Investor Presentation

Long Term Outlook

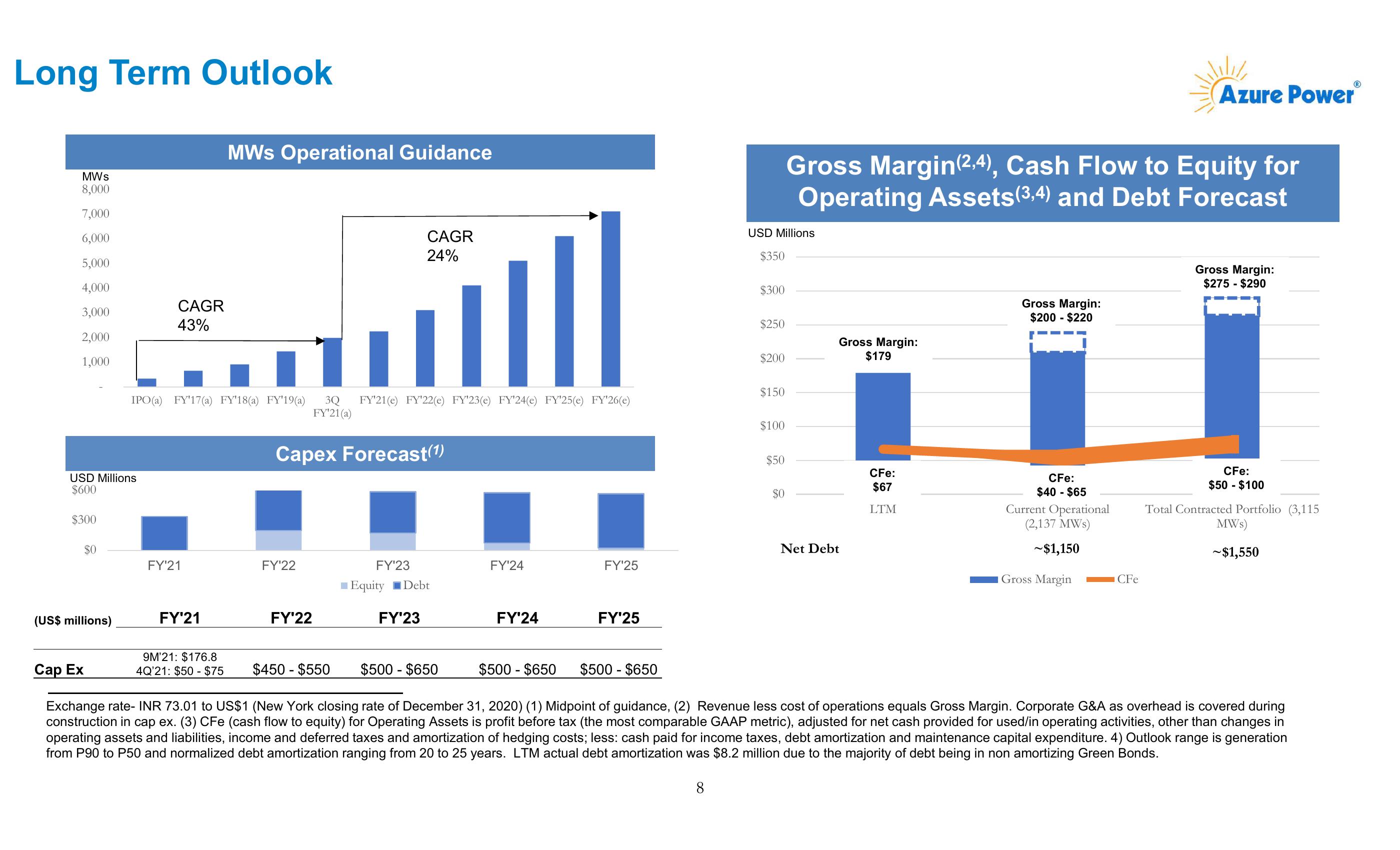

MWs Operational Guidance

MWs

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

Azure Power

Gross Margin (2,4), Cash Flow to Equity for

Operating Assets (3,4) and Debt Forecast

CAGR

24%

USD Millions

$350

$300

CAGR

43%

$250

Gross Margin:

$275 - $290

Gross Margin:

$200 - $220

Gross Margin:

$200

$179

IPO (a) FY'17(a) FY'18(a) FY'19(a) 3Q FY'21(e) FY'22(e) FY'23(e) FY'24(e) FY'25(e) FY'26(e)

FY'21(a)

Capex Forecast(1)

$150

$100

$50

CFe:

USD Millions

$600

$67

$0

CFe:

$40 - $65

CFe:

$50 - $100

LTM

$300

Current Operational

(2,137 MWs)

Total Contracted Portfolio (3,115

MWs)

$0

Net Debt

FY'21

FY'22

FY'23

FY'24

FY'25

Equity Debt

(US$ millions)

FY'21

FY'22

FY'23

FY'24

FY'25

~$1,150

~$1,550

Gross Margin

CFe

Cap Ex

9M'21: $176.8

4Q'21: $50 - $75

$450 - $550

$500 - $650

$500 - $650 $500 - $650

Exchange rate- INR 73.01 to US$1 (New York closing rate of December 31, 2020) (1) Midpoint of guidance, (2) Revenue less cost of operations equals Gross Margin. Corporate G&A as overhead is covered during

construction in cap ex. (3) CFe (cash flow to equity) for Operating Assets is profit before tax (the most comparable GAAP metric), adjusted for net cash provided for used/in operating activities, other than changes in

operating assets and liabilities, income and deferred taxes and amortization of hedging costs; less: cash paid for income taxes, debt amortization and maintenance capital expenditure. 4) Outlook range is generation

from P90 to P50 and normalized debt amortization ranging from 20 to 25 years. LTM actual debt amortization was $8.2 million due to the majority of debt being in non amortizing Green Bonds.

00

8View entire presentation