UBS Results Presentation Deck

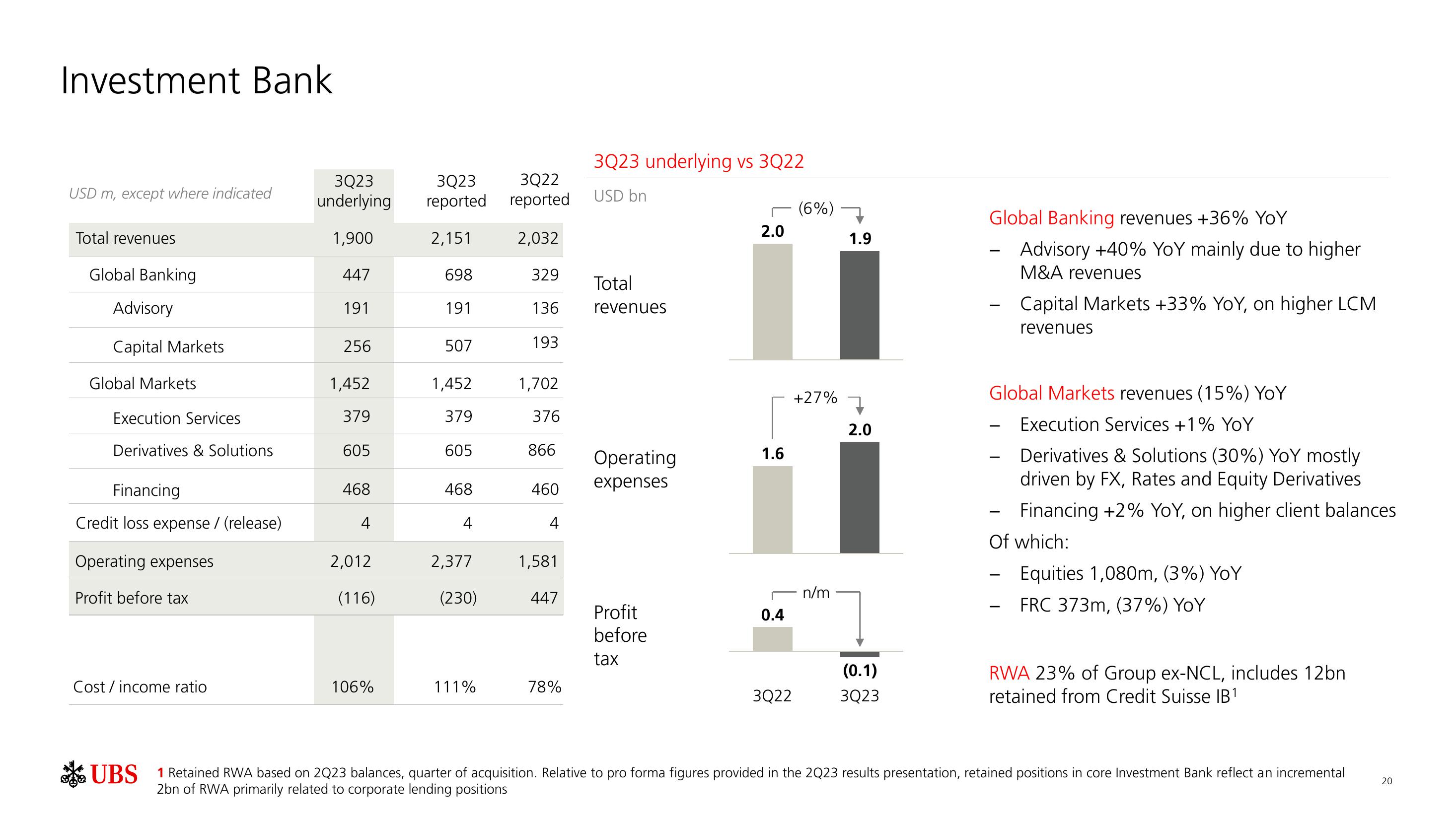

Investment Bank

USD m, except where indicated

Total revenues

Global Banking

Advisory

Capital Markets

Global Markets

Execution Services

Derivatives & Solutions

Financing

Credit loss expense / (release)

Operating expenses

Profit before tax

Cost / income ratio

3Q23

underlying

1,900

447

191

256

1,452

379

605

468

4

2,012

(116)

106%

3Q23

reported

2,151

698

191

507

1,452

379

605

468

4

2,377

(230)

111%

3Q22

reported

2,032

329

136

193

1,702

376

866

460

4

1,581

447

78%

3Q23 underlying vs 3Q22

USD bn

Total

revenues

Operating

expenses

Profit

before

tax

2.0

1.6

0.4

3Q22

(6%)

+27%

n/m

1.9

2.0

(0.1)

3Q23

Global Banking revenues +36% YoY

Advisory +40% YoY mainly due to higher

M&A revenues

Capital Markets +33% YoY, on higher LCM

revenues

Global Markets revenues (15%) YOY

Execution Services +1% YoY

Derivatives & Solutions (30%) YoY mostly

driven by FX, Rates and Equity Derivatives

Financing +2% YOY, on higher client balances

Of which:

-

Equities 1,080m, (3%) YoY

FRC 373m, (37%) YoY

RWA 23% of Group ex-NCL, includes 12bn

retained from Credit Suisse IB¹

UBS 1 Retained RWA based on 2023 balances, quarter of acquisition. Relative to pro forma figures provided in the 2Q23 results presentation, retained positions in core Investment Bank reflect an incremental

2bn of RWA primarily related to corporate lending positions

20View entire presentation