Tradeweb Investor Presentation Deck

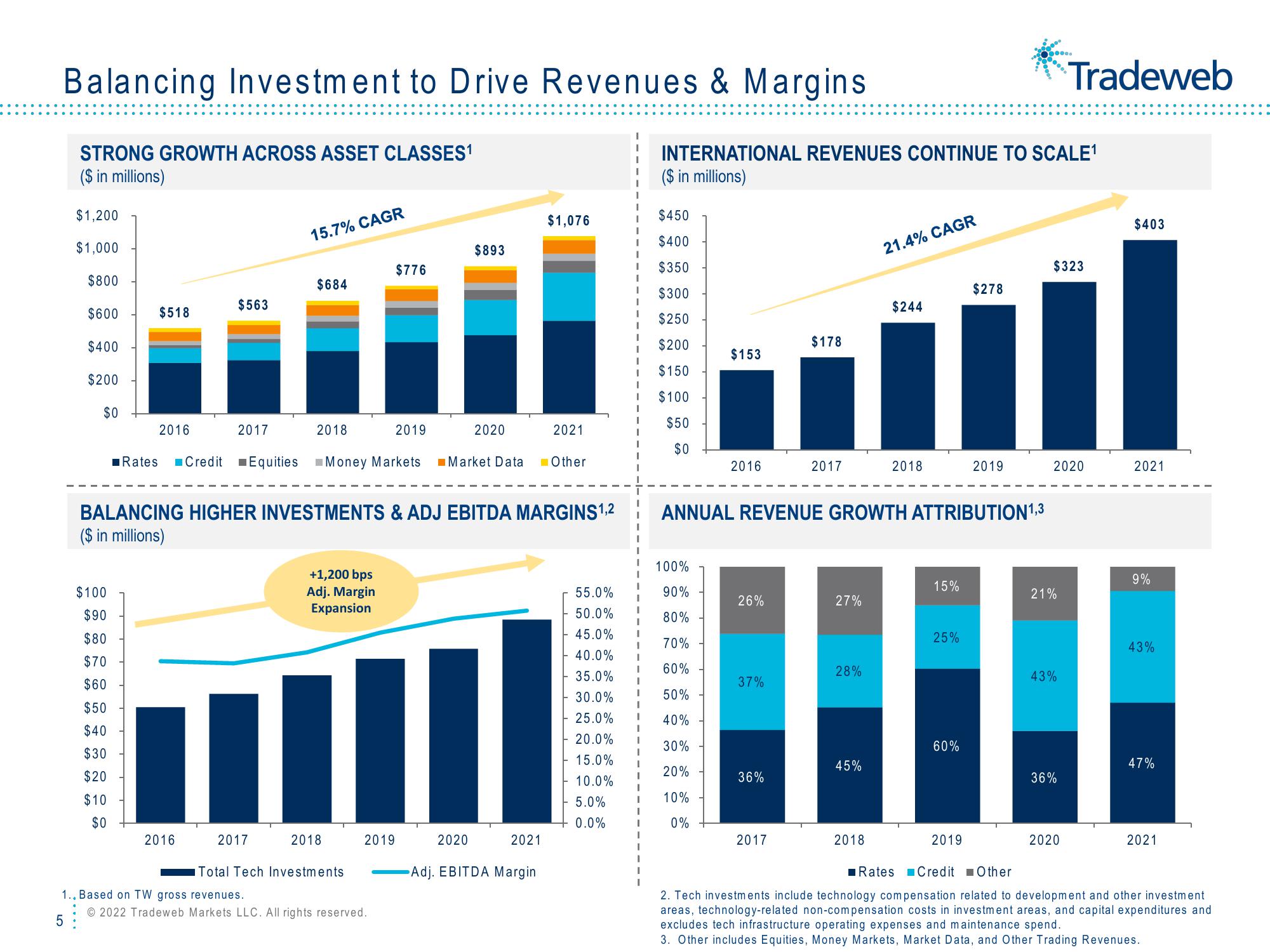

Balancing Investment to Drive Revenues & Margins

STRONG GROWTH ACROSS ASSET CLASSES¹

($ in millions)

$1,200

$1,000

$800

$600

$400

$200

$0

Rates

$100

$90

$80

$70

$60

$50

$40

$30

$20

$10

$0

$518

2016

$563

2016

2017

15.7% CAGR

$684

2017

2018

+1,200 bps

Adj. Margin

Expansion

2018

BALANCING HIGHER INVESTMENTS & ADJ EBITDA MARGINS 1,2

($ in millions)

Total Tech Investments

$776

Credit Equities Money Markets Market Data Other

2019

2019

1.. Based on TW gross revenues.

Ⓒ2022 Tradeweb Markets LLC. All rights reserved.

5

$893

2020

2020

$1,076

2021

2021

Adj. EBITDA Margin

I

I

I

I

55.0%

50.0%

45.0% 1

40.0% 1

35.0%

30.0%

25.0%

20.0% 1

I

15.0% I

10.0%

5.0% I

0.0%

I

1

I

I

$450

$400

$350

INTERNATIONAL REVENUES CONTINUE TO SCALE¹

($ in millions)

$250

$200

$150

$100

$50

$0

1 100%

90%

80%

70%

1 60%

$153

50%

40%

30%

20%

10%

0%

2016

26%

37%

36%

$178

2017

2017

ANNUAL REVENUE GROWTH ATTRIBUTION¹,3

27%

28%

45%

21.4% CAGR

2018

$244

2018

15%

25%

60%

$278

2019

2019

....

$323

2020

21%

Tradeweb

43%

36%

2020

$403

2021

9%

43%

47%

2021

Rates Credit Other

2. Tech investments include technology compensation related to development and other investment

areas, technology-related non-compensation costs in investment areas, and capital expenditures and

excludes tech infrastructure operating expenses and maintenance spend.

3. Other includes Equities, Money Markets, Market Data, and Other Trading Revenues.View entire presentation