Hanmi Financial Results Presentation Deck

Deposit Base

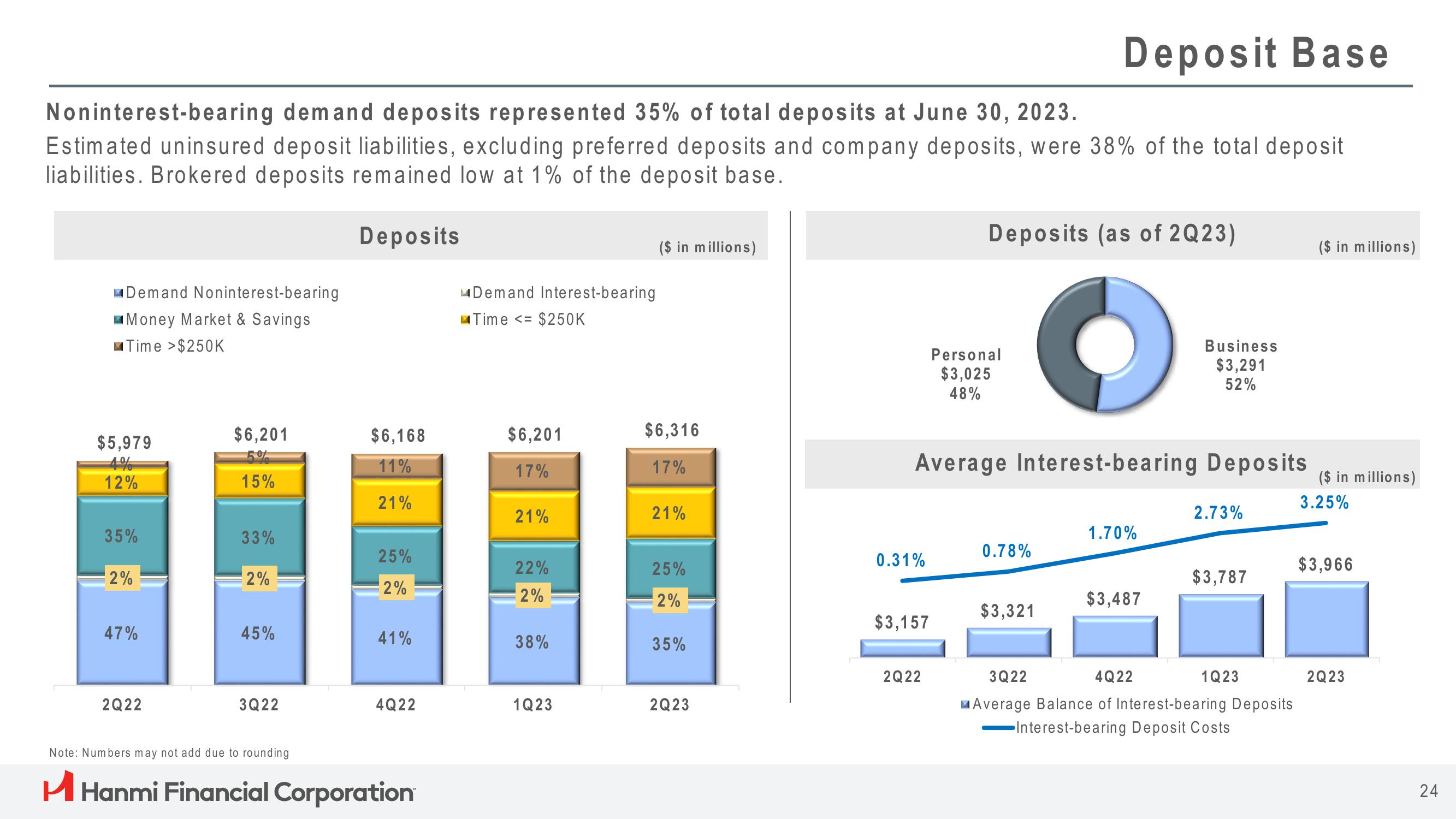

Noninterest-bearing demand deposits represented 35% of total deposits at June 30, 2023.

Estimated uninsured deposit liabilities, excluding preferred deposits and company deposits, were 38% of the total deposit

liabilities. Brokered deposits remained low at 1% of the deposit base.

Deposits

Demand Noninterest-bearing

Money Market & Savings

Time >$250K

$5,979

12%

35%

-2%

47%

2Q22

$6,201

15%

33%

2%

45%

3Q22

$6,168

11%

21%

25%

2%

41%

4Q22

Note: Numbers may not add due to rounding

H Hanmi Financial Corporation

Demand Interest-bearing

Time <= $250K

$6,201

17%

21%

22%

2%

38%

1Q23

($ in millions)

$6,316

17%

21%

25%

2%

35%

2Q23

Deposits (as of 2Q23)

O

Average Interest-bearing Deposits

0.31%

$3,157

2Q22

Personal

$3,025

48%

0.78%

$3,321

1.70%

$3,487

Business

$3,291

52%

2.73%

$3,787

4Q22

3Q22

Average Balance of Interest-bearing Deposits

Interest-bearing Deposit Costs

1Q23

($ in millions)

($ in millions)

3.25%

$3,966

2Q23

24View entire presentation