Owens&Minor Results Presentation Deck

3

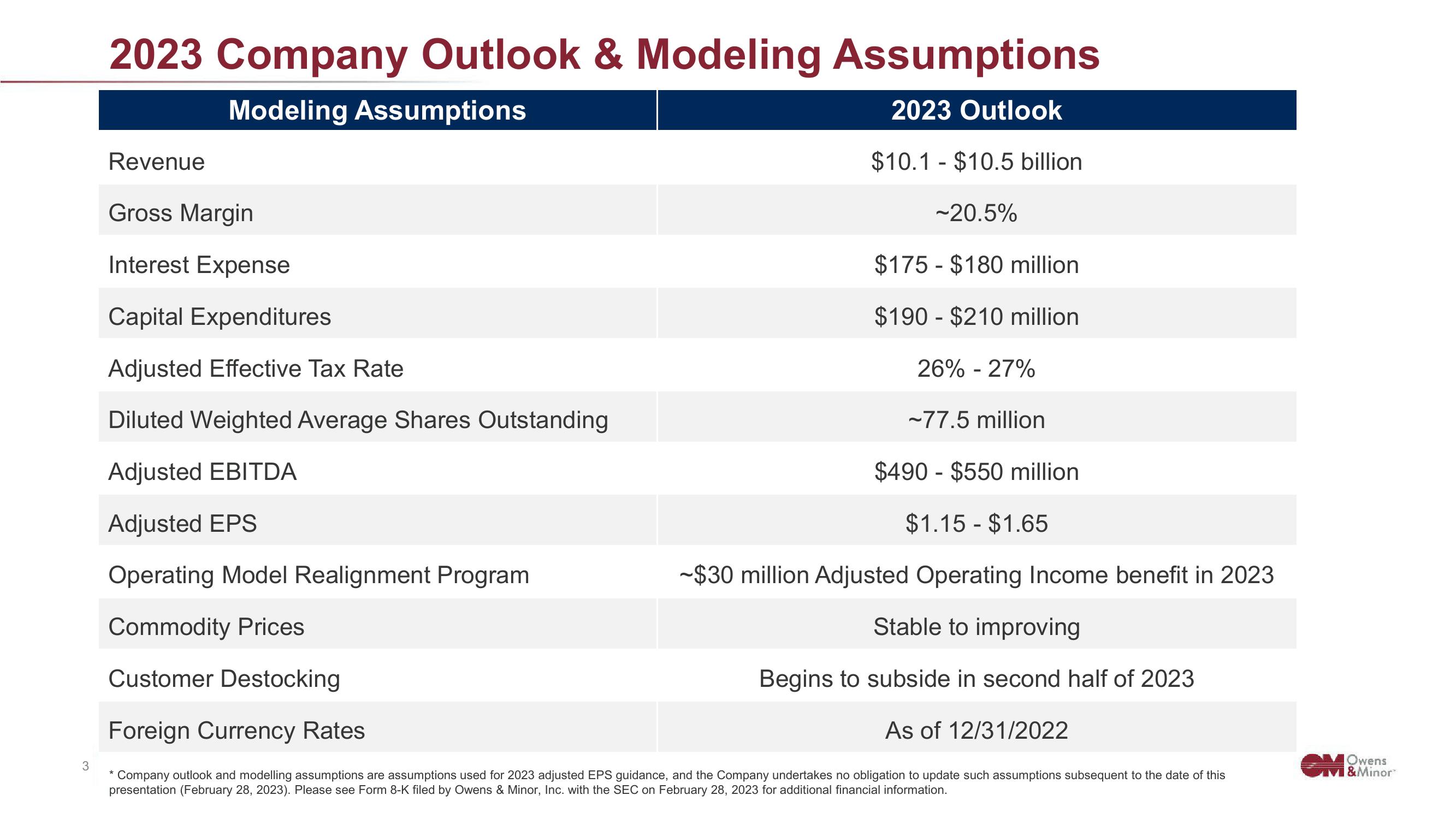

2023 Company Outlook & Modeling Assumptions

Modeling Assumptions

2023 Outlook

$10.1 $10.5 billion

Revenue

Gross Margin

Interest Expense

Capital Expenditures

Adjusted Effective Tax Rate

Diluted Weighted Average Shares Outstanding

Adjusted EBITDA

Adjusted EPS

Operating Model Realignment Program

Commodity Prices

Customer Destocking

-

~20.5%

$175 $180 million

$190 $210 million

-

26% -27%

~77.5 million

$490 $550 million

$1.15 - $1.65

-$30 million Adjusted Operating Income benefit in 2023

Stable to improving

Begins to subside in second half of 2023

Foreign Currency Rates

As of 12/31/2022

Company outlook and modelling assumptions are assumptions used for 2023 adjusted EPS guidance, and the Company undertakes no obligation to update such assumptions subsequent to the date of this

presentation (February 28, 2023). Please see Form 8-K filed by Owens & Minor, Inc. with the SEC on February 28, 2023 for additional financial information.

Owens

VI & MinorView entire presentation