Hilltop Holdings Results Presentation Deck

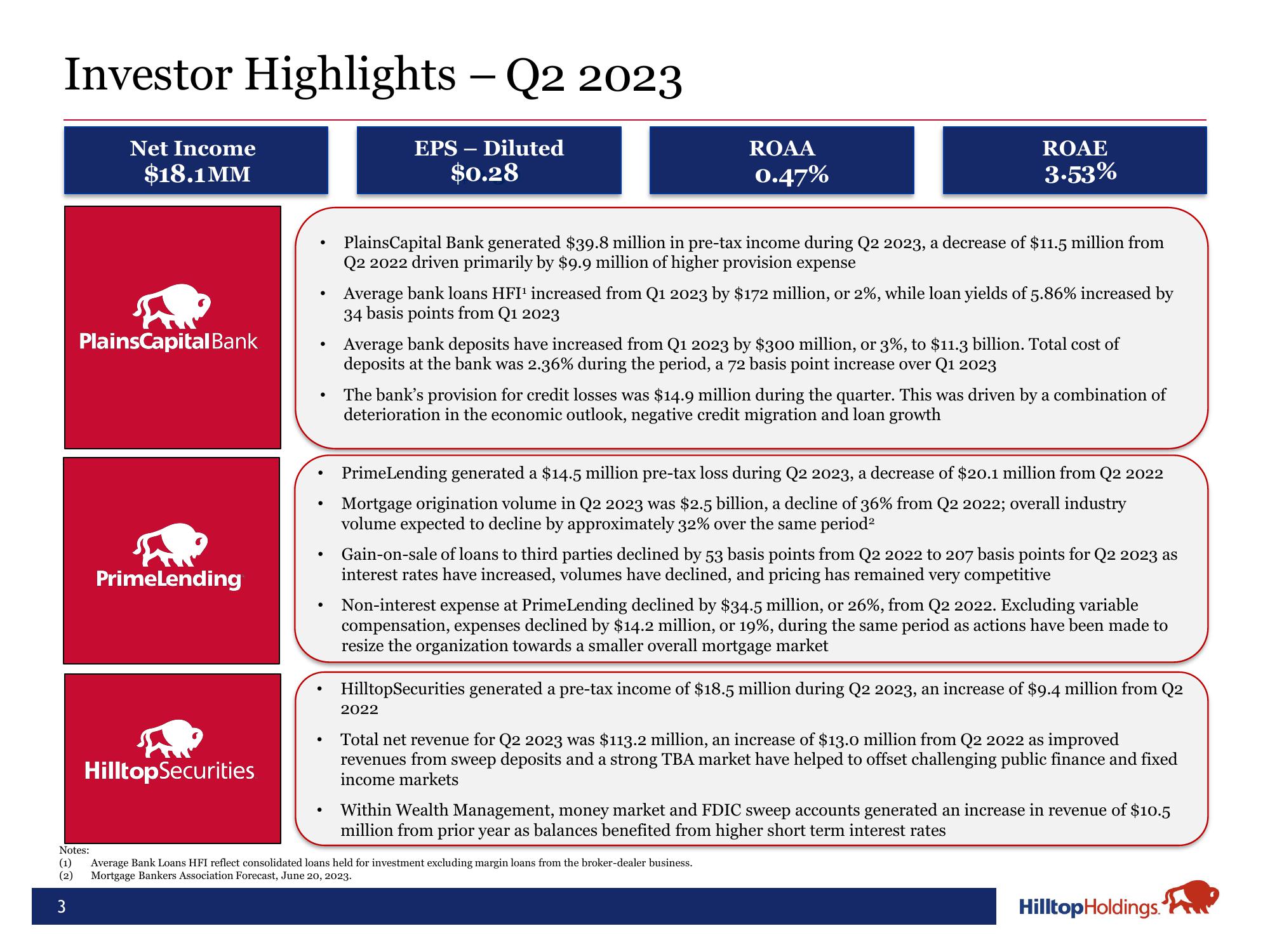

Investor Highlights - Q2 2023

EPS - Diluted

$0.28

Net Income

$18.1MM

PlainsCapital Bank

PrimeLending

HilltopSecurities

●

●

ROAA

0.47%

PlainsCapital Bank generated $39.8 million in pre-tax income during Q2 2023, a decrease of $11.5 million from

Q2 2022 driven primarily by $9.9 million of higher provision expense

ROAE

3.53%

Average bank loans HFI¹ increased from Q1 2023 by $172 million, or 2%, while loan yields of 5.86% increased by

34 basis points from Q1 2023

Average bank deposits have increased from Q1 2023 by $300 million, or 3%, to $11.3 billion. Total cost of

deposits at the bank was 2.36% during the period, a 72 basis point increase over Q1 2023

The bank's provision for credit losses was $14.9 million during the quarter. This was driven by a combination of

deterioration in the economic outlook, negative credit migration and loan growth

PrimeLending generated a $14.5 million pre-tax loss during Q2 2023, a decrease of $20.1 million from Q2 2022

Mortgage origination volume in Q2 2023 was $2.5 billion, a decline of 36% from Q2 2022; overall industry

volume expected to decline by approximately 32% over the same period²

Gain-on-sale of loans to third parties declined by 53 basis points from Q2 2022 to 207 basis points for Q2 2023 as

interest rates have increased, volumes have declined, and pricing has remained very competitive

2022

Non-interest expense at PrimeLending declined by $34.5 million, or 26%, from Q2 2022. Excluding variable

compensation, expenses declined by $14.2 million, or 19%, during the same period as actions have been made to

resize the organization towards a smaller overall mortgage market

HilltopSecurities generated a pre-tax income of $18.5 million during Q2 2023, an increase of $9.4 million from Q2

Total net revenue for Q2 2023 was $113.2 million, an increase of $13.0 million from Q2 2022 as improved

revenues from sweep deposits and a strong TBA market have helped to offset challenging public finance and fixed

income markets

Notes:

(1) Average Bank Loans HFI reflect consolidated loans held for investment excluding margin loans from the broker-dealer business.

(2) Mortgage Bankers Association Forecast, June 20, 2023.

3

Within Wealth Management, money market and FDIC sweep accounts generated an increase in revenue of $10.5

million from prior year as balances benefited from higher short term interest rates

Hilltop Holdings.View entire presentation