Altus Power SPAC Presentation Deck

Altus Power's Attractive Portfolio Profile

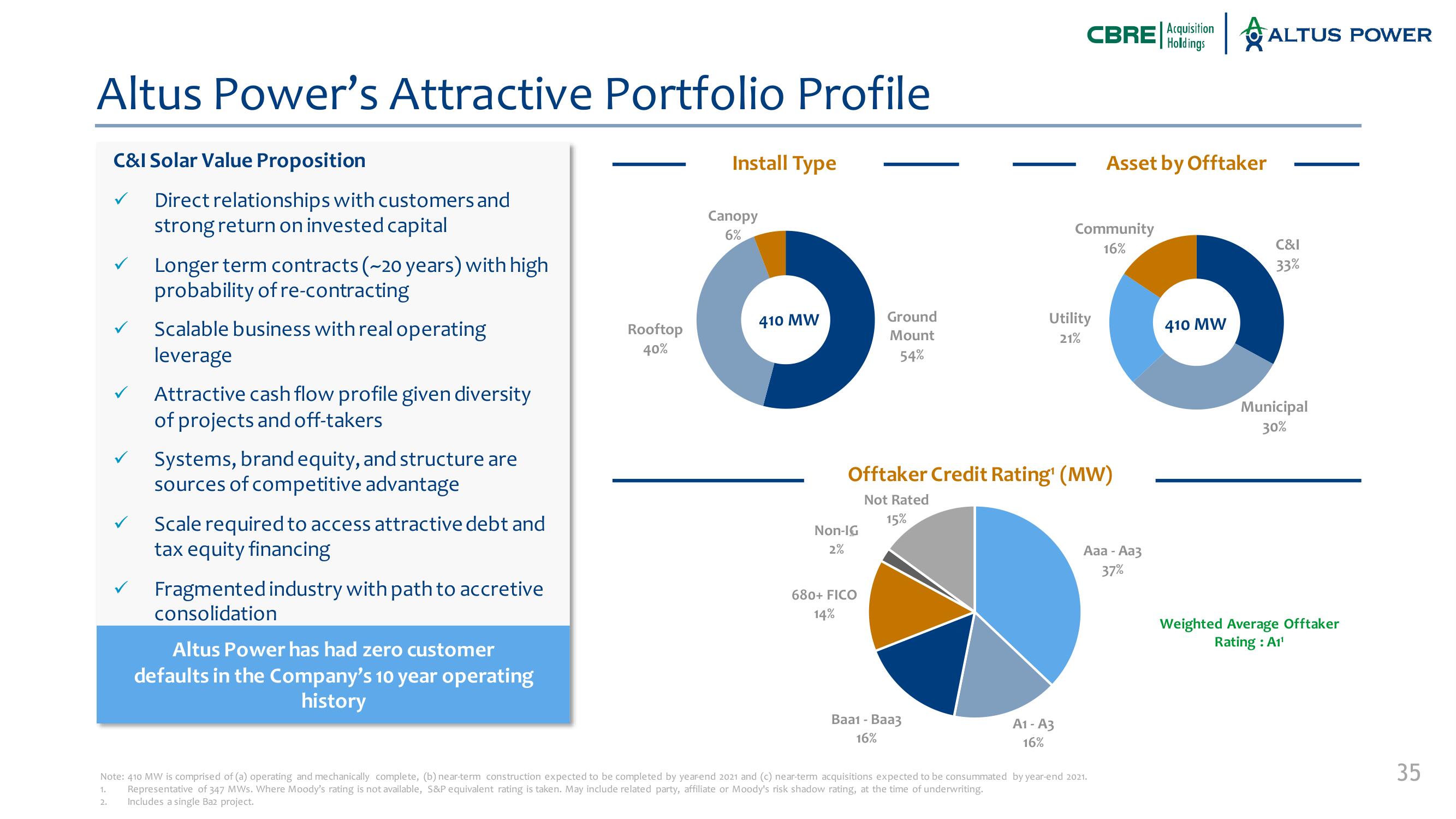

C&I Solar Value Proposition

1.

2.

Direct relationships with customers and

strong return on invested capital

Longer term contracts (~20 years) with high

probability of re-contracting

Scalable business with real operating

leverage

Attractive cash flow profile given diversity

of projects and off-takers

Systems, brand equity, and structure are

sources of competitive advantage

Scale required to access attractive debt and

tax equity financing

Fragmented industry with path to accretive

consolidation

Altus Power has had zero customer

defaults in the Company's 10 year operating

history

Rooftop

40%

Install Type

Canopy

6%

410 MW

Non-IG

2%

Ground

Mount

54%

680+ FICO

14%

Baa1 - Baaz

16%

CBRE Acquisition ALTUS POWER

Holdings

Offtaker Credit Rating¹ (MW)

Not Rated

15%

Utility

21%

A1-A3

16%

Community

16%

Asset by Offtaker

Note: 410 MW is comprised of (a) operating and mechanically complete, (b) near-term construction expected to be completed by year-end 2021 and (c) near-term acquisitions expected to be consummated by year-end 2021.

Representative of 347 MWs. Where Moody's rating is not available, S&P equivalent rating is taken. May include related party, affiliate or Moody's risk shadow rating, at the time of underwriting.

Includes a single Baz project.

Aaa - Aa3

37%

410 MW

C&I

33%

Municipal

30%

Weighted Average Offtaker

Rating: A1¹

35View entire presentation