HBT Financial Results Presentation Deck

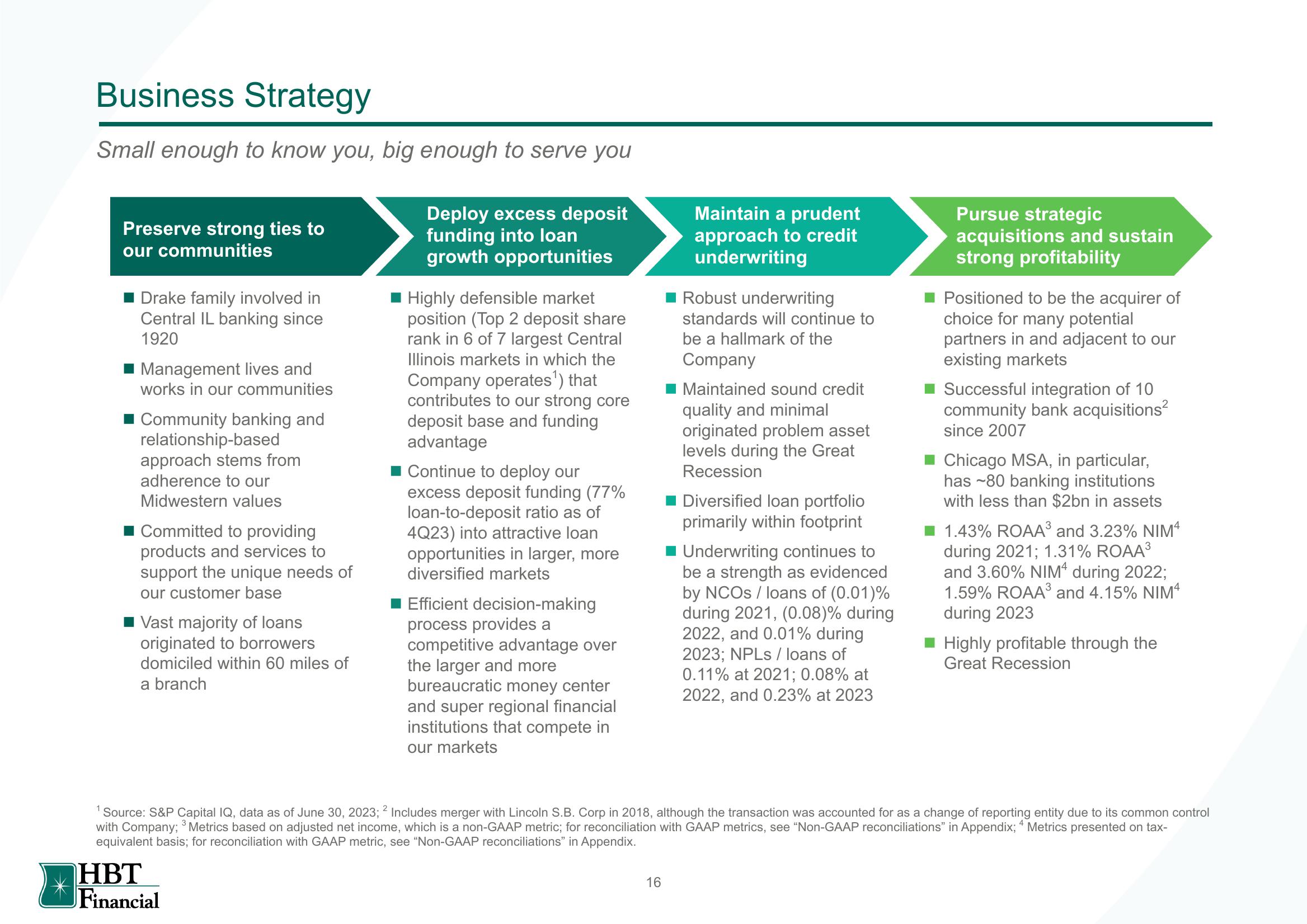

Business Strategy

Small enough to know you, big enough to serve you

Preserve strong ties to

our communities

Drake family involved in

Central IL banking since

1920

Management lives and

works in our communities

Community banking and

relationship-based

approach stems from

adherence to our

Midwestern values

Committed to providing

products and services to

support the unique needs of

our customer base

Vast majority of loans

originated to borrowers

domiciled within 60 miles of

a branch

Deploy excess deposit

funding into loan

growth opportunities

HBT

Financial

Highly defensible market

position (Top 2 deposit share

rank in 6 of 7 largest Central

Illinois markets in which the

Company operates¹) that

contributes to our strong core

deposit base and funding

advantage

Continue to deploy our

excess deposit funding (77%

loan-to-deposit ratio as of

4Q23) into attractive loan

opportunities in larger, more

diversified markets

Efficient decision-making

process provides a

competitive advantage over

the larger and more

bureaucratic money center

and super regional financial

institutions that compete in

our markets

Maintain a prudent

approach to credit

underwriting

16

Robust underwriting

standards will continue to

be a hallmark of the

Company

Maintained sound credit

quality and minimal

originated problem asset

levels during the Great

Recession

Diversified loan portfolio

primarily within footprint

Underwriting continues to

be a strength as evidenced

by NCOS / loans of (0.01)%

during 2021, (0.08)% during

2022, and 0.01% during

2023; NPLs/loans of

0.11% at 2021; 0.08% at

2022, and 0.23% at 2023

Pursue strategic

acquisitions and sustain

strong profitability

Positioned to be the acquirer of

choice for many potential

partners in and adjacent to our

existing markets

Successful integration of 10

community bank acquisitions²

since 2007

Chicago MSA, in particular,

has -80 banking institutions

with less than $2bn in assets

1.43% ROAA³ and 3.23% NIM4

during 2021; 1.31% ROAA³

and 3.60% NIM during 2022;

1.59% ROAA³ and 4.15% NIM4

during 2023

Source: S&P Capital IQ, data as of June 30, 2023; 2 Includes merger with Lincoln S.B. Corp in 2018, although the transaction was accounted for as a change of reporting entity due to its common control

with Company; ³ Metrics based on adjusted net income, which is a non-GAAP metric; for reconciliation with GAAP metrics, see "Non-GAAP reconciliations" in Appendix; 4 Metrics presented on tax-

equivalent basis; for reconciliation with GAAP metric, see "Non-GAAP reconciliations" in Appendix.

Highly profitable through the

Great RecessionView entire presentation