Nikola SPAC Presentation Deck

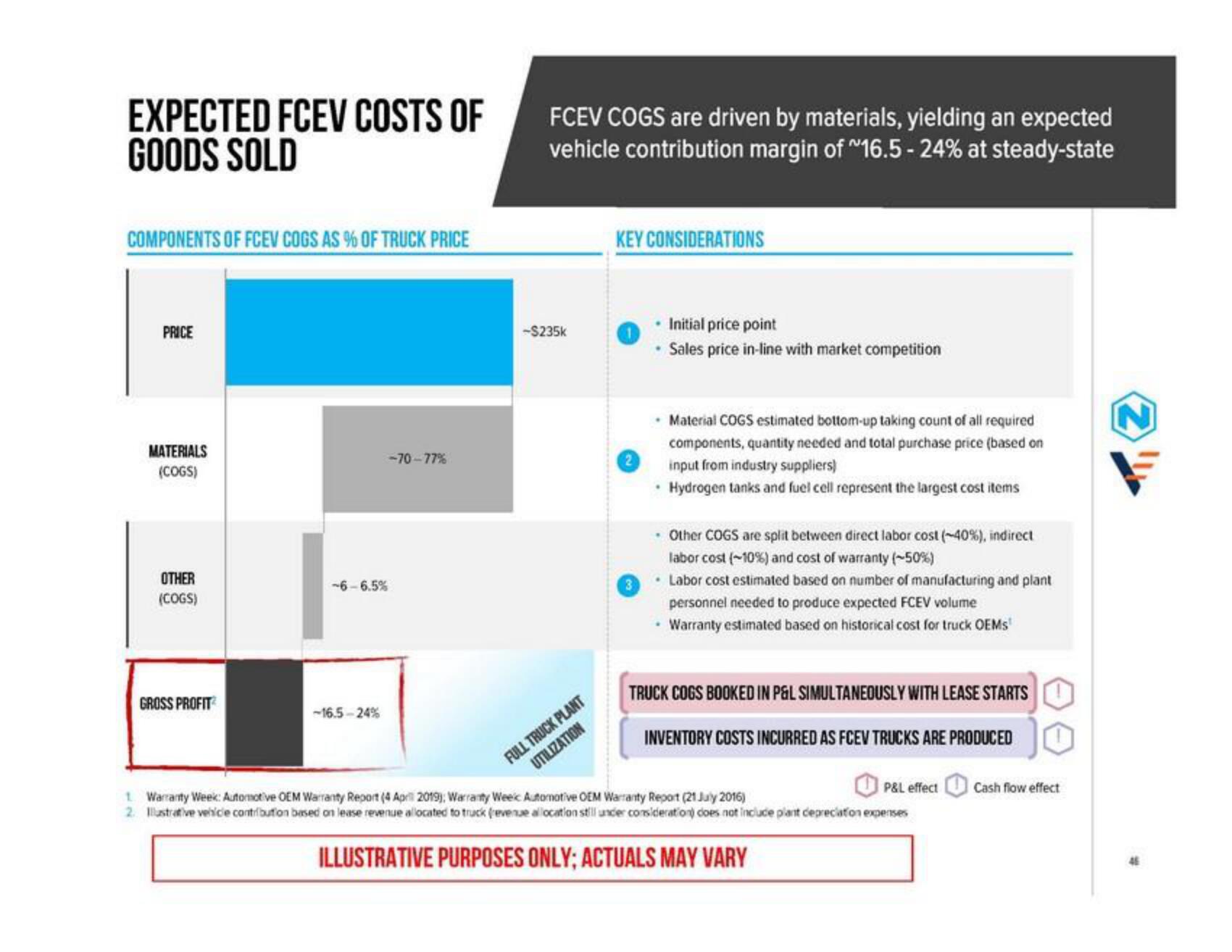

EXPECTED FCEV COSTS OF

GOODS SOLD

COMPONENTS OF FCEV COGS AS % OF TRUCK PRICE

PRICE

MATERIALS

(COGS)

OTHER

(COGS)

GROSS PROFIT

-6-6.5%

-16.5-24%

-70-77%

FCEV COGS are driven by materials, yielding an expected

vehicle contribution margin of "16.5 -24% at steady-state

-$235k

FULL TRUCK PLANT

UTILIZATION

KEY CONSIDERATIONS

• Initial price point

Sales price in-line with market competition

Material COGS estimated bottom-up taking count of all required

components, quantity needed and total purchase price (based on

input from industry suppliers)

• Hydrogen tanks and fuel cell represent the largest cost items

- Other COGS are split between direct labor cost (-40%), indirect

labor cost (-10%) and cost of warranty (-50%)

.

3

• Labor cost estimated based on number of manufacturing and plant

personnel needed to produce expected FCEV volume

• Warranty estimated based on historical cost for truck OEMs

TRUCK COGS BOOKED IN P&L SIMULTANEOUSLY WITH LEASE STARTS

INVENTORY COSTS INCURRED AS FCEV TRUCKS ARE PRODUCED

P&L effect

1 Warranty Week: Automotive OEM Warranty Report (4 April 2019); Warranty Weeic Automotive OEM Warranty Report (21 July 2016)

2. Illustrative vehicle contribution based on lease revenue allocated to truck (revenue allocation still under consideration) does not include plant depreciation expenses

ILLUSTRATIVE PURPOSES ONLY; ACTUALS MAY VARY

Cash flow effectView entire presentation