Doma SPAC Presentation Deck

Unaudited

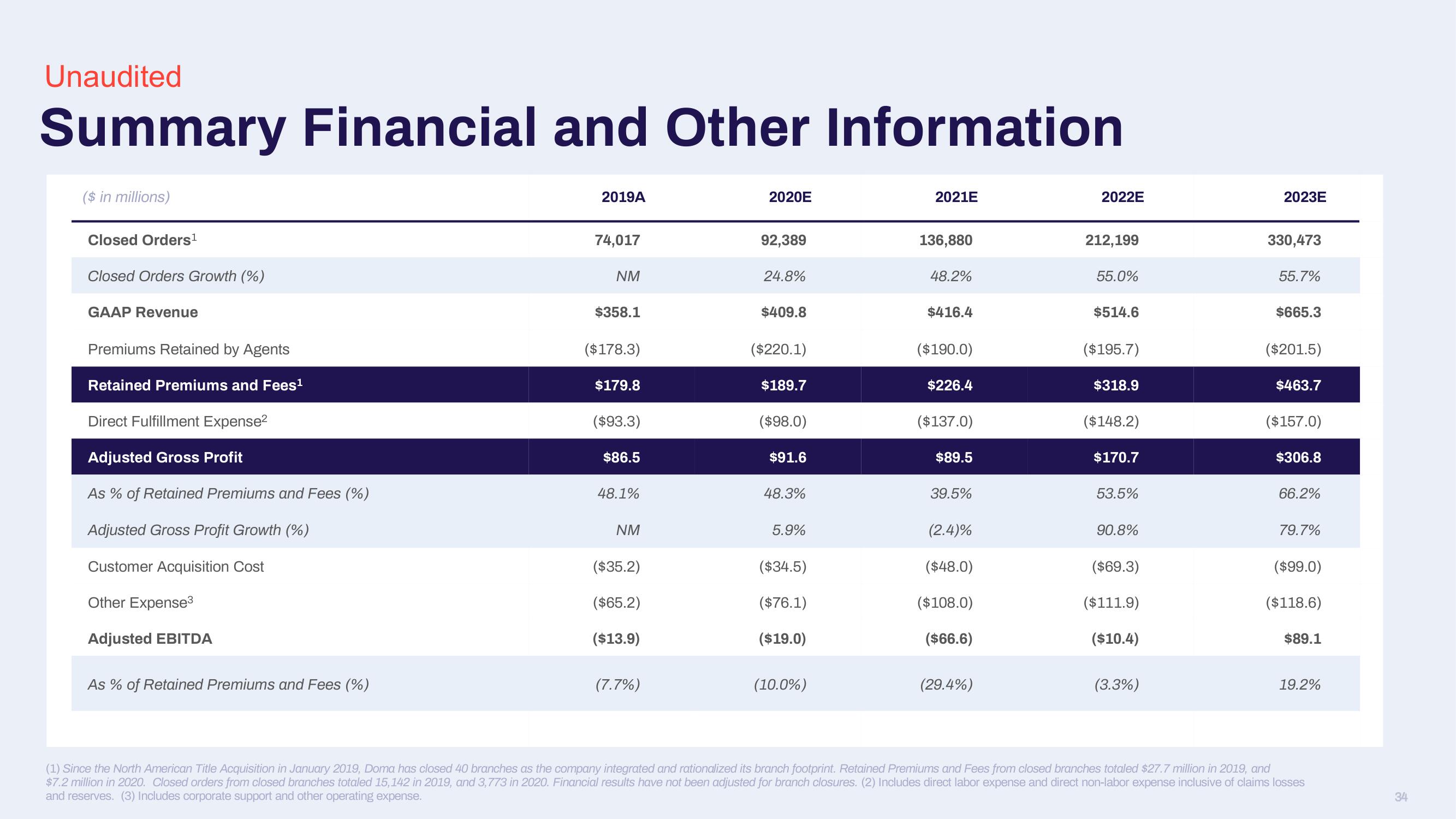

Summary Financial and Other Information

($ in millions)

Closed Orders¹

Closed Orders Growth (%)

GAAP Revenue

Premiums Retained by Agents

Retained Premiums and Fees¹

Direct Fulfillment Expense²

Adjusted Gross Profit

As % of Retained Premiums and Fees (%)

Adjusted Gross Profit Growth (%)

Customer Acquisition Cost

Other Expense³

Adjusted EBITDA

As % of Retained Premiums and Fees (%)

2019A

74,017

NM

$358.1

($178.3)

$179.8

($93.3)

$86.5

48.1%

NM

($35.2)

($65.2)

($13.9)

(7.7%)

2020E

92,389

24.8%

$409.8

($220.1)

$189.7

($98.0)

$91.6

48.3%

5.9%

($34.5)

($76.1)

($19.0)

(10.0%)

2021E

136,880

48.2%

$416.4

($190.0)

$226.4

($137.0)

$89.5

39.5%

(2.4)%

($48.0)

($108.0)

($66.6)

(29.4%)

2022E

212,199

55.0%

$514.6

($195.7)

$318.9

($148.2)

$170.7

53.5%

90.8%

($69.3)

($111.9)

($10.4)

(3.3%)

2023E

330,473

55.7%

$665.3

($201.5)

$463.7

($157.0)

$306.8

66.2%

79.7%

($99.0)

($118.6)

$89.1

19.2%

(1) Since the North American Title Acquisition in January 2019, Doma has closed 40 branches as the company integrated and rationalized its branch footprint. Retained Premiums and Fees from closed branches totaled $27.7 million in 2019, and

$7.2 million in 2020. Closed orders from closed branches totaled 15,142 in 2019, and 3,773 in 2020. Financial results have not been adjusted for branch closures. (2) Includes direct labor expense and direct non-labor expense inclusive of claims losses

and reserves. (3) Includes corporate support and other operating expense.

34View entire presentation