CorpAcq SPAC Presentation Deck

18

1C

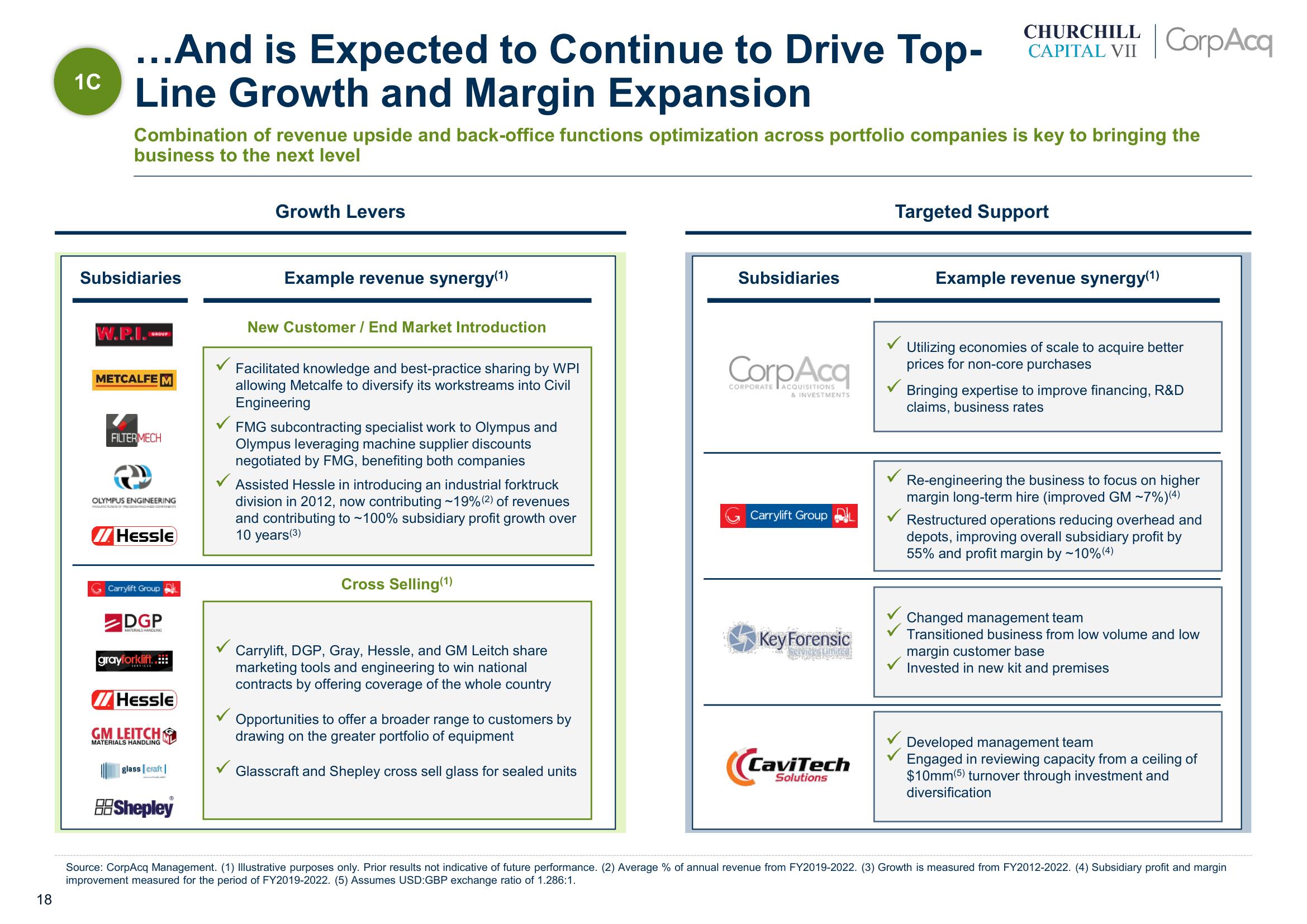

...And is Expected to Continue to Drive Top-

Line Growth and Margin Expansion

Combination of revenue upside and back-office functions optimization across portfolio companies is key to bringing the

business to the next level

Subsidiaries

W.P.I.

GROUP

METCALFEM

FILTERMECH

OLYMPUS ENGINEERING

PANTOFFEENCOMEN

Hessle

GCarrylift Group

DGP

MATERIALS HANDLING

grayforklift..

Hessle

GM LEITCH

glass craft |

Shepley

Growth Levers

Example revenue synergy(1)

New Customer / End Market Introduction

Facilitated knowledge and best-practice sharing by WPI

allowing Metcalfe to diversify its workstreams into Civil

Engineering

FMG subcontracting specialist work to Olympus and

Olympus leveraging machine supplier discounts

negotiated by FMG, benefiting both companies

Assisted Hessle in introducing an industrial forktruck

division in 2012, now contributing ~19% (2) of revenues

and contributing to ~100% subsidiary profit growth over

10 years (³)

Cross Selling(1)

Carrylift, DGP, Gray, Hessle, and GM Leitch share

marketing tools and engineering to win national

contracts by offering coverage of the whole country

Opportunities to a broader range to customers by

drawing on the greater portfolio of equipment

Glasscraft and Shepley cross sell glass for sealed units

Subsidiaries

CORPORATE ACQUISITIONS

& INVESTMENTS

Carrylift Group

Key Forensic

CHURCHILL

CAPITAL VII CorpAcq

CaviTech

Solutions

Targeted Support

Example revenue synergy(¹)

Utilizing economies of scale to acquire better

prices for non-core purchases

Bringing expertise to improve financing, R&D

claims, business rates

Re-engineering the business to focus on higher

margin long-term hire (improved GM -7%)(4)

Restructured operations reducing overhead and

depots, improving overall subsidiary profit by

55% and profit margin by ~10% (4)

Changed management team

Transitioned business from low volume and low

margin customer base

Invested in new kit and premises

Developed management team

Engaged in reviewing capacity from a ceiling of

$10mm (5) turnover through investment and

diversification

Source: CorpAcq Management. (1) Illustrative purposes only. Prior results not indicative of future performance. (2) Average % of annual revenue from FY2019-2022. (3) Growth is measured from FY2012-2022. (4) Subsidiary profit and margin

improvement measured for the period of FY2019-2022. (5) Assumes USD:GBP exchange ratio of 1.286:1.View entire presentation