Signify Health Results Presentation Deck

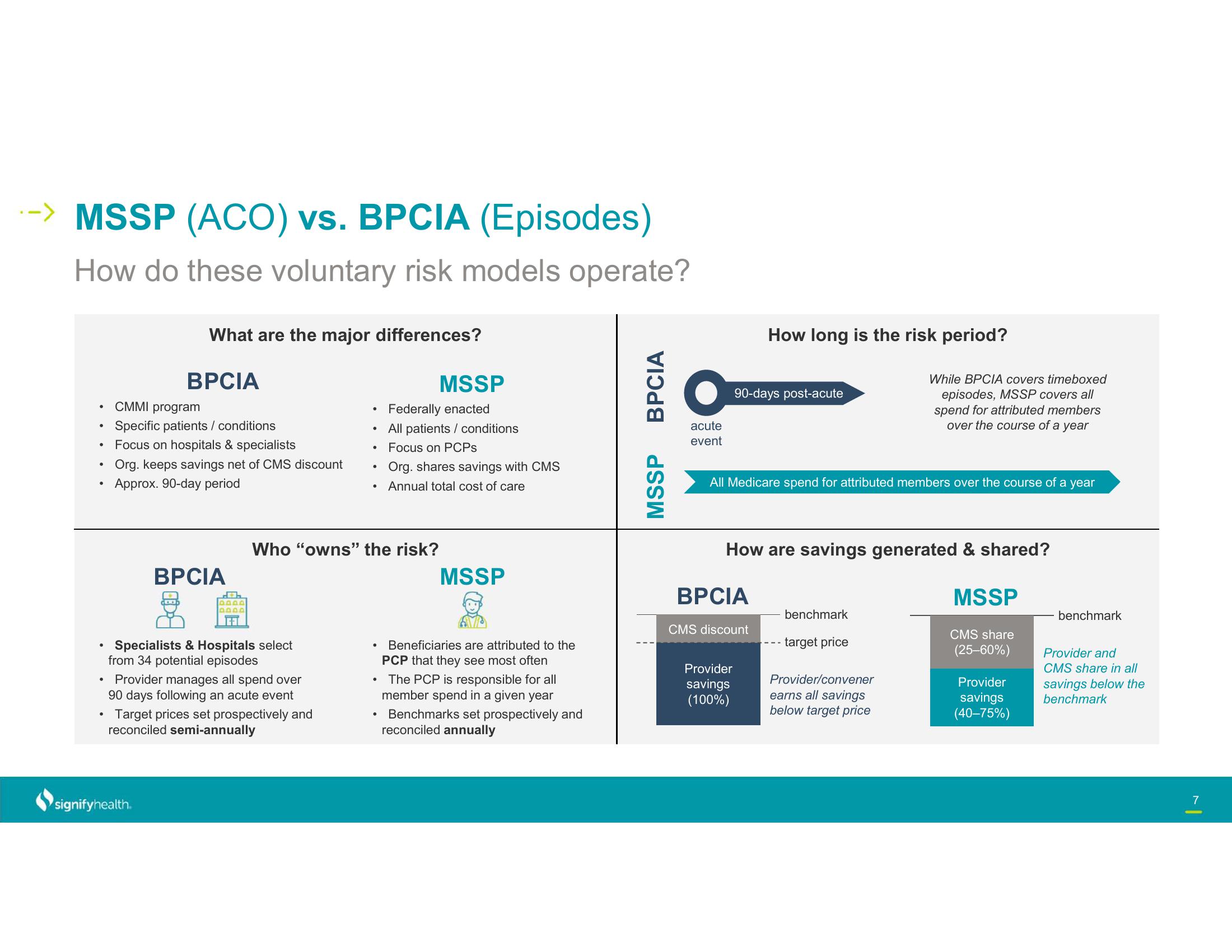

--> MSSP (ACO) vs. BPCIA (Episodes)

How do these voluntary risk models operate?

●

●

●

•

●

What are the major differences?

BPCIA

CMMI program

Specific patients / conditions

Focus on hospitals & specialists

Org. keeps savings net of CMS discount

Approx. 90-day period

BPCIA

Specialists & Hospitals select

from 34 potential episodes

signifyhealth.

Provider manages all spend over

90 days following an acute event

Target prices set prospectively and

reconciled semi-annually

●

●

Who "owns" the risk?

●

MSSP

Federally enacted

All patients / conditions

Focus on PCPs

Org. shares savings with CMS

Annual total cost of care

MSSP

Beneficiaries are attributed to the

PCP that they see most often

The PCP is responsible for all

member spend in a given year

• Benchmarks set prospectively and

reconciled annually

BPCIA

MSSP

O

acute

event

How long is the risk period?

90-days post-acute

All Medicare spend for attributed members over the course of a year

BPCIA

CMS discount

Provider

savings

(100%)

How are savings generated & shared?

MSSP

CMS share

(25-60%)

benchmark

While BPCIA covers timeboxed

episodes, MSSP covers all

spend for attributed members

over the course of a year

target price

Provider/convener

earns all savings

below target price

Provider

savings

(40-75%)

benchmark

Provider and

CMS share in all

savings below the

benchmark

7View entire presentation