Vale Results Presentation Deck

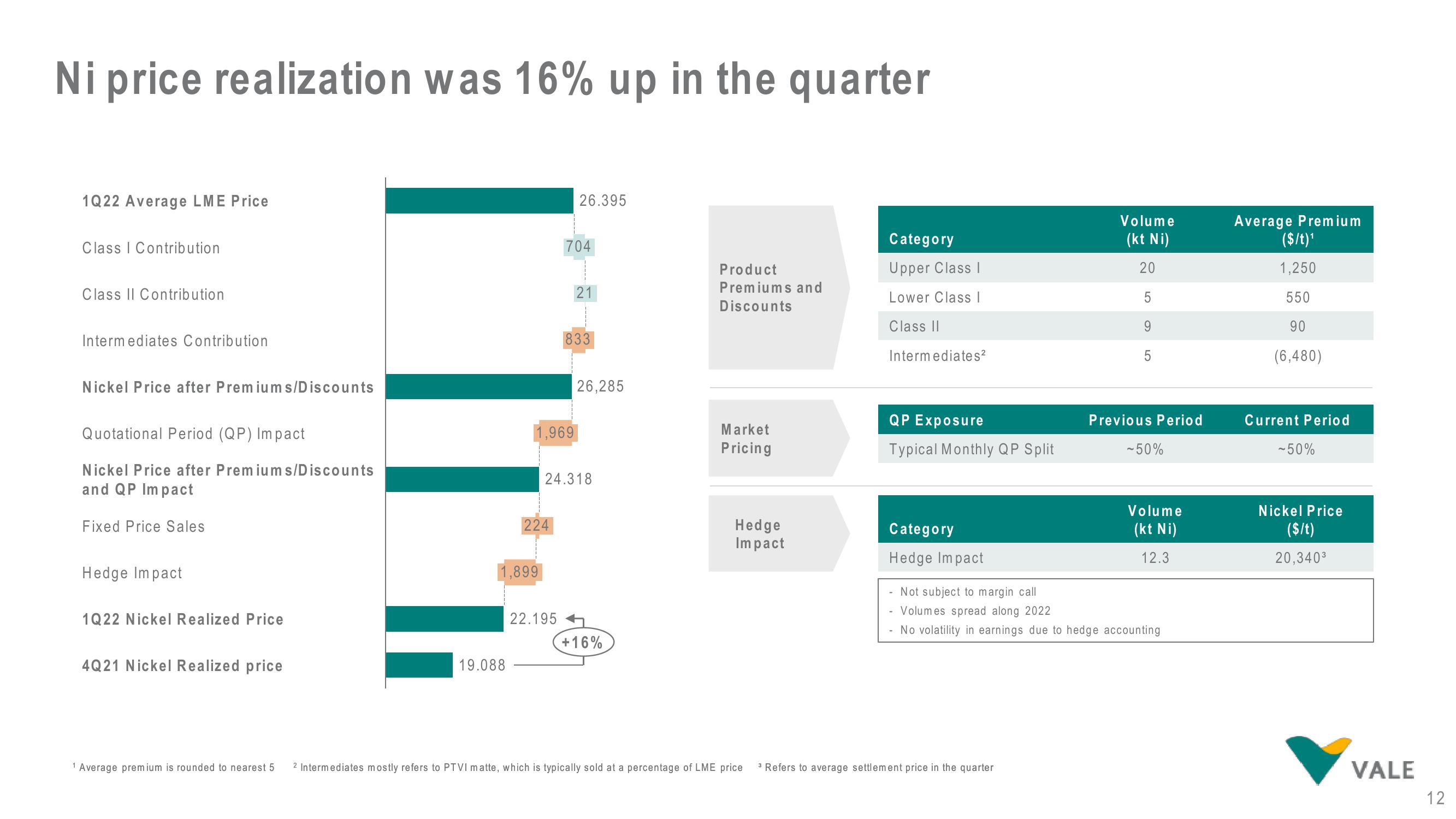

Ni price realization was 16% up in the quarter

1Q22 Average LME Price

Class I Contribution

Class II Contribution

Intermediates Contribution

Nickel Price after Premiums/Discounts

Quotational Period (QP) Impact

Nickel Price after Premiums/Discounts

and QP Impact

Fixed Price Sales

Hedge Impact

1Q22 Nickel Realized Price

4Q21 Nickel Realized price

1 Average premium is rounded to nearest 5

19.088

1,899

1,969

224

26.395

704

22.195

21

833

24.318

26,285

+16%

Product

Premiums and

Discounts

Market

Pricing

Hedge

Impact

Category

Upper Class I

Lower Class I

Class II

Intermediates²

QP Exposure

Typical Monthly QP Split

Category

Hedge Impact

Volume

(kt Ni)

20

5

9

2 Intermediates mostly refers to PTVI matte, which is typically sold at a percentage of LME price 3 Refers to average settlement price in the quarter

LO

5

Previous Period

-50%

Volume

(kt Ni)

12.3

Not subject to margin call

- Volumes spread along 2022

- No volatility in earnings due to hedge accounting

Average Premium

($/t)¹

1,250

550

90

(6,480)

Current Period

-50%

Nickel Price

($/t)

20,340³

VALE

12View entire presentation