MP Materials Investor Conference Presentation Deck

1.

2.

3.

4.

5.

6.

7.

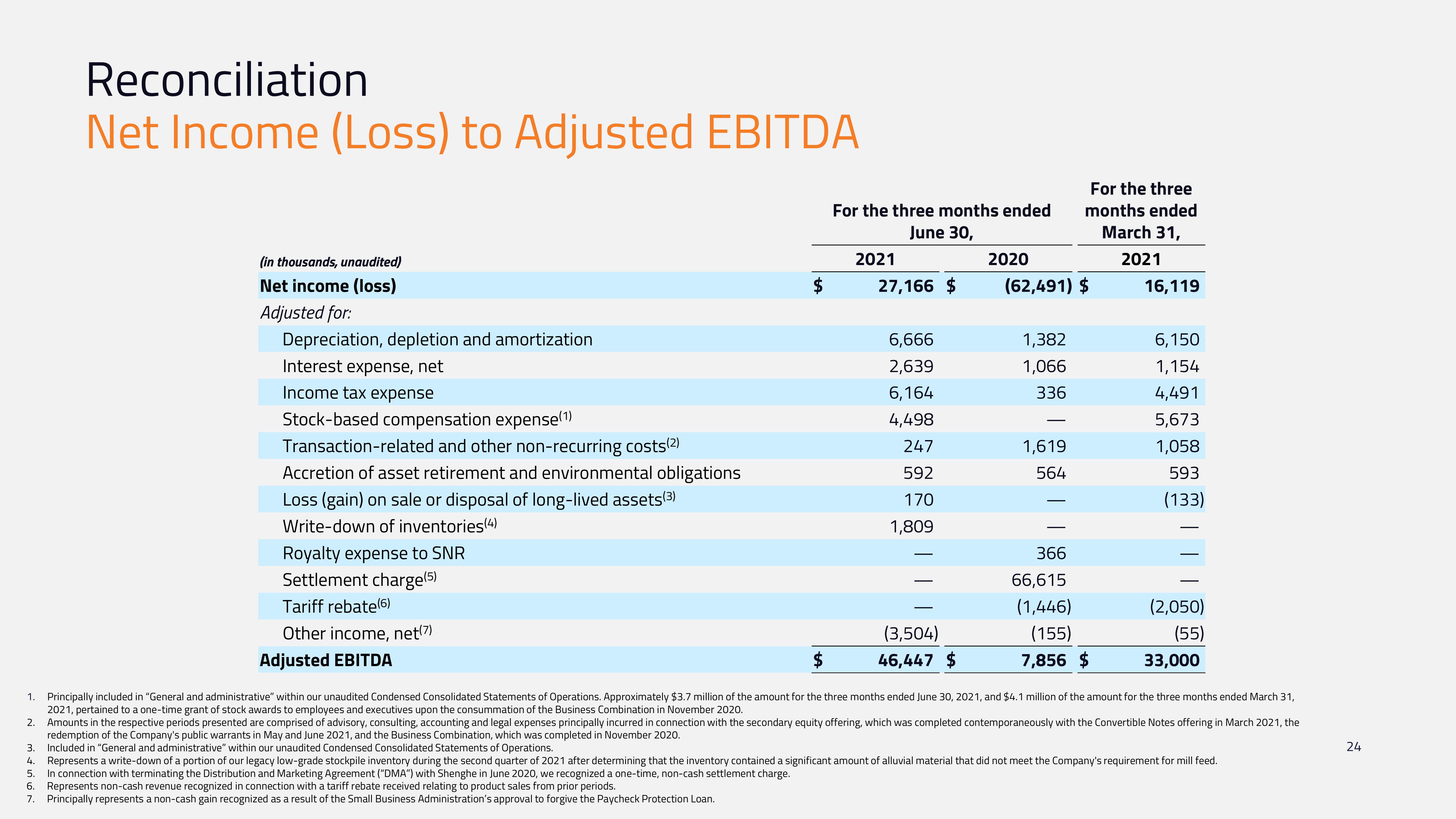

Reconciliation

Net Income (Loss) to Adjusted EBITDA

(in thousands, unaudited)

Net income (loss)

Adjusted for:

Depreciation, depletion and amortization

Interest expense, net

Income tax expense

Stock-based compensation expense(1)

Transaction-related and other non-recurring costs(2)

Accretion of asset retirement and environmental obligations

Loss (gain) on sale or disposal of long-lived assets (3)

Write-down of inventories(4)

Royalty expense to SNR

Settlement charge(5)

Tariff rebate(6)

Other income, net(7)

Adjusted EBITDA

For the three months ended

June 30,

2021

Represents non-cash revenue recognized in connection with a tariff rebate received relating to product sales from prior periods.

Principally represents a non-cash gain recognized as a result of the Small Business Administration's approval to forgive the Paycheck Protection Loan.

27,166 $

6,666

2,639

6,164

4,498

247

592

170

1,809

(3,504)

46,447 $

2020

(62,491) $

1,382

1,066

336

For the three

months ended

March 31,

2021

1,619

564

366

66,615

(1,446)

(155)

7,856 $

16,119

6,150

1,154

4,491

5,673

1,058

593

(133)

(2,050)

(55)

33,000

Principally included in "General and administrative" within our unaudited Condensed Consolidated Statements of Operations. Approximately $3.7 million of the amount for the three months ended June 30, 2021, and $4.1 million of the amount for the three months ended March 31,

2021, pertained to a one-time grant of stock awards to employees and executives upon the consummation of the Business Combination in November 2020.

Amounts in the respective periods presented are comprised of advisory, consulting, accounting and legal expenses principally incurred in connection with the secondary equity offering, which was completed contemporaneously with the Convertible Notes offering in March 2021, the

redemption of the Company's public warrants in May and June 2021, and the Business Combination, which was completed in November 2020.

Included in "General and administrative" within our unaudited Condensed Consolidated Statements of Operations.

Represents a write-down of a portion of our legacy low-grade stockpile inventory during the second quarter of 2021 after determining that the inventory contained a significant amount of alluvial material that did not meet the Company's requirement for mill feed.

In connection with terminating the Distribution and Marketing Agreement ("DMA") with Shenghe in June 2020, we recognized a one-time, non-cash settlement charge.

24View entire presentation