Nexters Results Presentation Deck

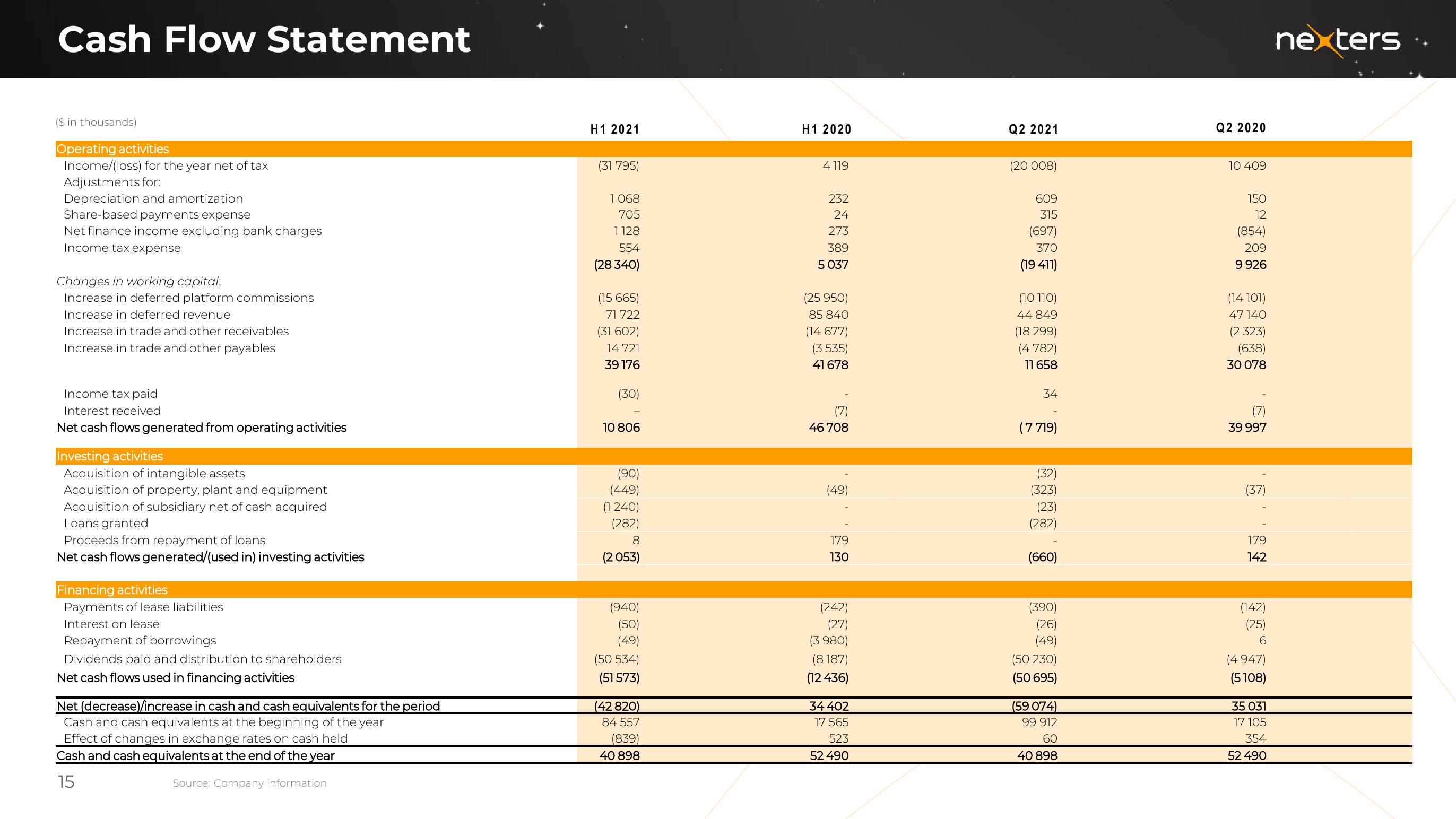

Cash Flow Statement

($ in thousands)

Operating activities

Income/(loss) for the year net of tax

Adjustments for:

Depreciation and amortization

Share-based payments expense

Net finance income excluding bank charges

Income tax expense

Changes in working capital:

Increase in deferred platform commissions

Increase in deferred revenue

Increase in trade and other receivables

Increase in trade and other payables

Income tax paid

Interest received

Net cash flows generated from operating activities

Investing activities

Acquisition of intangible assets

Acquisition of property, plant and equipment

Acquisition of subsidiary net of cash acquired

Loans granted

Proceeds from repayment of loans

Net cash flows generated/(used in) investing activities

Financing activities

Payments of lease liabilities

Interest on lease

Repayment of borrowings

Dividends paid and distribution to shareholders

Net cash flows used in financing activities

Net (decrease)/increase in cash and cash equivalents for the period

Cash and cash equivalents at the beginning of the year

Effect of changes in exchange rates on cash held

Cash and cash equivalents at the end of the year

15

Source: Company information

H1 2021

(31 795)

1 068

705

1128

554

(28 340)

(15 665)

71 722

(31 602)

14 721

39 176

(30)

10 806

(90)

(449)

(1 240)

(282)

8

(2 053)

(940)

(50)

(49)

(50 534)

(51 573)

(42 820)

84 557

(839)

40 898

H1 2020

4 119

232

24

273

389

5 037

(25 950)

85 840

(14 677)

(3 535)

41 678

(7)

46 708

(49)

179

130

(242)

(27)

(3 980)

(8187)

(12 436)

34 402

17 565

523

52 490

Q2 2021

(20 008)

609

315

(697)

370

(19 411)

(10 110)

44 849

(18 299)

(4782)

11 658

34

(7 719)

(32)

(323)

(23)

(282)

(660)

(390)

(26)

(49)

(50 230)

(50 695)

(59 074)

99 912

60

40 898

Q2 2020

10 409

150

12

(854)

209

9926

(14 101)

47140

(2 323)

(638)

30 078

39 997

(37)

179

142

(142)

(25)

6

(4 947)

(5108)

35 031

17 105

354

52 490

nexters.View entire presentation