SmileDirectClub Investor Presentation Deck

Gross margin.

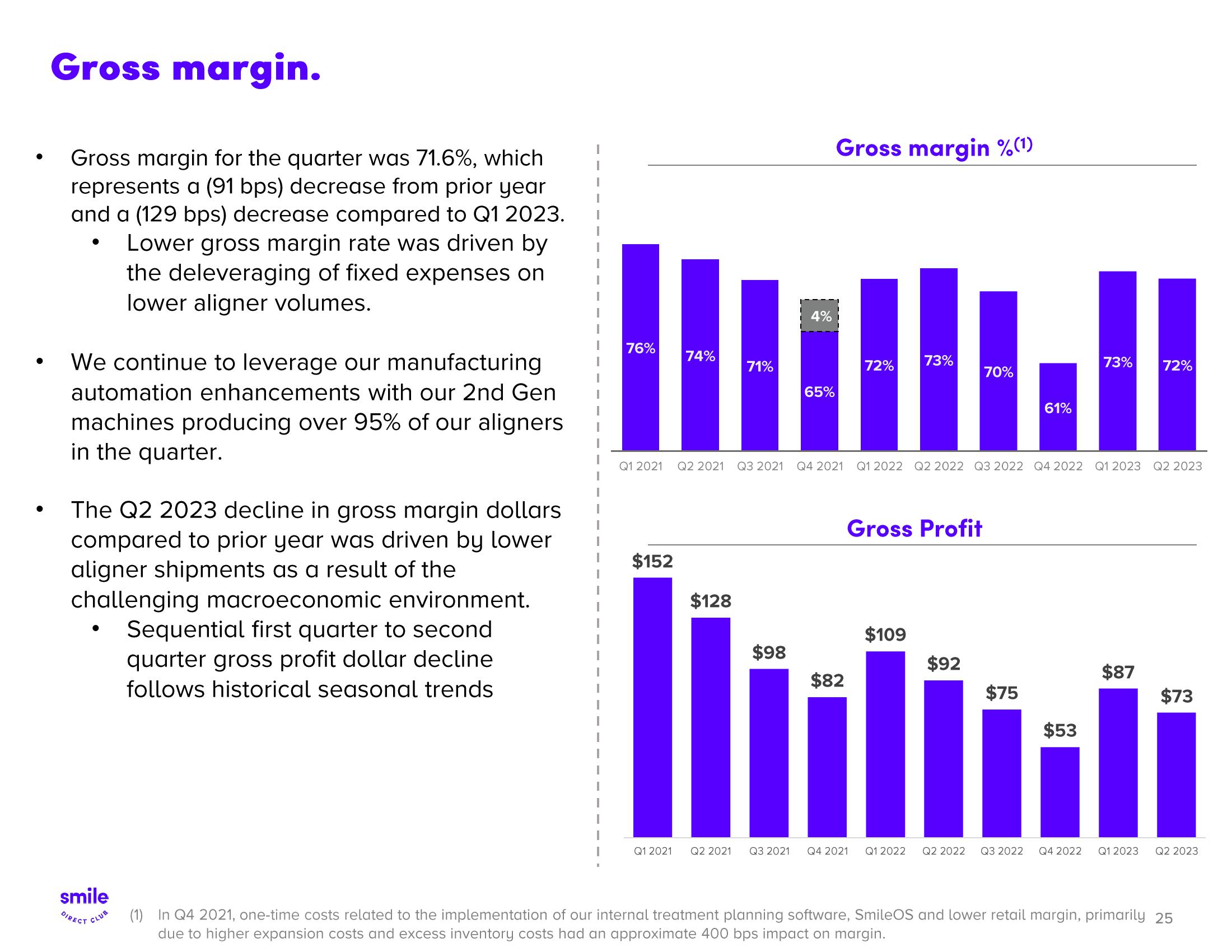

Gross margin for the quarter was 71.6%, which

represents a (91 bps) decrease from prior year

and a (129 bps) decrease compared to Q1 2023.

Lower gross margin rate was driven by

the deleveraging of fixed expenses on

lower aligner volumes.

We continue to leverage our manufacturing

automation enhancements with our 2nd Gen

machines producing over 95% of our aligners

in the quarter.

The Q2 2023 decline in gross margin dollars

compared to prior year was driven by lower

aligner shipments as a result of the

challenging macroeconomic environment.

Sequential first quarter to second

quarter gross profit dollar decline

follows historical seasonal trends

smile

DIRECT CLUB

I

76%

74%

$152

71%

$128

$98

4%

MILI

72% 73%

70%

61%

Q1 2021 Q2 2021 Q3 2021 Q4 2021

Gross margin %(¹)

65%

Gross Profit

$82

Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023

$109

$92

$75

73% 72%

$53

$87

Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023

$73

Q2 2023

(1)

In Q4 2021, one-time costs related to the implementation of our internal treatment planning software, SmileOS and lower retail margin, primarily 25

due to higher expansion costs and excess inventory costs had an approximate 400 bps impact on margin.View entire presentation