IGI SPAC Presentation Deck

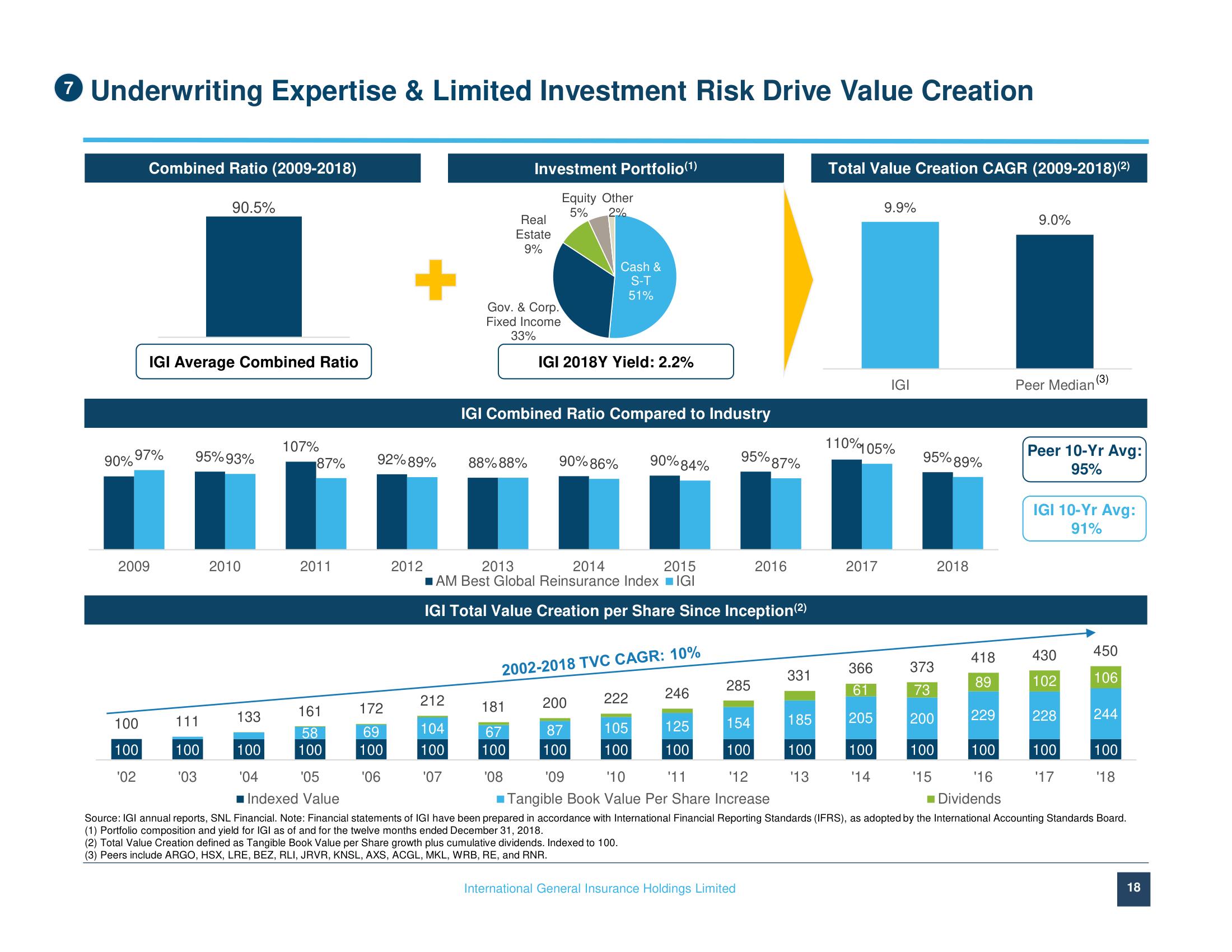

7 Underwriting Expertise & Limited Investment Risk Drive Value Creation

Combined Ratio (2009-2018)

90% 97%

IGI Average Combined Ratio

2009

100

100

'02

90.5%

95%93%

111

100

'03

2010

133

107%

100

'04

87%

2011

92%89%

2012

172

69

100

'06

212

104

100

'07

Investment Portfolio(1)

Equity Other

5% 2%

Real

Estate

9%

Gov. & Corp.

Fixed Income

33%

88%88%

IGI Combined Ratio Compared to Industry

Cash &

S-T

51%

IGI 2018Y Yield: 2.2%

181

67

100

'08

90%86%

2013

2014

2015

■AM Best Global Reinsurance Index■IGI

IGI Total Value Creation per Share Since Inception (²)

2002-2018 TVC CAGR: 10%

90%84%

222

105

100

246

95%87%

125

100

285

2016

International General Insurance Holdings Limited

331

Total Value Creation CAGR (2009-2018)(²)

185

100

'13

110%105%

2017

9.9%

I

366

61

205

IGI

100

'14

95% 89%

200

161

154

58

87

100

100

100

100

'05

'10

'11

'12

'16

'09

Tangible Book Value Per Share Increase

■Indexed Value

■ Dividends

Source: IGI annual reports, SNL Financial. Note: Financial statements of IGI have been prepared in accordance with International Financial Reporting Standards (IFRS), as adopted by the International Accounting Standards Board.

(1) Portfolio composition and yield for IGI as of and for the twelve months ended December 31, 2018.

(2) Total Value Creation defined as Tangible Book Value per Share growth plus cumulative dividends. Indexed to 100.

(3) Peers include ARGO, HSX, LRE, BEZ, RLI, JRVR, KNSL, AXS, ACGL, MKL, WRB, RE, and RNR.

373

73

200

2018

100

'15

418

89

9.0%

229

Peer Median

Peer 10-Yr Avg:

95%

IGI 10-Yr Avg:

91%

430

102

(3)

228

100

'17

450

106

244

100

'18

18View entire presentation