OppFi SPAC Presentation Deck

31

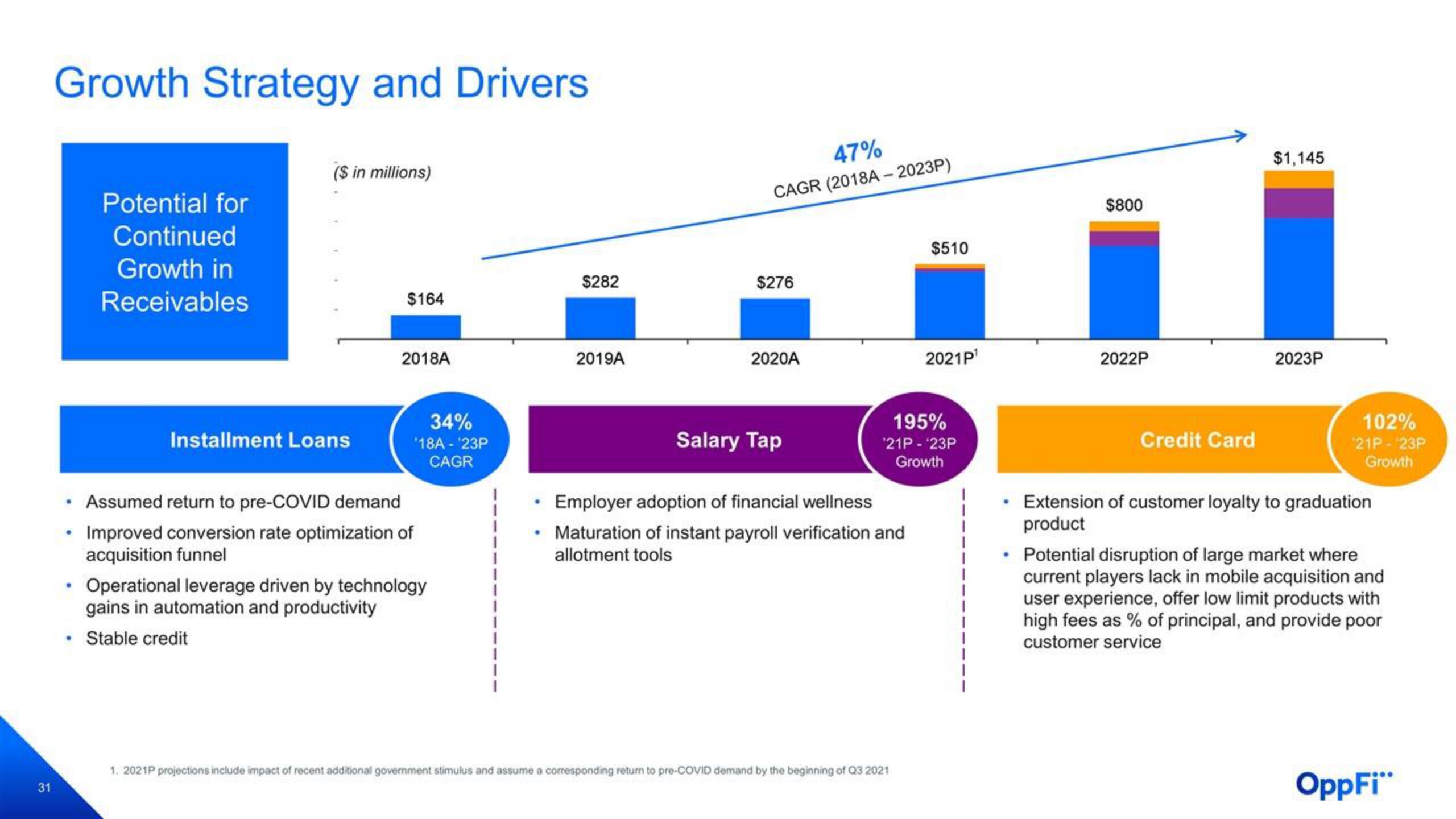

Growth Strategy and Drivers

.

Potential for

Continued

Growth in

Receivables

($ in millions)

Installment Loans

$164

2018A

34%

*18A - ¹23P

CAGR

Assumed return to pre-COVID demand

Improved conversion rate optimization of

acquisition funnel

Operational leverage driven by technology

gains in automation and productivity

Stable credit

$282

2019A

47%

CAGR (2018A-2023P)

$276

2020A

Salary Tap

Employer adoption of financial wellness

Maturation of instant payroll verification and

allotment tools

$510

195%

¹21P - ¹23P

Growth

1. 2021P projections include impact of recent additional government stimulus and assume a corresponding return to pre-COVID demand by the beginning of Q3 2021

2021P¹

$800

2022P

Credit Card

$1,145

2023P

102%

'21P - ¹23P

Growth

Extension of customer loyalty to graduation

product

. Potential disruption of large market where

current players lack in mobile acquisition and

user experience, offer low limit products with

high fees as % of principal, and provide poor

customer service

OppFi"View entire presentation