Matson Results Presentation Deck

3

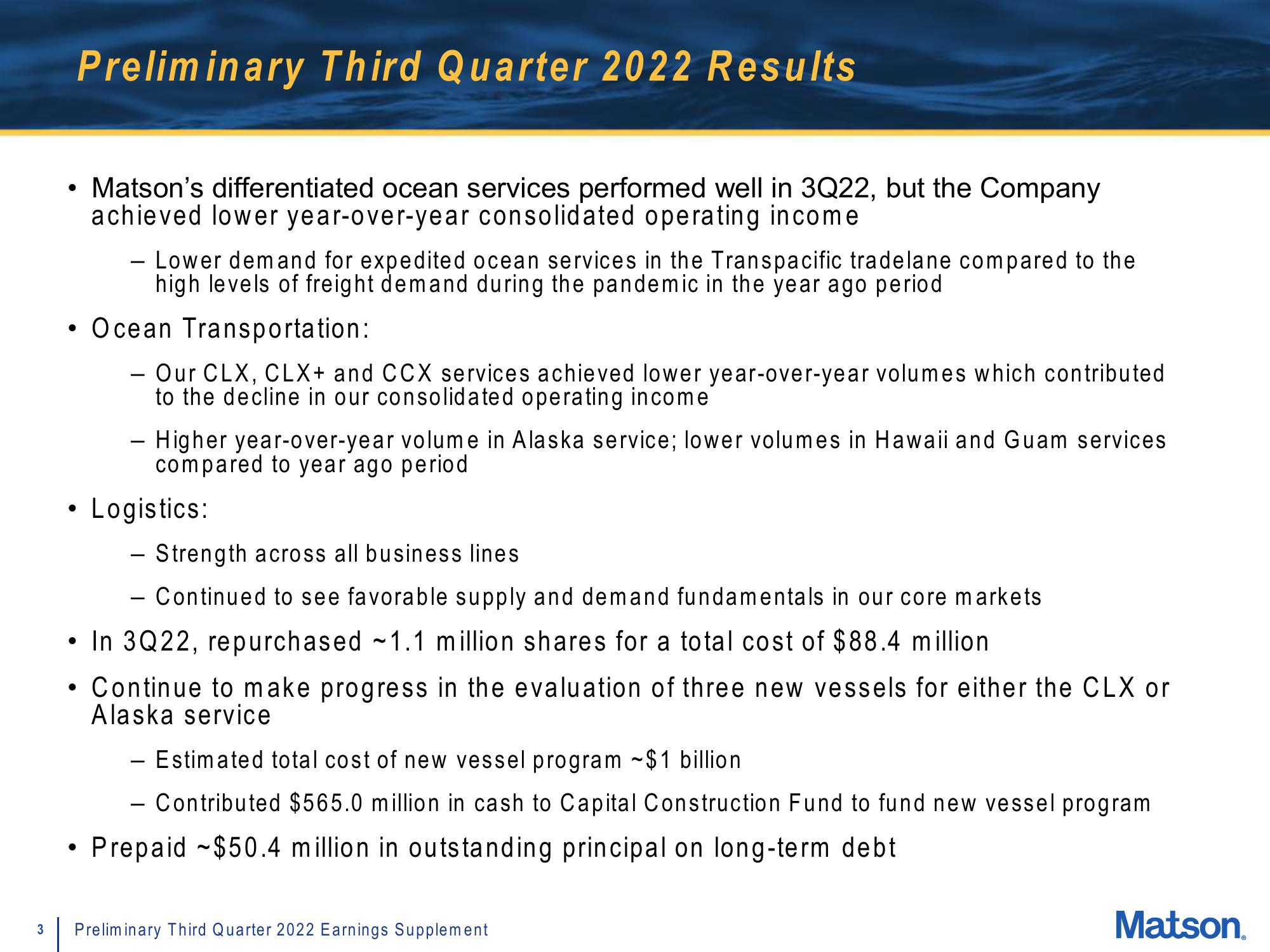

Preliminary Third Quarter 2022 Results

• Matson's differentiated ocean services performed well in 3Q22, but the Company

achieved lower year-over-year consolidated operating income

- Lower demand for expedited ocean services in the Transpacific tradelane compared to the

high levels of freight demand during the pandemic in the year ago period

• Ocean Transportation:

- Our CLX, CLX+ and CCX services achieved lower year-over-year volumes which contributed

to the decline in our consolidated operating income

●

●

- Higher year-over-year volume in Alaska service; lower volumes in Hawaii and Guam services

compared to year ago period

- Strength across all business lines

- Continued to see favorable supply and demand fundamentals in our core markets

• In 3Q22, repurchased ~1.1 million shares for a total cost of $88.4 million

●

●

Logistics:

Continue to make progress in the evaluation of three new vessels for either the CLX or

Alaska service

- Estimated total cost of new vessel program ~$1 billion

Contributed $565.0 million in cash to Capital Construction Fund to fund new vessel program

Prepaid $50.4 million in outstanding principal on long-term debt

P

Preliminary Third Quarter 2022 Earnings Supplement

Matson.View entire presentation