AMC Mergers and Acquisitions Presentation Deck

Transaction Overview

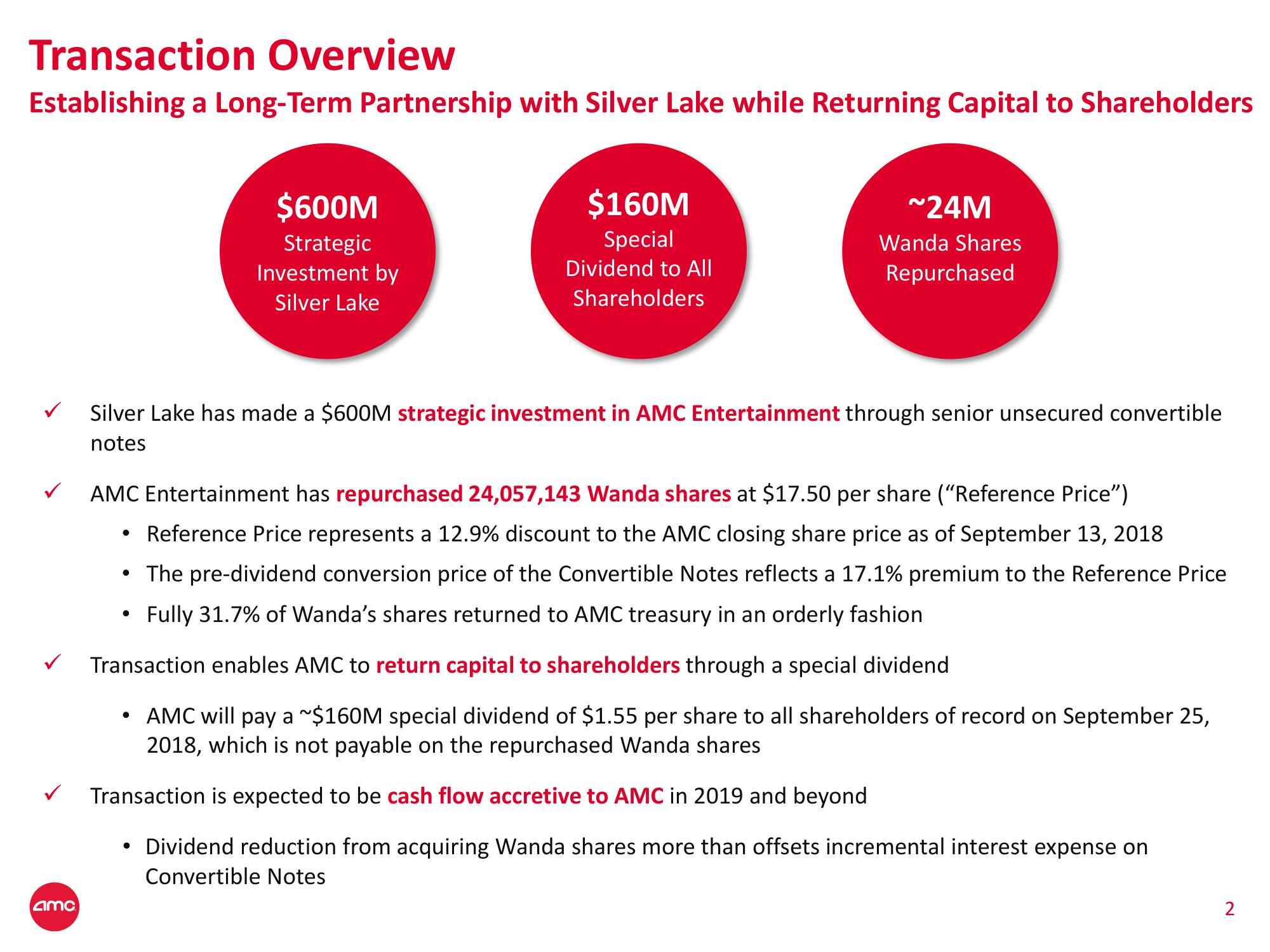

Establishing a Long-Term Partnership with Silver Lake while Returning Capital to Shareholders

amc

●

Silver Lake has made a $600M strategic investment in AMC Entertainment through senior unsecured convertible

notes

●

$600M

Strategic

Investment by

Silver Lake

AMC Entertainment has repurchased 24,057,143 Wanda shares at $17.50 per share ("Reference Price")

Reference Price represents a 12.9% discount to the AMC closing share price as of September 13, 2018

The pre-dividend conversion price of the Convertible Notes reflects a 17.1% premium to the Reference Price

Fully 31.7% of Wanda's shares returned to AMC treasury in an orderly fashion

Transaction enables AMC to return capital to shareholders through a special dividend

AMC will pay a ~$160M special dividend of $1.55 per share to all shareholders of record on September 25,

2018, which is not payable on the repurchased Wanda shares

Transaction is expected to be cash flow accretive to AMC in 2019 and beyond

Dividend reduction from acquiring Wanda shares more than offsets incremental interest expense on

Convertible Notes

●

$160M

Special

Dividend to All

Shareholders

●

~24M

Wanda Shares

Repurchased

2View entire presentation