HireRight Results Presentation Deck

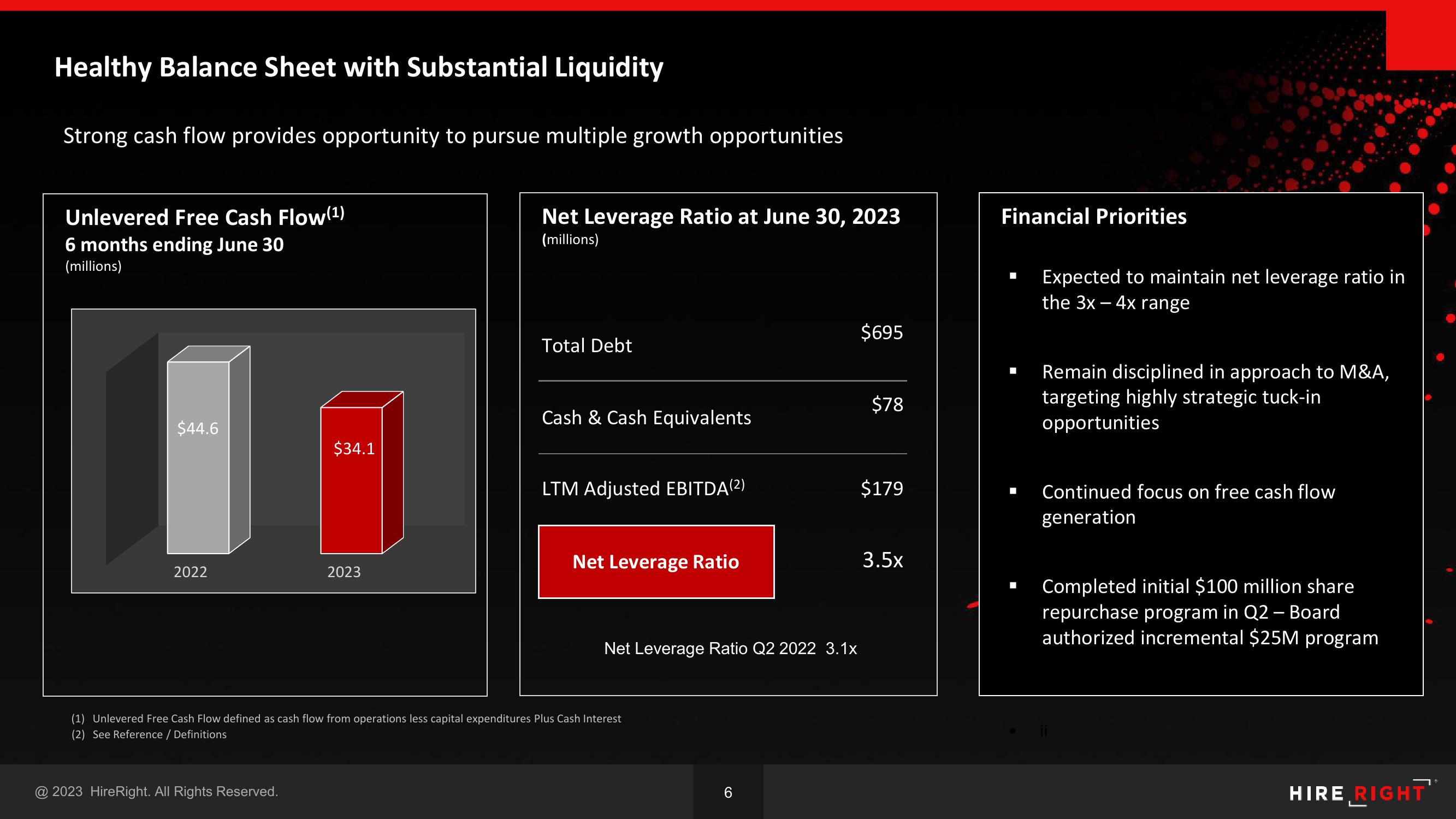

Healthy Balance Sheet with Substantial Liquidity

Strong cash flow provides opportunity to pursue multiple growth opportunities

Unlevered Free Cash Flow (1)

6 months ending June 30

(millions)

$44.6

2022

$34.1

@ 2023 HireRight. All Rights Reserved.

2023

Net Leverage Ratio at June 30, 2023

(millions)

Total Debt

Cash & Cash Equivalents

LTM Adjusted EBITDA (2)

Net Leverage Ratio

Net Leverage Ratio Q2 2022 3.1x

(1) Unlevered Free Cash Flow defined as cash flow from operations less capital expenditures Plus Cash Interest

(2) See Reference / Definitions

6

$695

$78

$179

3.5x

Financial Priorities

■

Expected to maintain net leverage ratio in

the 3x - 4x range

Remain disciplined in approach to M&A,

targeting highly strategic tuck-in

opportunities

Continued focus on free cash flow

generation

Completed initial $100 million share

repurchase program in Q2 - Board

authorized incremental $25M program

HIRE RIGHTView entire presentation