Trian Partners Activist Presentation Deck

Confidential - Not for Reproduction or Distribution

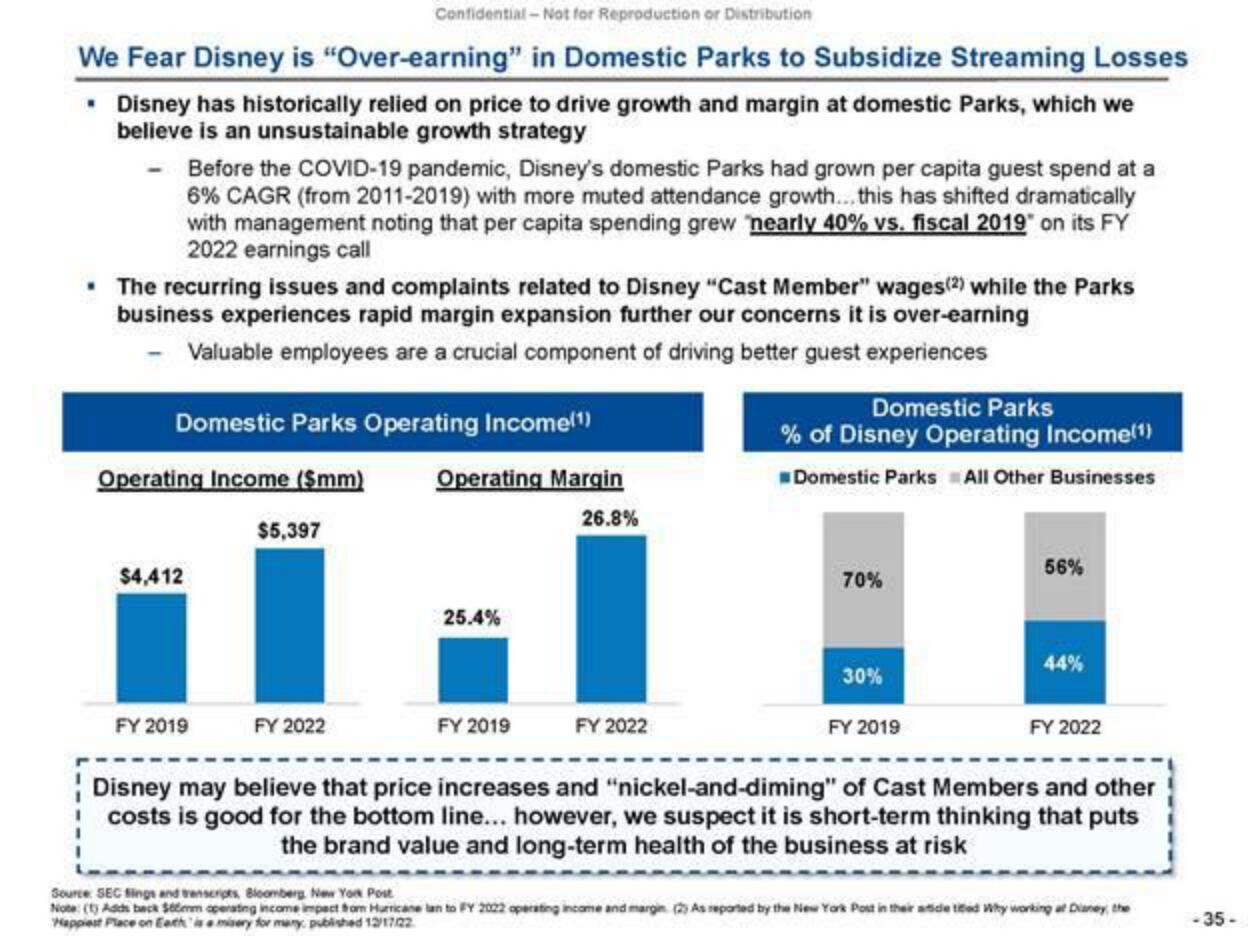

We Fear Disney is "Over-earning" in Domestic Parks to Subsidize Streaming Losses

• Disney has historically relied on price to drive growth and margin at domestic Parks, which we

believe is an unsustainable growth strategy

Before the COVID-19 pandemic, Disney's domestic Parks had grown per capita guest spend at a

6% CAGR (from 2011-2019) with more muted attendance growth... this has shifted dramatically

with management noting that per capita spending grew nearly 40% vs. fiscal 2019" on its FY

2022 earnings call

• The recurring issues and complaints related to Disney "Cast Member" wages (2) while the Parks

business experiences rapid margin expansion further our concerns it is over-earning

Valuable employees are a crucial component of driving better guest experiences

Domestic Parks Operating Income(¹)

Operating Income ($mm)

$5,397

$4,412

FY 2019

FY 2022

Operating Margin

25.4%

FY 2019

26.8%

FY 2022

Domestic Parks

% of Disney Operating Income(¹)

Domestic Parks All Other Businesses

70%

30%

FY 2019

56%

44%

FY 2022

Disney may believe that price increases and "nickel-and-diming" of Cast Members and other

costs is good for the bottom line... however, we suspect it is short-term thinking that puts

the brand value and long-term health of the business at risk

Source SEC fings and transcripts, Bloomberg. New York Post

Note: (1) Adds back $66mm aperating income impact from Hurricane lan to FY 2022 operating income and margin (2) As reported by the New York Post in their article tited Why working at Dianey, the

Happiest Place on Earth is a misery for many published 12/17/22

-35-View entire presentation