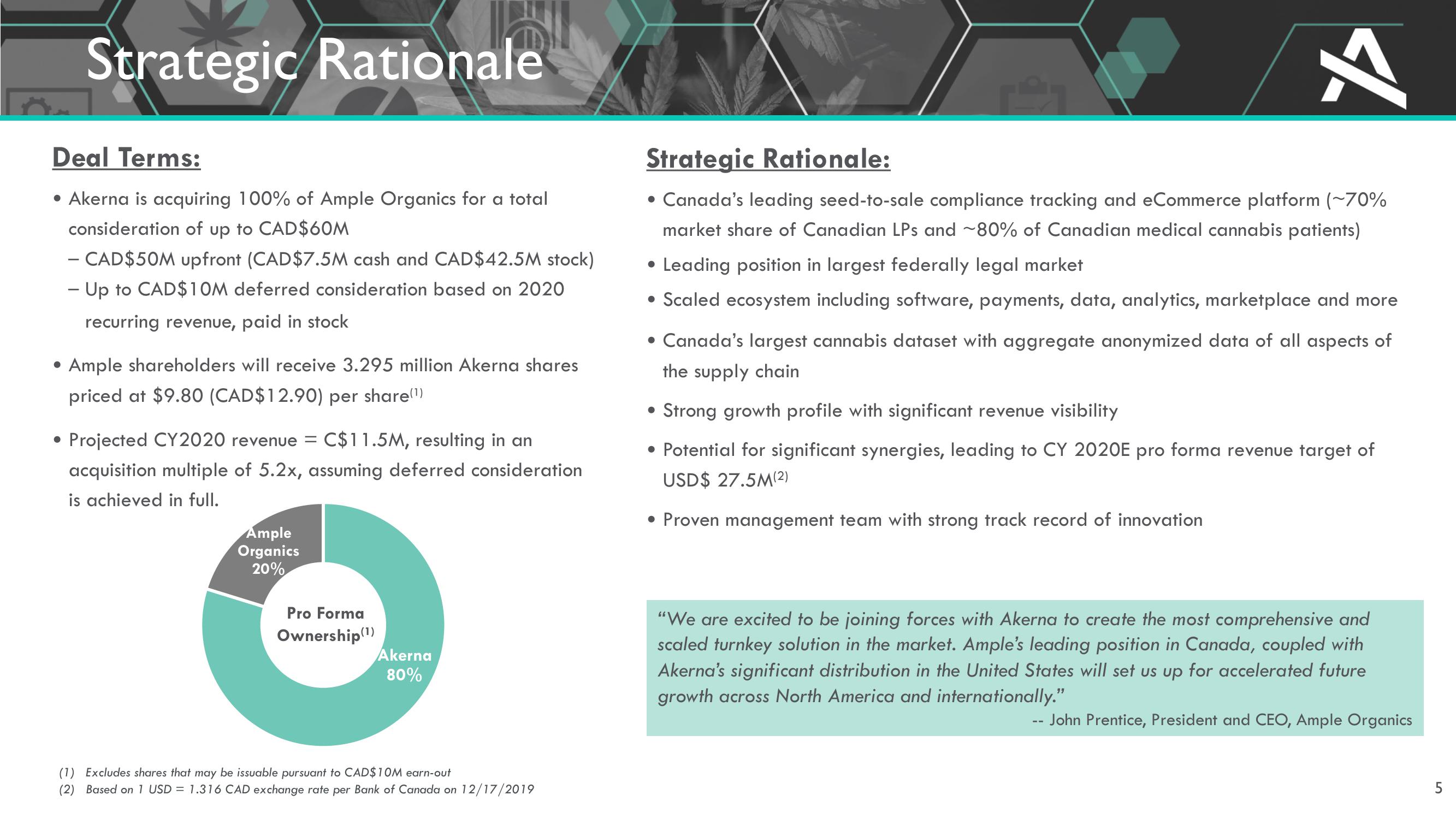

Ample

Organics

20%

Pro Forma

Ownership (¹)

Akerna

80%

(1) Excludes shares that may be issuable pursuant to CAD$10M earn-out

(2) Based on 1 USD = 1.316 CAD exchange rate per Bank of Canada on 12/17/2019

A

Strategic Rationale:

• Canada's leading seed-to-sale compliance tracking and eCommerce platform (~70%

market share of Canadian LPs and ~80% of Canadian medical cannabis patients)

• Leading position in largest federally legal market

• Scaled ecosystem including software, payments, data, analytics, marketplace and more

• Canada's largest cannabis dataset with aggregate anonymized data of all aspects of

the supply chain

• Strong growth profile with significant revenue visibility

• Potential for significant synergies, leading to CY 2020E pro forma revenue target of

USD$ 27.5M(2)

• Proven management team with strong track record of innovation

"We are excited to be joining forces with Akerna to create the most comprehensive and

scaled turnkey solution in the market. Ample's leading position in Canada, coupled with

Akerna's significant distribution in the United States will set us up for accelerated future

growth across North America and internationally."

- John Prentice, President and CEO, Ample Organics

5

слView entire presentation