AlTi SPAC Presentation Deck

AITi Transaction overview

ALVARIUM TIEDEMANN CAPITAL

$Millions; unless otherwise stated

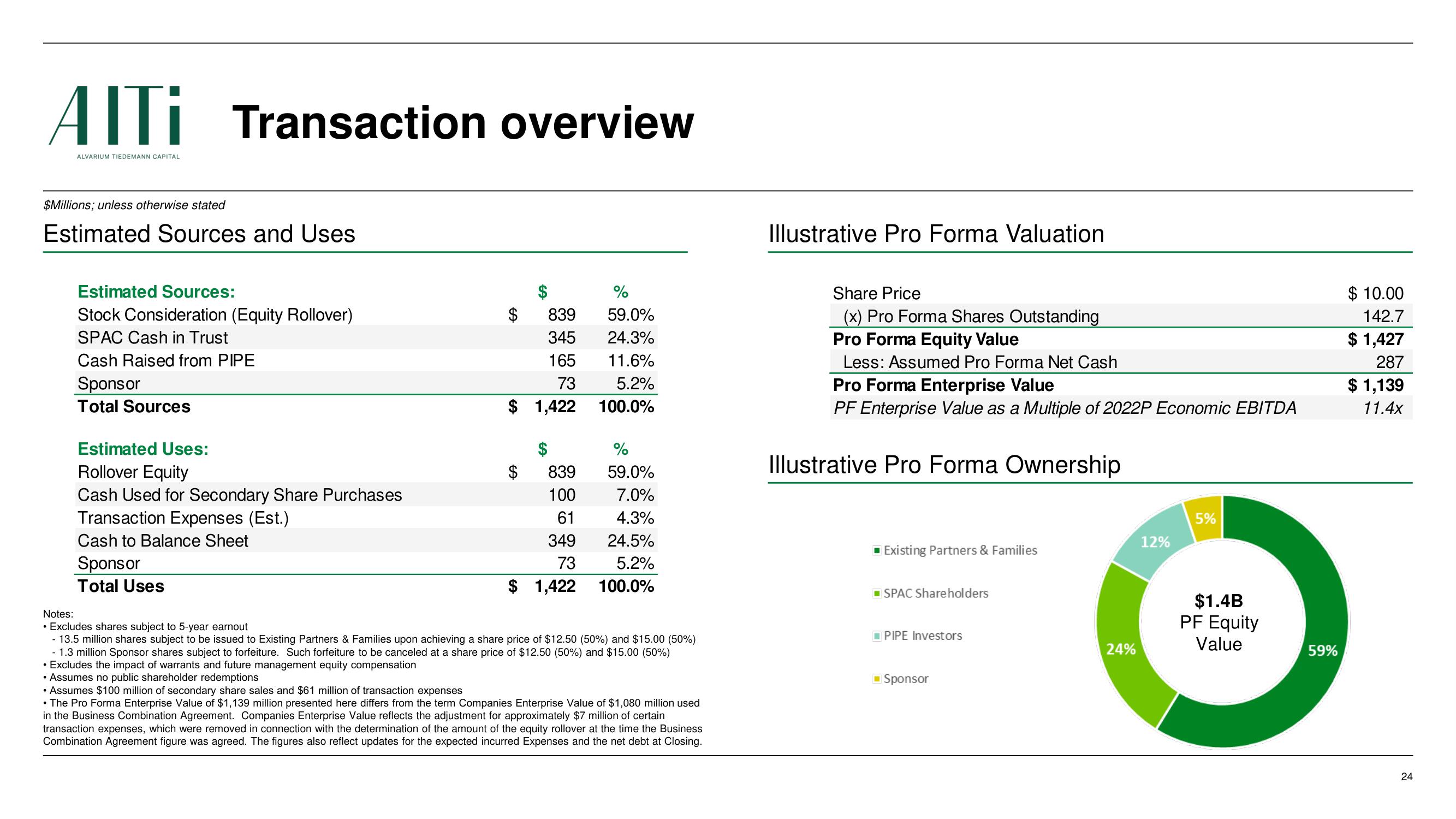

Estimated Sources and Uses

Estimated Sources:

Stock Consideration (Equity Rollover)

SPAC Cash in Trust

Cash Raised from PIPE

Sponsor

Total Sources

Estimated Uses:

Rollover Equity

Cash Used for Secondary Share Purchases

Transaction Expenses (Est.)

Cash to Balance Sheet

Sponsor

Total Uses

%

839 59.0%

345

165

73

24.3%

11.6%

5.2%

100.0%

$ 1,422

• Excludes the impact of warrants and future management equity compensation

• Assumes no public shareholder redemptions

EA

839

100

61

349

73

$ 1,422

%

59.0%

7.0%

4.3%

24.5%

5.2%

100.0%

Notes:

• Excludes shares subject to 5-year earnout

- 13.5 million shares subject to be issued to Existing Partners & Families upon achieving a share price of $12.50 (50%) and $15.00 (50%)

- 1.3 million Sponsor shares subject to forfeiture. Such forfeiture to be canceled at a share price of $12.50 (50%) and $15.00 (50%)

• Assumes $100 million of secondary share sales and $61 million of transaction expenses

• The Pro Forma Enterprise Value of $1,139 million presented here differs from the term Companies Enterprise Value of $1,080 million used

in the Business Combination Agreement. Companies Enterprise Value reflects the adjustment for approximately $7 million of certain

transaction expenses, which were removed in connection with the determination of the amount of the equity rollover at the time the Business

Combination Agreement figure was agreed. The figures also reflect updates for the expected incurred Expenses and the net debt at Closing.

Illustrative Pro Forma Valuation

Share Price

(x) Pro Forma Shares Outstanding

Pro Forma Equity Value

Less: Assumed Pro Forma Net Cash

Pro Forma Enterprise Value

PF Enterprise Value as a Multiple of 2022P Economic EBITDA

Illustrative Pro Forma Ownership

Existing Partners & Families

SPAC Shareholders

PIPE Investors

Sponsor

24%

12%

5%

$1.4B

PF Equity

Value

59%

$ 10.00

142.7

$ 1,427

287

$ 1,139

11.4x

24View entire presentation