jetBlue Mergers and Acquisitions Presentation Deck

jetBlue

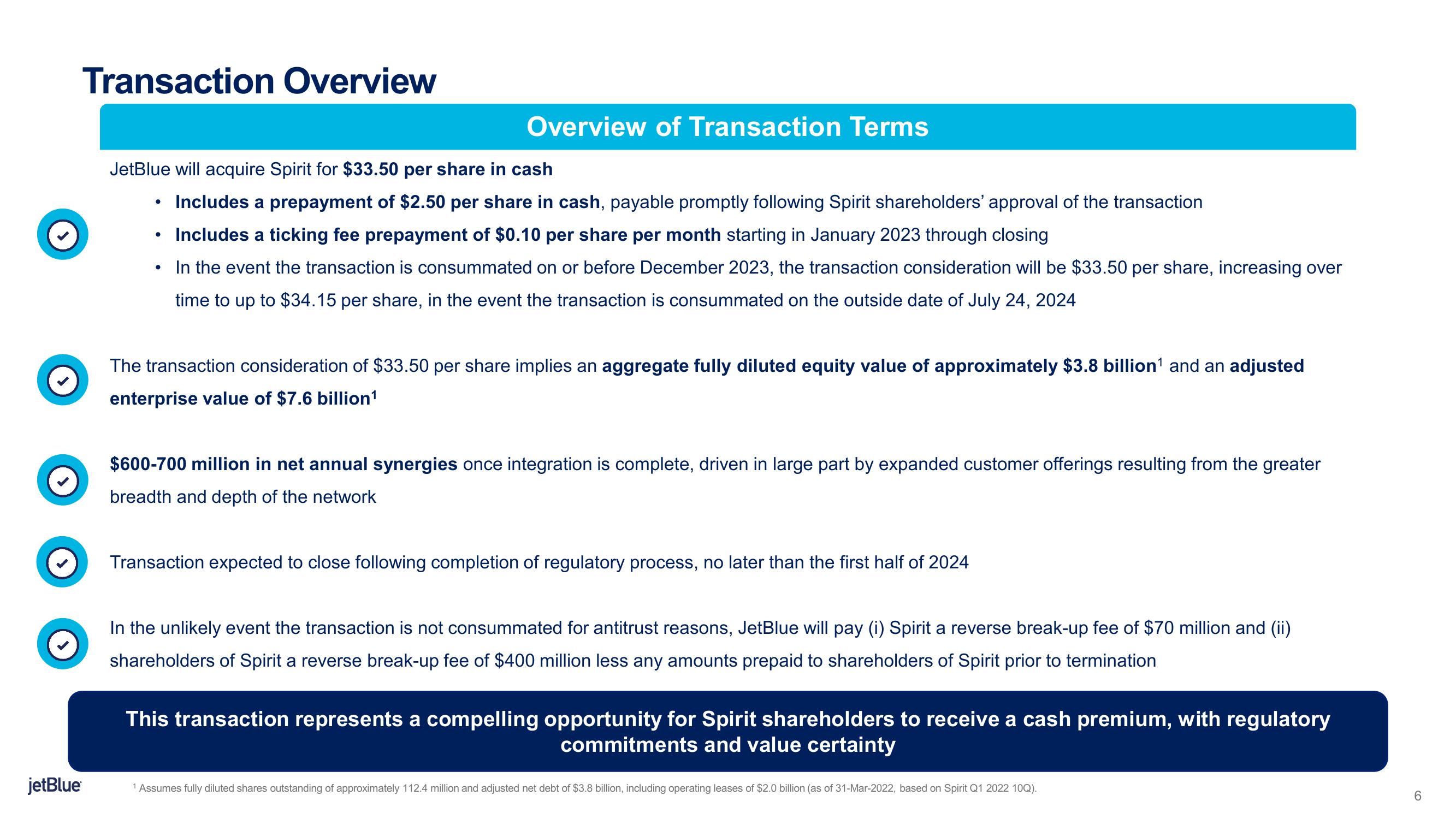

Transaction Overview

JetBlue will acquire Spirit for $33.50 per share in cash

Includes a prepayment of $2.50 per share in cash, payable promptly following Spirit shareholders' approval of the transaction

Includes a ticking fee prepayment of $0.10 per share per month starting in January 2023 through closing

In the event the transaction is consummated on or before December 2023, the transaction consideration will be $33.50 per share, increasing over

time to up to $34.15 per share, in the event the transaction is consummated on the outside date of July 24, 2024

●

Overview of Transaction Terms

●

The transaction consideration of $33.50 per share implies an aggregate fully diluted equity value of approximately $3.8 billion¹ and an adjusted

enterprise value of $7.6 billion¹

$600-700 million in net annual synergies once integration is complete, driven in large part by expanded customer offerings resulting from the greater

breadth and depth of the network

Transaction expected to close following completion of regulatory process, no later than the first half of 2024

In the unlikely event the transaction is not consummated for antitrust reasons, JetBlue will pay (i) Spirit a reverse break-up fee of $70 million and (ii)

shareholders of Spirit a reverse break-up fee of $400 million less any amounts prepaid to shareholders of Spirit prior to termination

This transaction represents a compelling opportunity for Spirit shareholders to receive a cash premium, with regulatory

commitments and value certainty

1 Assumes fully diluted shares outstanding of approximately 112.4 million and adjusted net debt of $3.8 billion, including operating leases of $2.0 billion (as of 31-Mar-2022, based on Spirit Q1 2022 10Q).

6View entire presentation