Crocs Investor Presentation Deck

NON-GAAP RECONCILIATION (CONT'D)

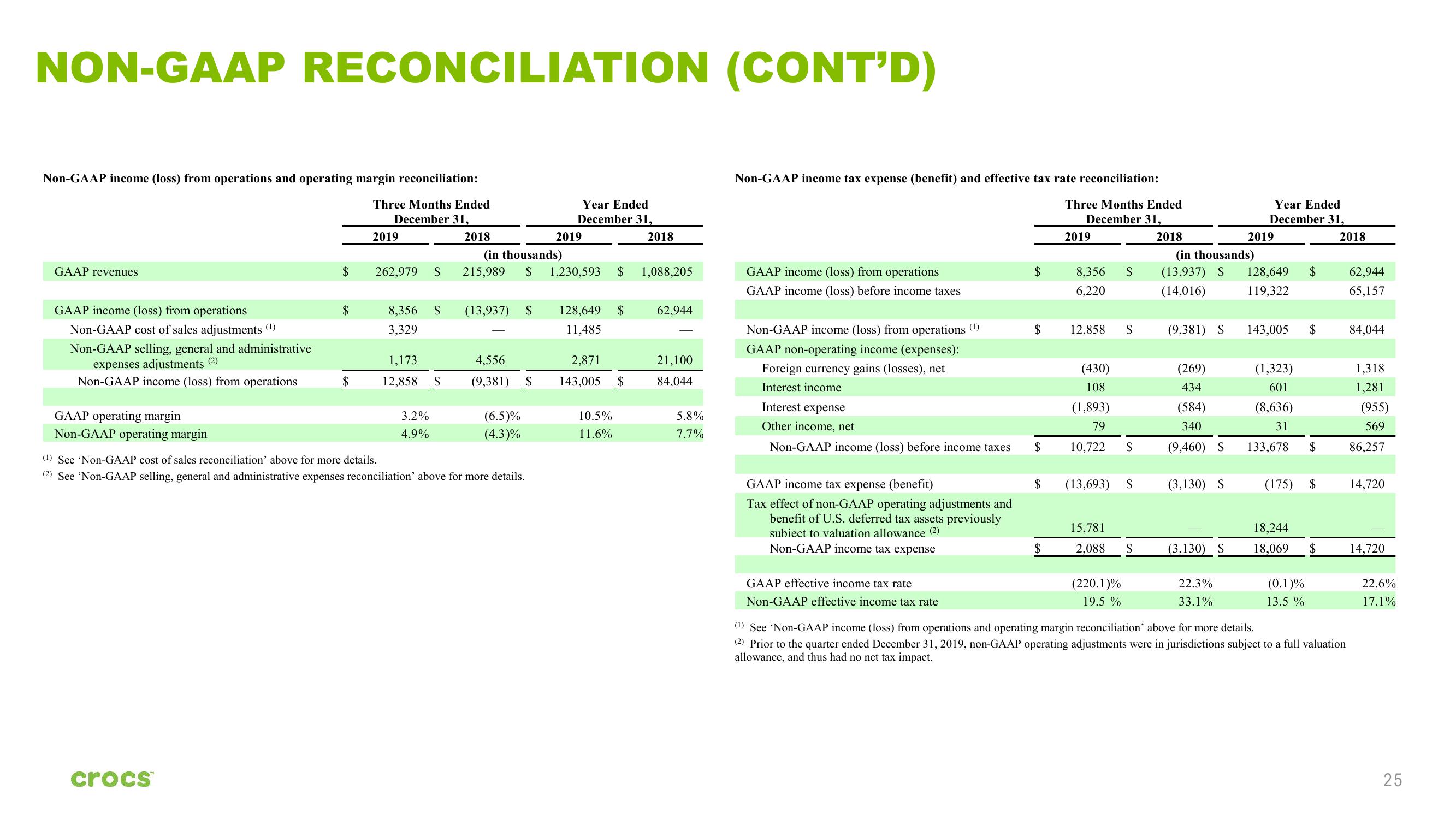

Non-GAAP income (loss) from operations and operating margin reconciliation:

Three Months Ended

December 31,

GAAP revenues

GAAP income (loss) from operations

Non-GAAP cost of sales adjustments (¹)

Non-GAAP selling, general and administrative

expenses adjustments (2)

Non-GAAP income (loss) from operations

GAAP operating margin

Non-GAAP operating margin

$

crocs™

$

$

2019

262,979 $

8,356

3,329

1,173

12,858

3.2%

4.9%

$

$

2018

(13,937)

(in thousands)

215,989 $ 1,230,593 $ 1,088,205

4,556

(9,381) $

(6.5)%

(4.3)%

Year Ended

December 31,

(1) See 'Non-GAAP cost of sales reconciliation' above for more details.

(2) See 'Non-GAAP selling, general and administrative expenses reconciliation' above for more details.

2019

$ 128,649 $

11,485

2,871

143,005 $

2018

10.5%

11.6%

62,944

21,100

84,044

5.8%

7.7%

Non-GAAP income tax expense (benefit) and effective tax rate reconciliation:

Three Months Ended

December 31,

GAAP income (loss) from operations

GAAP income (loss) before income taxes

Non-GAAP income (loss) from operations (¹)

GAAP non-operating income (expenses):

Foreign currency gains (losses), net

Interest income

Interest expense

Other income, net

Non-GAAP income (loss) before income taxes

GAAP income tax expense (benefit)

Tax effect of non-GAAP operating adjustments and

benefit of U.S. deferred tax assets previously

subiect to valuation allowance (2)

Non-GAAP income tax expense

GAAP effective income tax rate

Non-GAAP effective income tax rate

$

$

$

$

$

2019

8,356 $

6,220

12,858

(430)

108

(1,893)

79

10,722

(13,693)

$

(220.1)%

19.5%

$

$

15,781

2,088 $

2018

(in thousands)

(13,937) $

(14,016)

(9,381) $

(269)

434

(584)

340

(9,460) $

(3,130) $

(3,130) $

22.3%

33.1%

Year Ended

December 31,

2019

128,649 $

119,322

143,005

$

(1,323)

601

(8,636)

31

133,678 $

(175) $

18,244

18,069 $

(0.1)%

13.5 %

2018

(¹) See 'Non-GAAP income (loss) from operations and operating margin reconciliation' above for more details.

(2) Prior to the quarter ended December 31, 2019, non-GAAP operating adjustments were in jurisdictions subject to a full valuation

allowance, and thus had no net tax impact.

62,944

65,157

84,044

1,318

1,281

(955)

569

86,257

14,720

14,720

22.6%

17.1%

25View entire presentation