Tudor, Pickering, Holt & Co Investment Banking

EAP

Spon.

HG & EGP

uods

Other High

Growth MLP

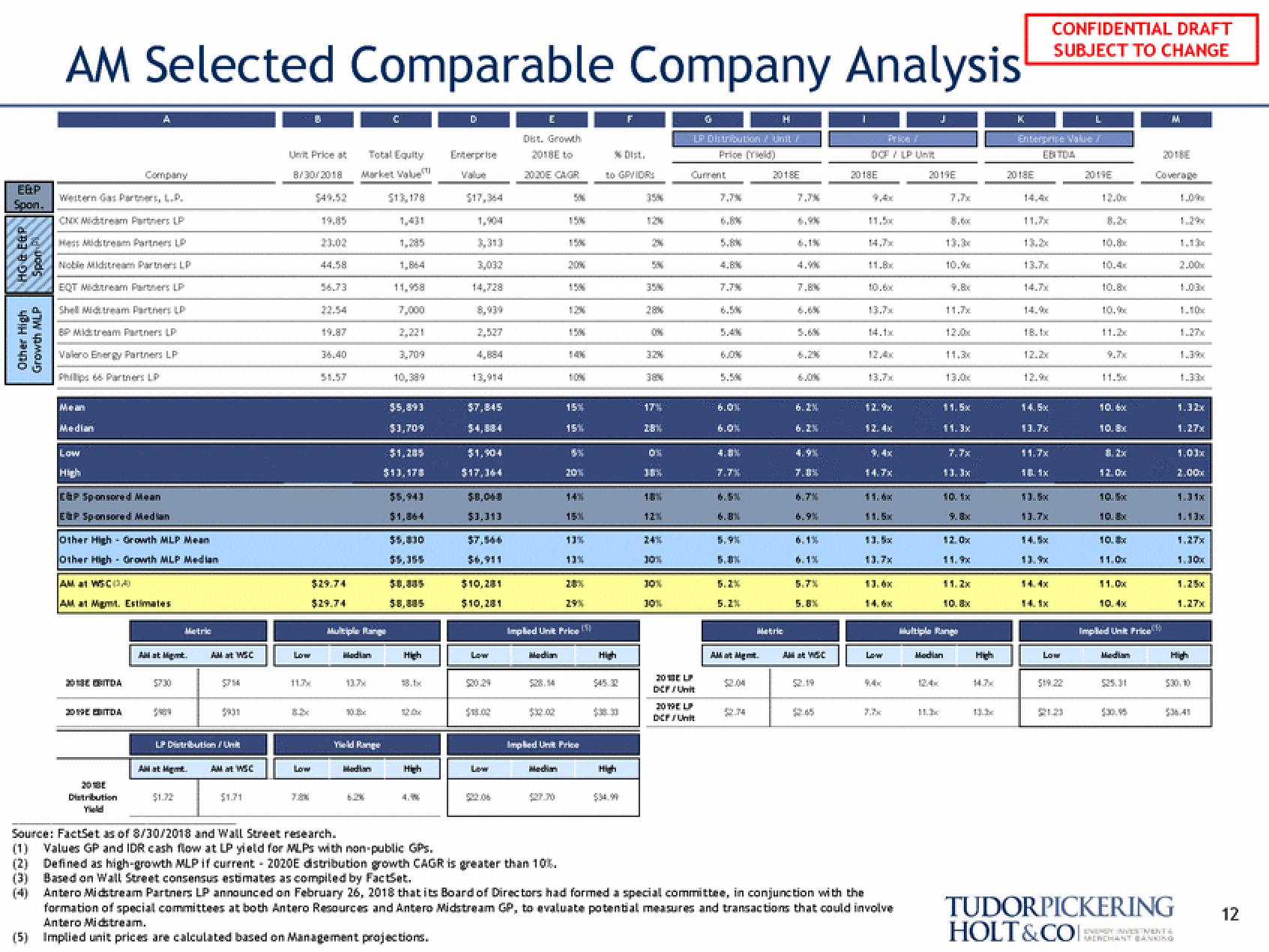

AM Selected Comparable Company Analysis

Company

Western Gas Partners, L.P.

CNX Midtream Partners LP

Hess Midstream Partners LP

Noble Midtream Partners LP

EQT Midtream Partners LP

Shell Midstream Partners LP

BP Midstream Partners LP

Valero Energy Partners LP

Phillips 66 Partners LP

Mean

Median

Low

C&P Sponsored Mean

E&P Sponsored Median

Other High Growth MLP Mean

Other High Growth MLP Median

AM at WSCA

AM at Mgmt. Estimates

2 BITDA

2019 TDA

20

Distribution

Alat Mt. AM at WSC

5730

Metric

LP Distribution/Unit

Alat Mem

$1.72

AM at WSC

$1.71

Unit Price at

8/30/2018

Low

11.7%

Low

7.8%

44.58

56.73

36.40

51.57

$29.74

$29.74

Total Equity

Market Value

$13,178

Madian

13.7%

10%

Yield Range

11,958

10,389

$5,893

$3,709

$13,170

$5,943

$5,000

High

120x

High

D

Enterprise

3,313

14,728

13,914

$7,845

$1,904

$17.344

$8,048

$3,313

$10.201

Low

$20.29

Low

902.06

Dist. Growth

2018 to

2020E CA/GR

Media

SN

Medin

15%

$27.70

20%

12%

15%

15%

20%

Implied Unit Price (

14%

15%

13%

13%

Implied Unit Price

* Dist.

to GPVIDR

High

High

35%

124

2

5M

35%

32%

380

17%

OS

18%

10%

12%

24%

10%

10%

30%

LP Distribution/Unit /

Price (Yield)

Current

2013 LP

DCF/Unit

2019 LP

DCF/Unit

7.7%

5.8%

4.8%

6.0%

4.8%

7.7%

6.8%

5.9%

5.2%

at Mgmt.

224

2018E

Metric

4,9%

4.9%

7.8%

6.2%

6.2%

4.9%

7.0%

6.1%

5.7%

5.8%

AM at VISC

$2.65

Price /

DCF / LP Unit

2018E

1

14,7x

11.8x

10.6x

13.7x

115x

13.7x

14.6x

Low

M4x

7.7x

Source: FactSet as of 8/30/2018 and Wall Street research.

(1) Values GP and IDR cash flow at LP yield for MLPs with non-public GPS.

(2) Defined as high-growth MLP if current - 2020E distribution growth CAGR is greater than 10%.

(3) Based on Wall Street consensus estimates as compiled by FactSet.

Antero Midstream Partners LP announced on February 26, 2018 that its Board of Directors had formed a special committee, in conjunction with the

formation of special committees at both Antero Resources and Antero Midstream GP, to evaluate potential measures and transactions that could involve

Antero Midstream.

(5) Implied unit prices are calculated based on Management projections.

2019E

10.9

Modian

124

11.7x

11.3x

13.0x

fi.ex

11.3x

7.7x

11.3x

10. 1x

Multiple Range

12.0x

High

147

13.3

Enterprise Value /

EBITDA

2018E

14.4x

13.2

13.7%

18.1

12.2x

12.9

H

13.7x

11x

lx

13.7x

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

4x

Low

$19.22

2019E

12.0x

10.4x

10.8x

9.7x

10.6x

10.8x

12.0x

10.8x

10.x

11.0x

11.0x

Implied Unit Price

$25.31

M

1.0%

TUDORPICKERING

HOLT&CO

1.2%

MERCHANT BANKING

1.03

1.10

1.3%

1.33

1.32x

1.27x

1.03x

2.00x

1.31x

1.13x

1.27x

1,10x

530,10

1.27x

$36.41

12View entire presentation