Ready Capital Investor Presentation Deck

Capital Structure

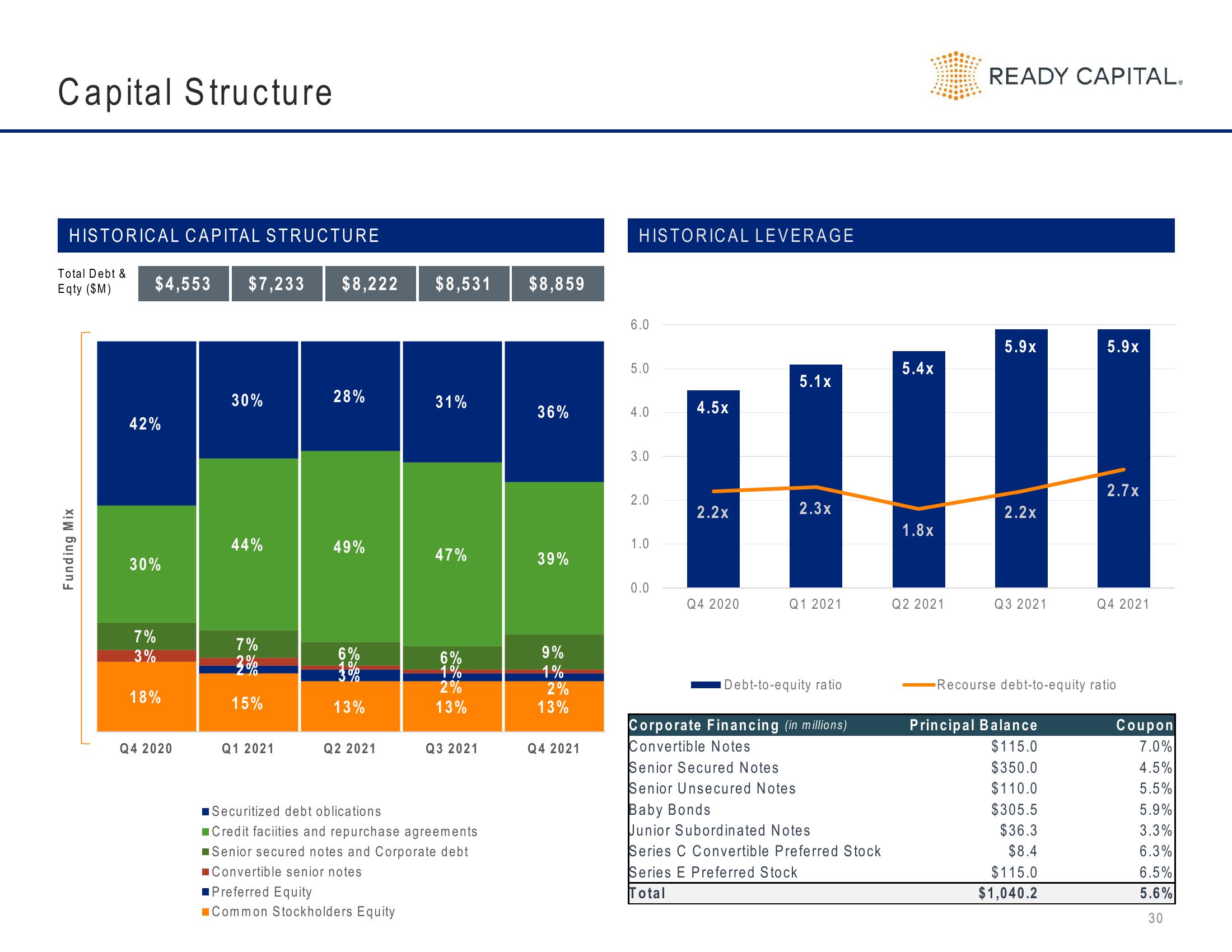

HISTORICAL CAPITAL STRUCTURE

Total Debt &

Eqty ($M)

Funding Mix

$4,553 $7,233 $8,222 $8,531

42%

30%

7%

3%

18%

Q4 2020

30%

44%

7%

2%

500

15%

Q1 2021

28%

49%

643

6%

%

13%

Q2 2021

31%

47%

6%

1%

2%

13%

Q3 2021

■Securitized debt oblications

Credit faciities and repurchase agreements

Senior secured notes and Corporate debt

■Convertible senior notes

Preferred Equity

Common Stockholders Equity

$8,859

36%

39%

9%

1%

2%

13%

Q4 2021

HISTORICAL LEVERAGE

6.0

5.0

4.0

3.0

2.0

1.0

0.0

4.5x

2.2x

Q4 2020

5.1x

2.3x

Q1 2021

Senior Secured Notes

Senior Unsecured Notes

Debt-to-equity ratio

Corporate Financing (in millions)

Convertible Notes

Baby Bonds

Junior Subordinated Notes

Series C Convertible Preferred Stock

Series E Preferred Stock

Total

5.4x

1.8x

Q2 2021

READY CAPITAL.

5.9x

2.2x

Q3 2021

Principal Balance

$115.0

5.9x

$350.0

$110.0

$305.5

$36.3

$8.4

$115.0

$1,040.2

2.7x

-Recourse debt-to-equity ratio

Q4 2021

Coupon

7.0%

4.5%

5.5%

5.9%

3.3%

6.3%

6.5%

5.6%

30View entire presentation