Hilltop Holdings Results Presentation Deck

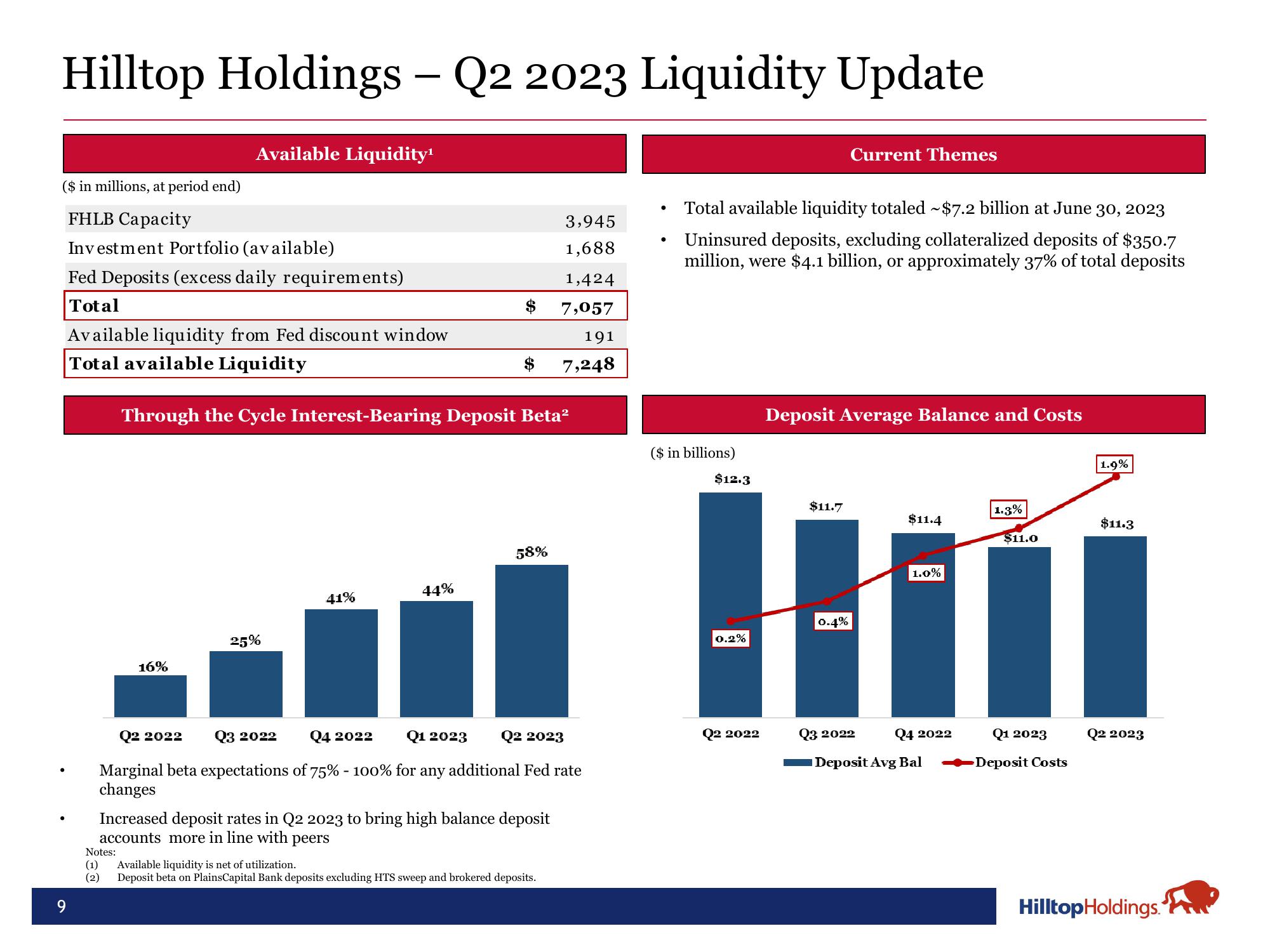

Hilltop Holdings – Q2 2023 Liquidity Update

($ in millions, at period end)

FHLB Capacity

a

Available Liquidity¹

Investment Portfolio (available)

Fed Deposits (excess daily requirements)

Total

Available liquidity from Fed discount window

Total available Liquidity

16%

25%

Through the Cycle Interest-Bearing Deposit Beta²

41%

$

44%

58%

3,945

1,688

1,424

7,057

Increased deposit rates in Q2 2023 to bring high balance deposit

accounts more in line with peers

191

7,248

Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023

Marginal beta expectations of 75% - 100% for any additional Fed rate

changes

Notes:

(1) Available liquidity is net of utilization.

(2) Deposit beta on PlainsCapital Bank deposits excluding HTS sweep and brokered deposits.

●

Total available liquidity totaled ~$7.2 billion at June 30, 2023

Uninsured deposits, excluding collateralized deposits of $350.7

million, were $4.1 billion, or approximately 37% of total deposits

($ in billions)

$12.3

0.2%

Q2 2022

Current Themes

Deposit Average Balance and Costs

$11.7

0.4%

$11.4

1.0%

Q3 2022 Q4 2022

Deposit Avg Bal

1.3%

$11.0

Q1 2023

Deposit Costs

1.9%

$11.3

Q2 2023

Hilltop Holdings.View entire presentation