Silicon Valley Bank Results Presentation Deck

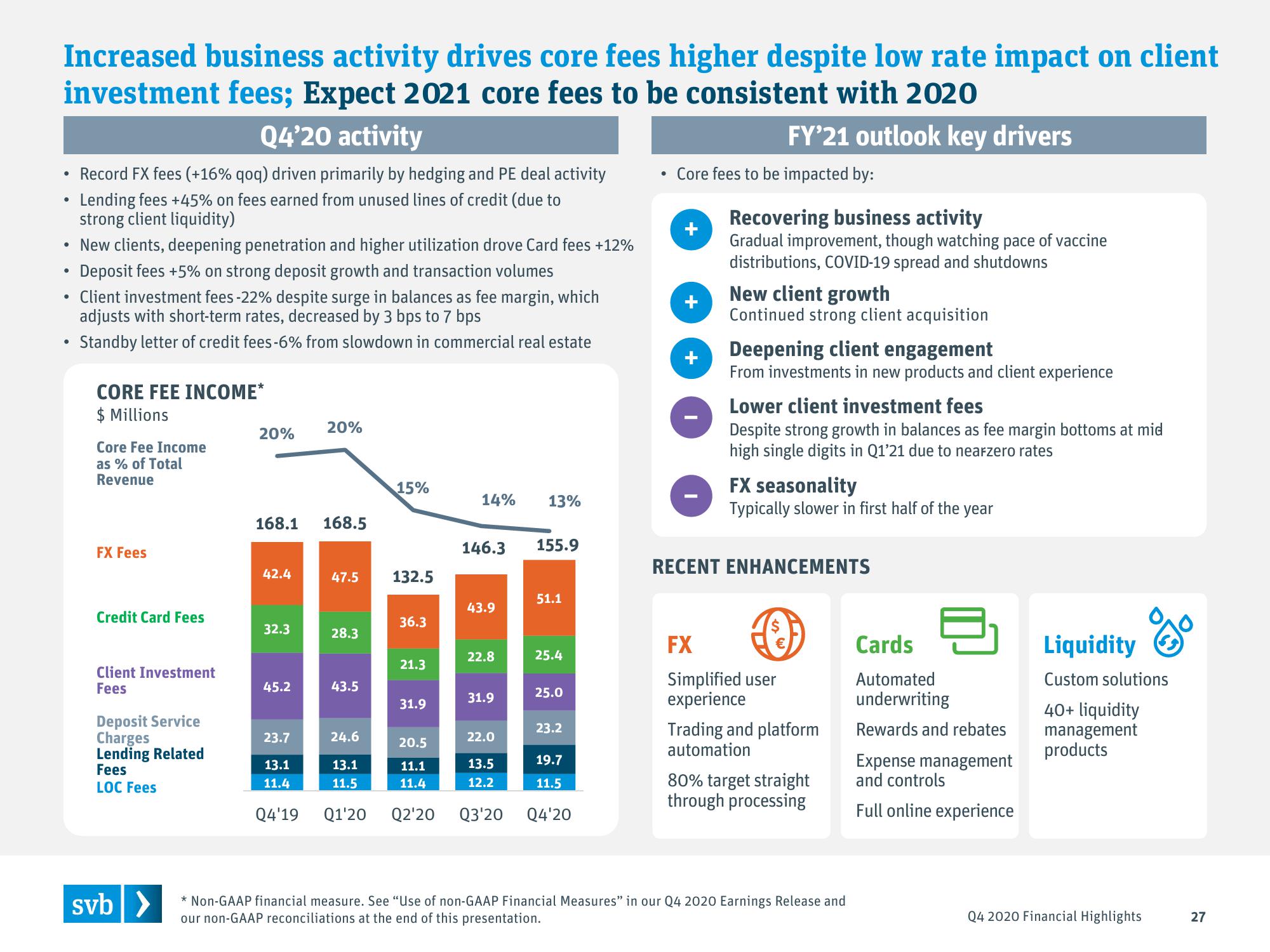

Increased business activity drives core fees higher despite low rate impact on client

investment fees; Expect 2021 core fees to be consistent with 2020

Q4'20 activity

• Record FX fees (+16% qoq) driven primarily by hedging and PE deal activity

Lending fees +45% on fees earned from unused lines of credit (due to

strong client liquidity)

• New clients, deepening penetration and higher utilization drove Card fees +12%

• Deposit fees +5% on strong deposit growth and transaction volumes

Client investment fees -22% despite surge in balances as fee margin, which

adjusts with short-term rates, decreased by 3 bps to 7 bps

Standby letter of credit fees -6% from slowdown in commercial real estate

●

●

●

CORE FEE INCOME*

$ Millions

Core Fee Income

as % of Total

Revenue

FX Fees

Credit Card Fees

Client Investment

Fees

Deposit Service

Charges

Lending Related

Fees

LOC Fees

svb>

20%

168.1 168.5

42.4

32.3

45.2

23.7

13.1

11.4

20%

Q4'19

47.5 132.5

28.3

43.5

24.6

15%

13.1

11.5

36.3

21.3

31.9

20.5

11.1

11.4

14% 13%

146.3

43.9

22.8

31.9

22.0

13.5

12.2

155.9

51.1

25.4

25.0

23.2

19.7

11.5

Q1'20 Q2'20 Q3'20 Q4'20

• Core fees to be impacted by:

+

+

+

FY'21 outlook key drivers

Recovering business activity

Gradual improvement, though watching pace of vaccine

distributions, COVID-19 spread and shutdowns

New client growth

Continued strong client acquisition

Deepening client engagement

From investments in new products and client experience

Lower client investment fees

Despite strong growth in balances as fee margin bottoms at mid

high single digits in Q1'21 due to nearzero rates

FX seasonality

Typically slower in first half of the year

RECENT ENHANCEMENTS

FX

Simplified user

experience

Trading and platform

automation

80% target straight

through processing

* Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q4 2020 Earnings Release and

our non-GAAP reconciliations at the end of this presentation.

8

Cards

Automated

underwriting

Rewards and rebates

Expense management

and controls

Full online experience

Liquidity

Custom solutions

40+ liquidity

management

products

Q4 2020 Financial Highlights

27View entire presentation