Freightos SPAC Presentation Deck

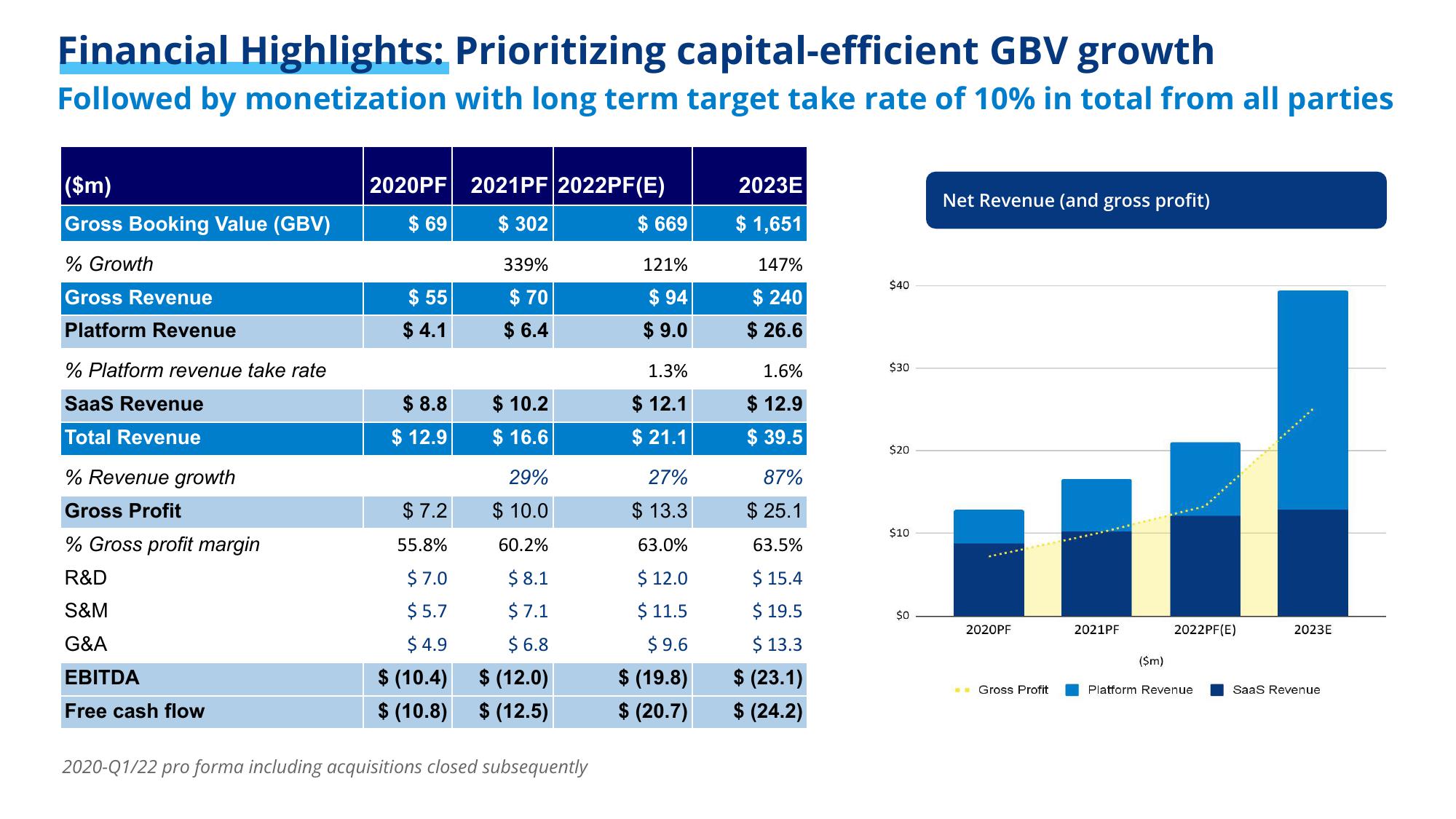

Financial Highlights: Prioritizing capital-efficient GBV growth

Followed by monetization with long term target take rate of 10% in total from all parties

($m)

Gross Booking Value (GBV)

% Growth

Gross Revenue

Platform Revenue

% Platform revenue take rate

SaaS Revenue

Total Revenue

% Revenue growth

Gross Profit

% Gross profit margin

R&D

S&M

G&A

EBITDA

Free cash flow

2020PF 2021PF 2022PF(E)

$69

$ 302

$55

$4.1

$8.8

$12.9

339%

$70

$ 6.4

$ 10.2

$16.6

29%

$7.2

$10.0

55.8%

60.2%

$7.0

$8.1

$5.7

$7.1

$ 4.9

$6.8

$ (10.4)

$ (12.0)

$ (10.8) $ (12.5)

2020-Q1/22 pro forma including acquisitions closed subsequently

$ 669

121%

$94

$9.0

1.3%

$ 12.1

$ 21.1

27%

$13.3

63.0%

$ 12.0

$11.5

$9.6

$ (19.8)

$ (20.7)

2023E

$ 1,651

147%

$ 240

$ 26.6

1.6%

$ 12.9

$39.5

87%

$ 25.1

63.5%

$15.4

$19.5

$ 13.3

$ (23.1)

$ (24.2)

$40

$30

$20

$10

$0

Net Revenue (and gross profit)

2020PF

Gross Profit

2021PF

($m)

2022PF(E)

Platform Revenue

2023E

SaaS RevenueView entire presentation