Maersk Investor Presentation Deck

Highlights Q2 2020

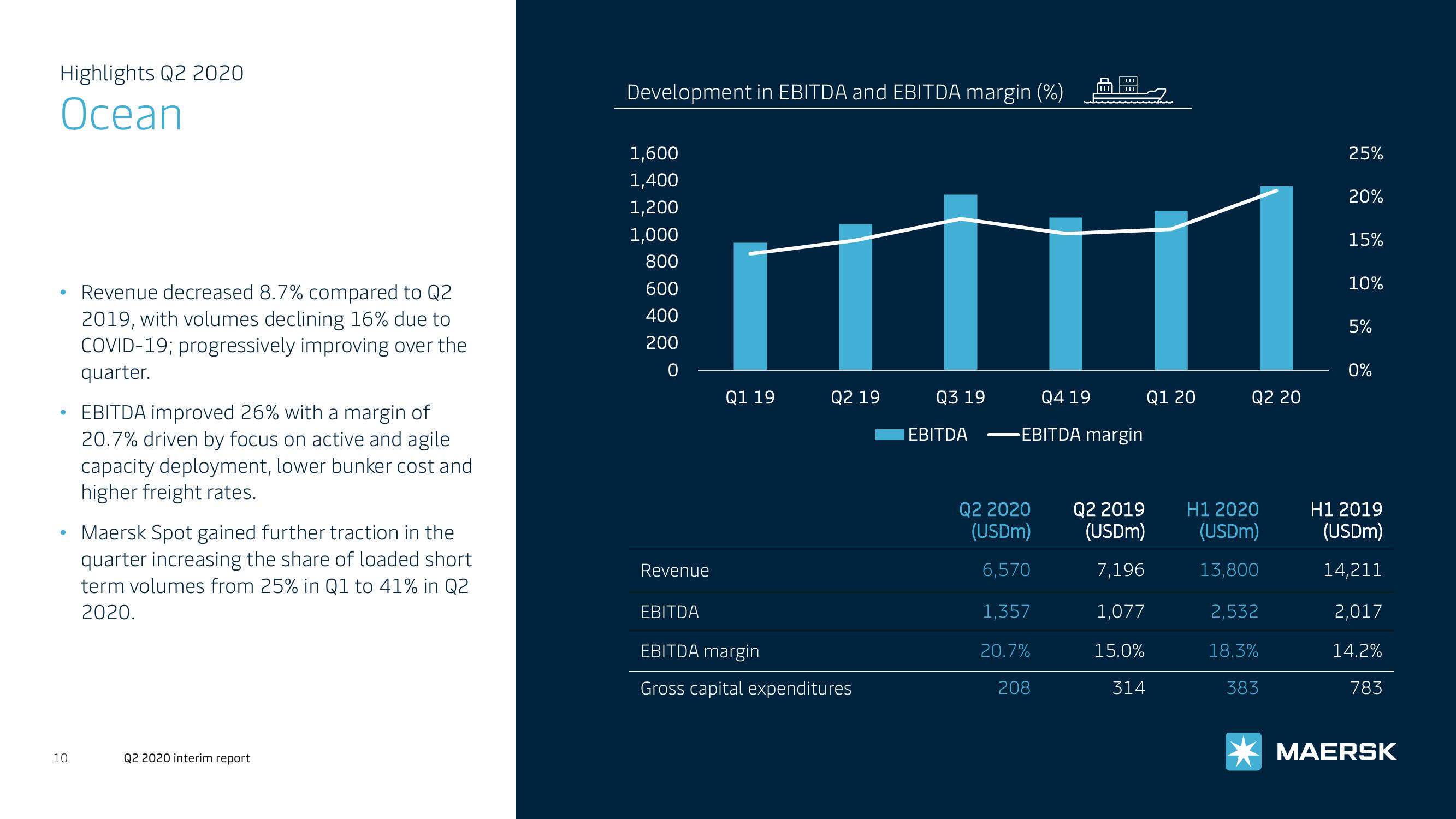

Ocean

●

●

●

10

Revenue decreased 8.7% compared to Q2

2019, with volumes declining 16% due to

COVID-19; progressively improving over the

quarter.

EBITDA improved 26% with a margin of

20.7% driven by focus on active and agile

capacity deployment, lower bunker cost and

higher freight rates.

Maersk Spot gained further traction in the

quarter increasing the share of loaded short

term volumes from 25% in Q1 to 41% in Q2

2020.

Q2 2020 interim report

Development in EBITDA and EBITDA margin (%)

1,600

1,400

1,200

1,000

800

600

400

200

0

Revenue

nt_l

Q3 19

Q4 19

EBITDA margin

Q1 19

Q2 19

EBITDA

EBITDA margin

Gross capital expenditures

EBITDA

Q2 2020

(USDM)

6,570

1,357

20.7%

208

Q2 2019

(USDM)

7,196

1,077

15.0%

314

Q1 20

Q2 20

H1 2020

(USDm)

13,800

2,532

18.3%

383

25%

20%

15%

10%

5%

0%

H1 2019

(USDM)

14,211

2,017

14.2%

783

MAERSKView entire presentation