HashiCorp Investor Day Presentation Deck

43

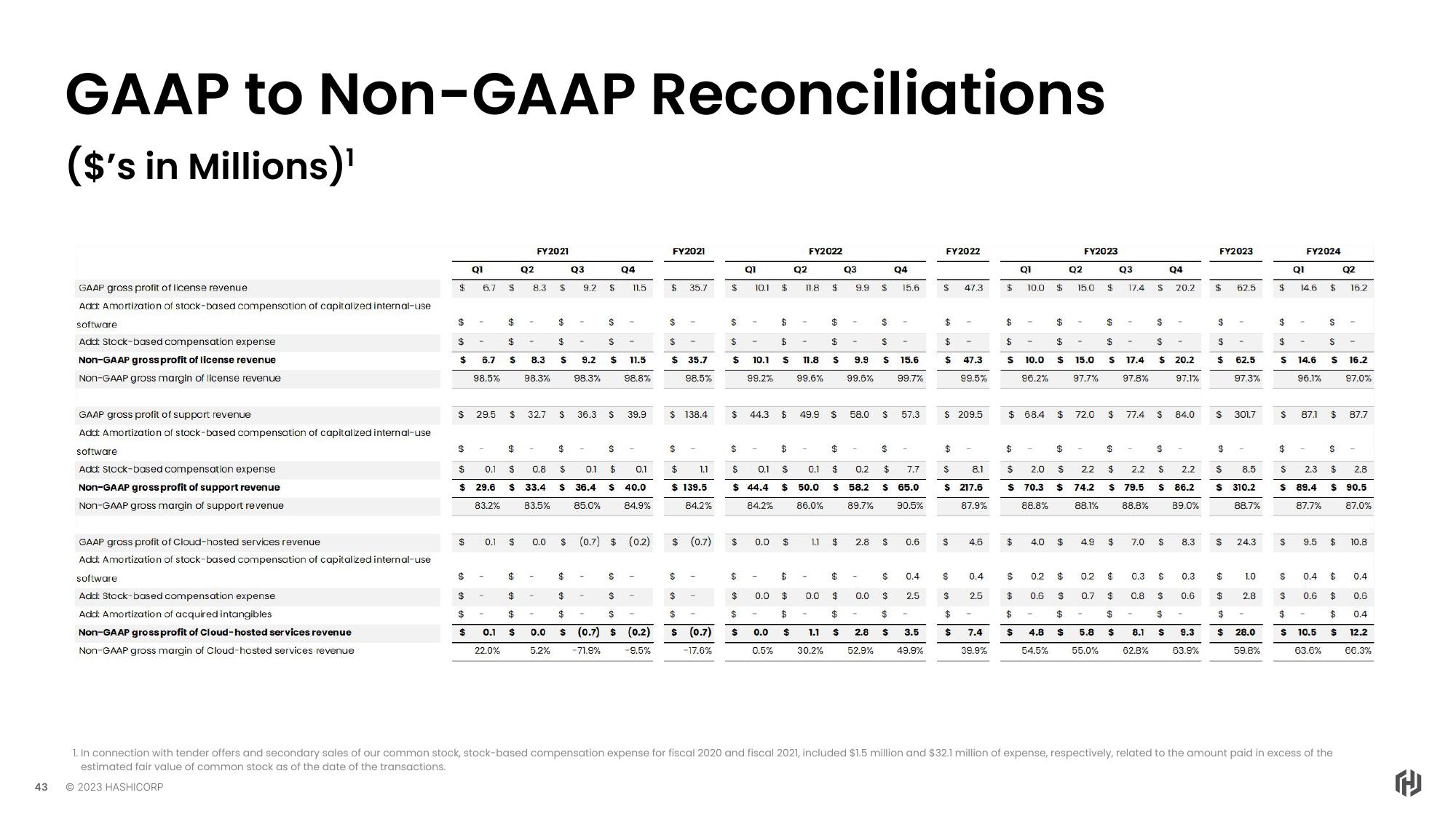

GAAP to Non-GAAP Reconciliations

($'s in Millions)¹

GAAP gross profit of license revenue.

Add: Amortization of stock-based compensation of capitalized internal-use

software

Add: Stock-based compensation expense

Non-GAAP gross profit of license revenue

Non-GAAP gross margin of license revenue

GAAP gross profit of support revenue

Add: Amortization of stock-based compensation of capitalized internal-use

software

Add: Stock-based compensation expense

Non-GAAP gross profit of support revenue

Non-GAAP gross margin of support revenue

GAAP gross profit of Cloud-hosted services revenue

Add: Amortization of stock-based compensation of capitalized internal-use

software

Add: Stock-based compensation expense

Add: Amortization of acquired intangibles

Non-GAAP gross profit of Cloud-hosted services revenue

Non-GAAP gross margin of Cloud-hosted services revenue

$

$

$

$

$

Q1

$

6.7 $

6.7

98.5%

$

$

0.1

$

29.5 $

$

$

0.1

$

$ 29.6 $

83.2%

$

$

$

$

$

$

$

$ 0.1 $

22.0%

$

02

8.3

-

-

8.3

FY2021

98.3%

32.7

-

0.8

33.4

83.5%

0.0

-

-

0.0

5.2%

$

$

$

$

$ 9.2

98.3%

$

Q3

9.2

$

$

$

36.3

-

$

$

$

$

$ 11.5

98.8%

$

S 36.4 $

85.0%

Q4

11.5

$

0.1 $ 0.1

40.0

84.9%

$

39.9

$ (0.7) $ (0.2)

$

$

(0.7) $ (0.2)

-71.9%

-9.5%

FY2021

35.7

$

$

$ 35.7

98.5%

$ 138.4

$

$ 1.1

$ 139.5

$

84.2%

$ (0.7)

$

$

$ (0.7)

-17.6%

$ 10.1 $

$

$

$

$

Q1

$ 44.3

$

$

-

$

$

10.1

99.2%

$ -

$ 0.1 $

$ 44.4 $

84.2%

0.0

$

0.0

0.5%

$

02

$

FY2022

$

$

$

$ 11.8 $ 9.9

99.6%

99.6%

11.8 $

49.9 $

0.1

50.0

86.0%

$

1.1 $

0.0

03

9.9

$

58.0

-

$

$

0.0

$

$

$ 15.6

99.7%

$

2.8 $

Q4

$

0.2

$

7.7

$ 58.2 S 65.0

89.7%

90.5%

15.6

$

57.3

$

0.0 $

$

$

$

$

$

$ 1.1 $ 2.8 $ 3.5

30.2% 52.9%

49.9%

-

0.6

0.4

2.5

FY2022

$

$

$

$ 47.3

99.5%

47.3

$ 209.5

$

$

8.1

$ 217.6

$

$

$

-

87.9%

4.6

0.4

2.5

$

$ 7.4

39.9%

$ 10.0

$

$ -

$ 10.0

96.2%

Q1

$ 68.4

$

$

$

$

-

4.0

$

$

$ 2.0 $

22

$ 70.3 $ 74.2

88.8%

88.1%

0.2

0.6

$

$

Q2

$

$

$

$

$

$ -

$ 15.0 $ 17.4

97.7%

97.8%

FY2023

15.0 $

$

72.0 $

-

0.2 $

0.7 $

$

$

$ 4.8 $ 5.8 $

54.5%

55.0%

$

03

4.9 $

17,4

77.4

$

$ 79.5

88.8%

-

Q4

S 20.2

$

2.2 $ 2.2

$ 86.2

0.3

$

$

$ 20.2

7.0 $

62,8%

$ 84.0

97.1%

$

89.0%

8.3

0.3

0.6

0.8 $

$

8.1 $ 9.3

63.9%

FY2023

$

$

$

$

$ 301.7

62.5

$

62.5

97.3%

$

8.5

$ 310.2

$

$

88.7%

24.3

1.0

2.8

$

$ 28.0

59.8%

$

$

Q1

S

$

$

$

$ 14.6 $ 16.2

96.1%

97.0%

$

14.6 $ 16.2

-

FY2024

-

$ 87.1 $ 87.7

$

$

$ 2.3 $ 2.8

$ 89.4 $ 90.5

87.7%

87.0%

Q2

-

9.5 $ 10.8

0.4

0.6

$

0.4

S

$

0.6

$

$ 0.4

$ 10.5 $ 12.2

63.6%

66.3%

1. In connection with tender offers and secondary sales of our common stock, stock-based compensation expense for fiscal 2020 and fiscal 2021, included $1.5 million and $32.1 million of expense, respectively, related to the amount paid in excess of the

estimated fair value of common stock as of the date of the transactions.

© 2023 HASHICORP

HView entire presentation