Oaktree Real Estate Opportunities Fund VII, L.P.

OAKTREE REAL ESTATE OPPORTUNITIES FUND VII, L.P.

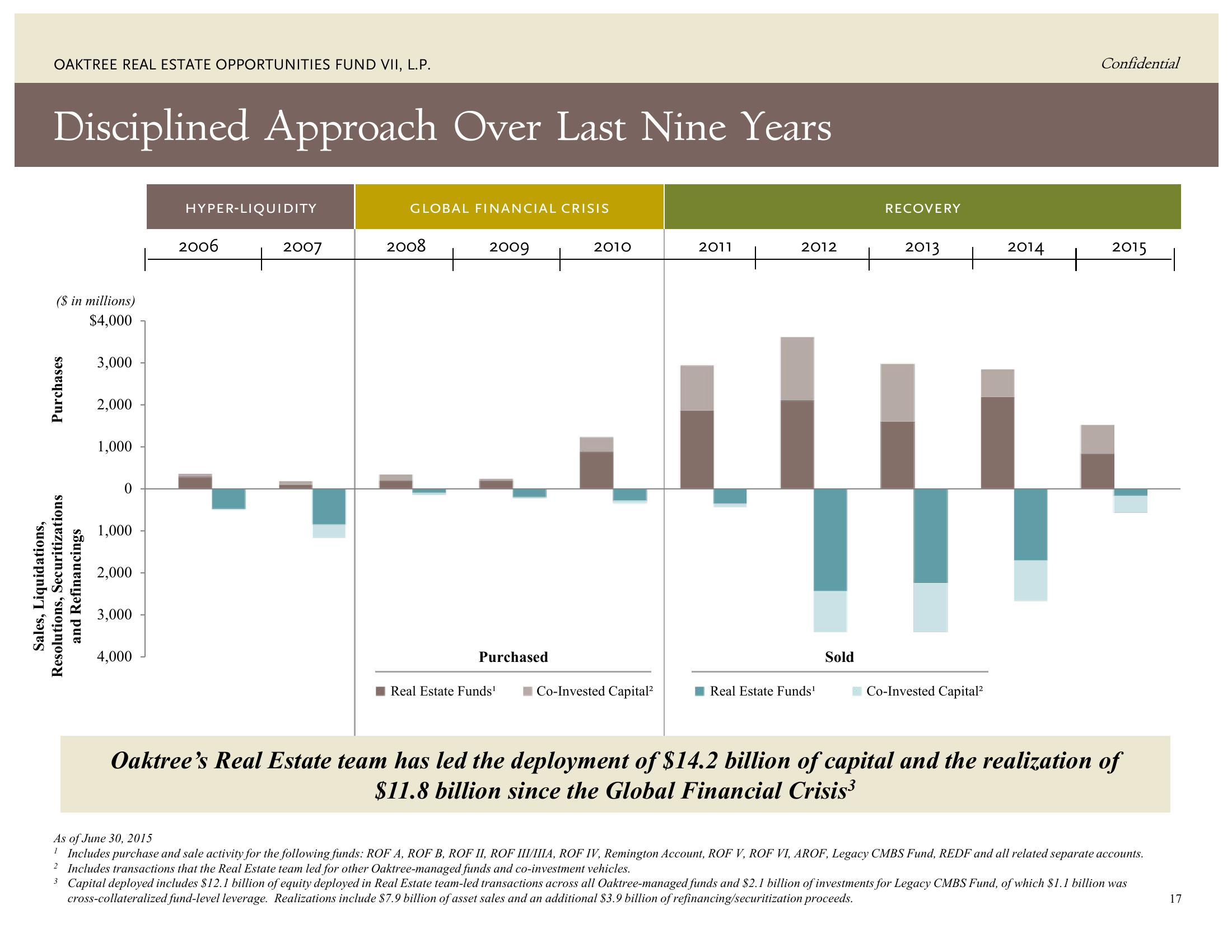

Disciplined Approach Over Last Nine Years

($ in millions)

$4,000

Purchases

Sales, Liquidations,

Resolutions, Securitizations

and Refinancings

3,000

2,000

1,000

0

1,000

2,000

3,000

4,000

HYPER-LIQUIDITY

2006

2007

GLOBAL FINANCIAL CRISIS

2008

2009

Purchased

Real Estate Funds¹

2010

Co-Invested Capital²

2011

2012

Real Estate Funds¹

RECOVERY

m

Sold

2013

Co-Invested Capital²

2014

Confidential

2015

Oaktree's Real Estate team has led the deployment of $14.2 billion of capital and the realization of

$11.8 billion since the Global Financial Crisis³

As of June 30, 2015

1 Includes purchase and sale activity for the following funds: ROF A, ROF B, ROF II, ROF III/IIIA, ROF IV, Remington Account, ROF V, ROF VI, AROF, Legacy CMBS Fund, REDF and all related separate accounts.

2 Includes transactions that the Real Estate team led for other Oaktree-managed funds and co-investment vehicles.

3 Capital deployed includes $12.1 billion of equity deployed in Real Estate team-led transactions across all Oaktree-managed funds and $2.1 billion of investments for Legacy CMBS Fund, of which $1.1 billion was

cross-collateralized fund-level leverage. Realizations include $7.9 billion of asset sales and an additional $3.9 billion of refinancing/securitization proceeds.

17View entire presentation