Despegar Mergers and Acquisitions Presentation Deck

DESPEGAR

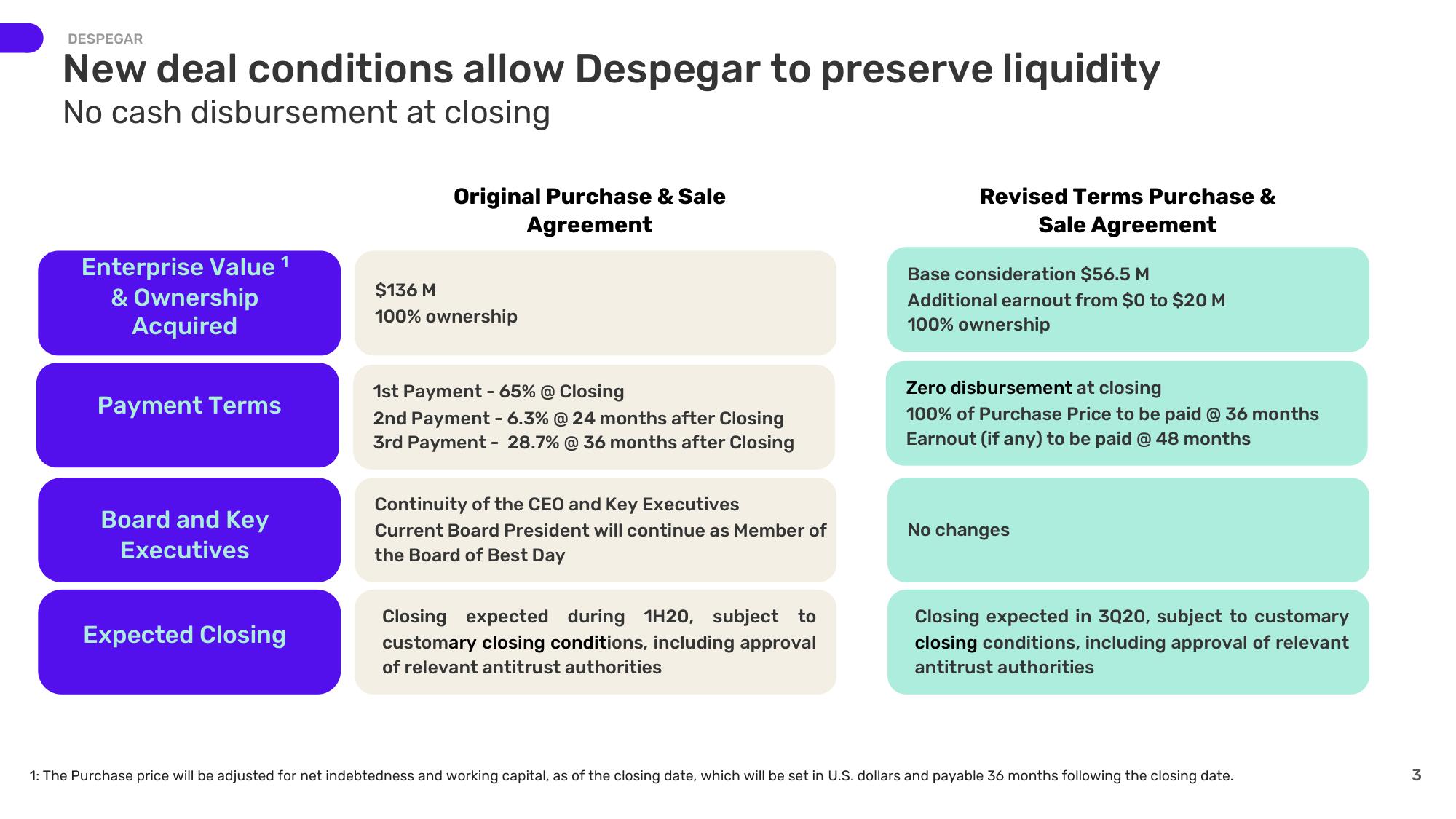

New deal conditions allow Despegar to preserve liquidity

No cash disbursement at closing

Enterprise Value ¹

& Ownership

Acquired

Payment Terms

Board and Key

Executives

Expected Closing

Original Purchase & Sale

Agreement

$136 M

100% ownership

1st Payment -65% @ Closing

2nd Payment - 6.3% @ 24 months after Closing

3rd Payment - 28.7% @ 36 months after Closing

Continuity of the CEO and Key Executives

Current Board President will continue as Member of

the Board of Best Day

Closing expected during 1H20, subject to

customary closing conditions, including approval

of relevant antitrust authorities

Revised Terms Purchase &

Sale Agreement

Base consideration $56.5 M

Additional earnout from $0 to $20 M

100% ownership

Zero disbursement at closing

100% of Purchase Price to be paid @ 36 months

Earnout (if any) to be paid @ 48 months

No changes

Closing expected in 3020, subject to customary

closing conditions, including approval of relevant

antitrust authorities

1: The Purchase price will be adjusted for net indebtedness and working capital, as of the closing date, which will be set in U.S. dollars and payable 36 months following the closing date.

3View entire presentation