Morgan Stanley Investment Banking Pitch Book

●

Project Roosevelt

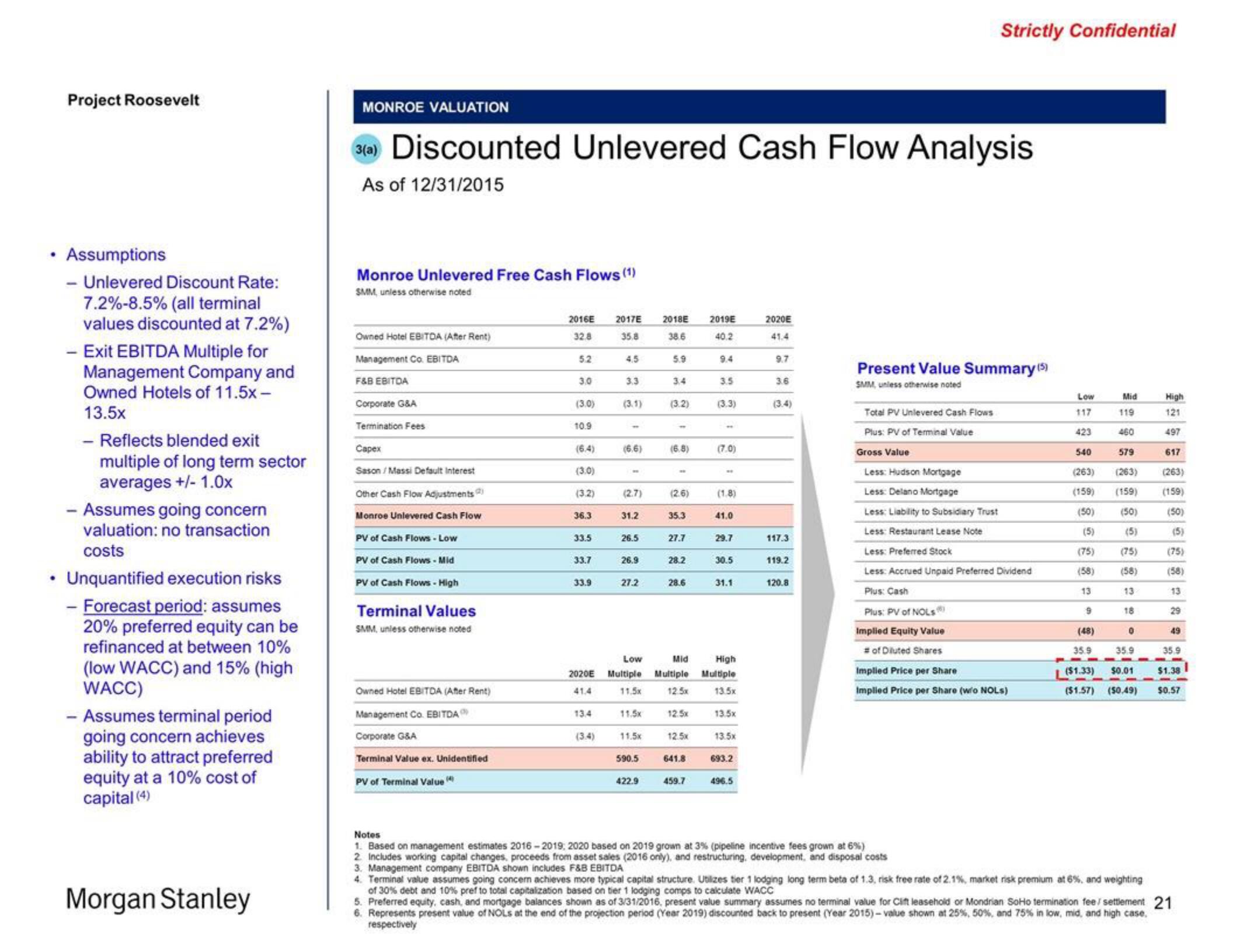

Assumptions

- Unlevered Discount Rate:

7.2%-8.5% (all terminal

values discounted at 7.2%)

- Exit EBITDA Multiple for

Management Company and

Owned Hotels of 11.5x -

13.5x

- Reflects blended exit

multiple of long term sector

averages +/- 1.0x

- Assumes going concern

valuation: no transaction

costs

Unquantified execution risks

- Forecast period: assumes

20% preferred equity can be

refinanced at between 10%

(low WACC) and 15% (high

WACC)

- Assumes terminal period

going concern achieves

ability to attract preferred

equity at a 10% cost of

capital (4)

Morgan Stanley

MONROE VALUATION

3(a) Discounted Unlevered Cash Flow Analysis

As of 12/31/2015

Monroe Unlevered Free Cash Flows (1)

SMM, unless otherwise noted

Owned Hotel EBITDA (After Rent)

Management Co., EBITDA

F&B EBITDA

Corporate G&A

Termination Fees

Capex

Sason/Massi Default Interest

Other Cash Flow Adjustments

Monroe Unlevered Cash Flow

PV of Cash Flows - Low

PV of Cash Flows - Mid

PV of Cash Flows - High

Terminal Values

SMM, unless otherwise noted

Owned Hotel EBITDA (After Rent)

Management Co. EBITDA

Corporate G&A

Terminal Value ex. Unidentified

PV of Terminal Value

2016E 2017E

32.8

35.8

5.2

3.0

(3.0)

10.9

(6.4)

(3.0)

(3.2)

36.3

33.5

33.7

33.9

2020E

41.4

13.4

(3.4)

4.5

3.3

(3.1)

(6.6)

(2.7)

31.2

26.5

26.9

27.2

Low

Multiple

11,58

115

1150

590.5

422.9

2018E

38.6

5.9

3.4

(3.2)

11

(6.8)

(2.6)

35.3

27.7

28.2

28.6

641.8

2019E

40.2

459.7

9.4

3.5

(3.3)

(7.0)

WE

(1.8)

41.0

29.7

30.5

Mid

High

Multiple Multiple

1250

135

125

1357

25

135

693.2

31.1

496.5

2020E

41.4

9.7

3.6

(3.4)

117.3

119.2

120.8

Present Value Summary (5)

SMM, unless otherwise noted

Total PV Unlevered Cash Flows

Plus: PV of Terminal Value

Gross Value

Strictly Confidential

Less: Hudson Mortgage

Less: Delano Mortgage

Less: Liability to Subsidiary Trust

Less: Restaurant Lease Note

Less: Preferred Stock

Less: Accrued Unpaid Preferred Dividend

Plus: Cash

Plus: PV of NOLS

Implied Equity Value

# of Diluted Shares

Implied Price per Share

Implied Price per Share (w/o NOLs)

Notes

1. Based on management estimates 2016-2019, 2020 based on 2019 grown at 3% (pipeline incentive fees grown at 6%)

2. Includes working capital changes, proceeds from asset sales (2016 only), and restructuring, development, and disposal costs

3. Management company EBITDA shown includes F&B EBITDA

Low

117

119

423

460

540

579

(263) (263)

(159) (159)

(50)

(50)

(5)

(5)

(75)

(75)

(58)

(58)

13

18

13

9

(48)

Mid

35.9

0

($1.33)

35.9

$0.01

($1.57) (50.49)

High

121

497

617

(263)

(159)

(50)

(5)

(75)

(58)

13

29

49

4. Terminal value assumes going concern achieves more typical capital structure. Utilizes tier 1 lodging long term beta of 1.3, risk free rate of 2.1%, market risk premium at 6%, and weighting

of 30% debt and 10% pref to total capitalization based on tier 1 lodging comps to calculate WACC

5. Preferred equity, cash, and mortgage balances shown as of 3/31/2016, present value summary assumes no terminal value for Clift leasehold or Mondrian SoHo termination fee / settlement 21

6. Represents present value of NOLS at the end of the projection period (Year 2019) discounted back to present (Year 2015)-value shown at 25%, 50%, and 75% in low, mid, and high case,

respectively

35.9

$1.38

$0.57View entire presentation