LCI Industries Investor Presentation Deck

FINANCIAL OVERVIEW

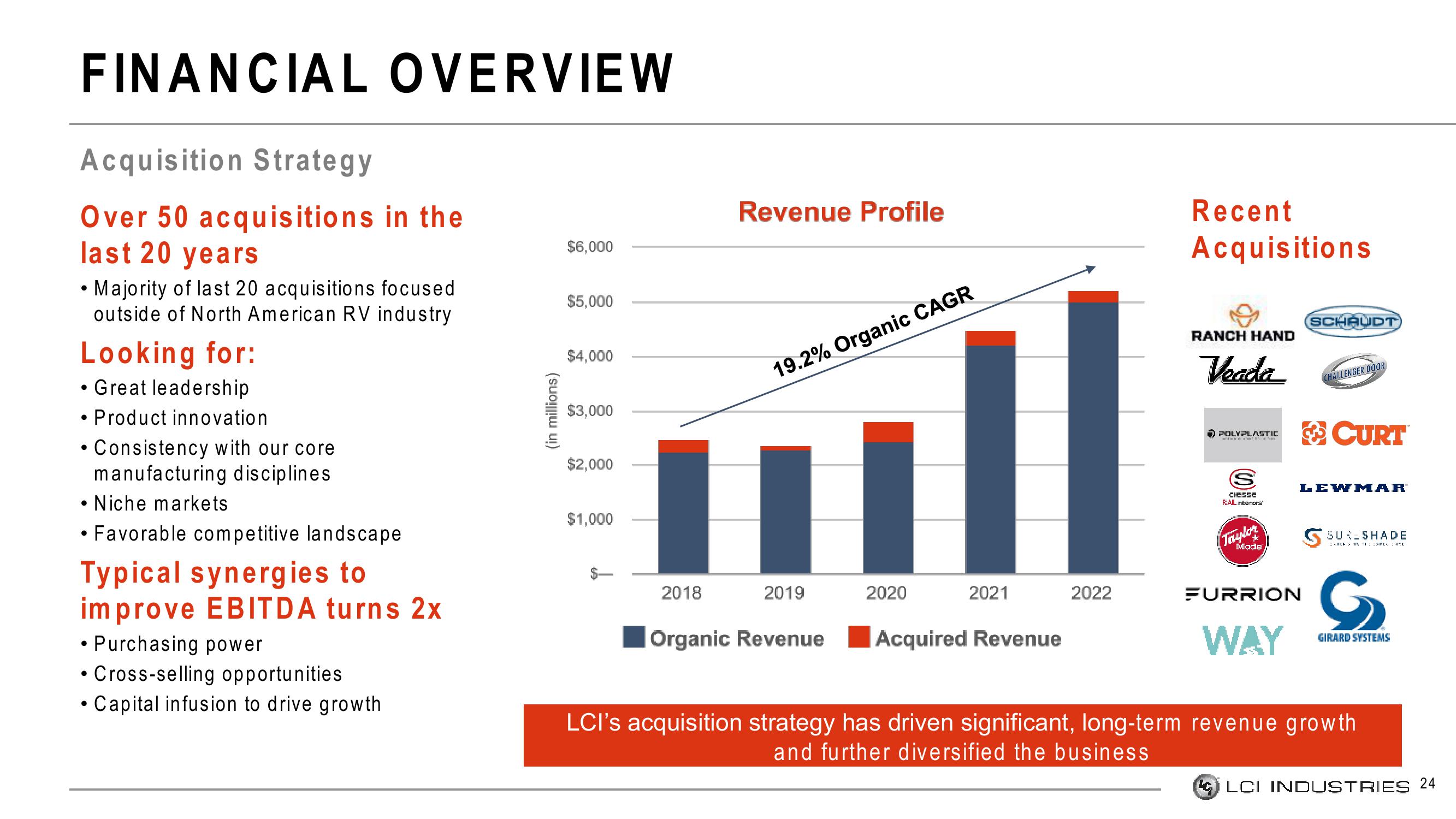

Acquisition Strategy

Over 50 acquisitions in the

last 20 years

• Majority of last 20 acquisitions focused

outside of North American RV industry

Looking for:

• Great leadership

●

• Product innovation

• Consistency with our core.

manufacturing disciplines.

• Niche markets

• Favorable competitive landscape

Typical synergies to

improve EBITDA turns 2x

• Purchasing power

• Cross-selling opportunities

●

• Capital infusion to drive growth

(in millions)

$6,000

$5,000

$4,000

$3,000

$2,000

$1,000

2018

Revenue Profile

19.2% Organic CAGR

2019

Organic Revenue

2020

2021

Acquired Revenue

2022

Recent

Acquisitions

RANCH HAND

Veada

POLYPLASTIC

54

S

CIESSE

RAIL inter

Tauplor

Made

FURRION

WAY

SCHAUDT

CHALLENGER DOOR

CURT

LEWMAR

SUN SHADE

CARE > 15:37:42

S

GIRARD SYSTEMS

LCI's acquisition strategy has driven significant, long-term revenue growth

and further diversified the business

LCI INDUSTRIES 24View entire presentation