First Citizens BancShares Results Presentation Deck

Noninterest expense

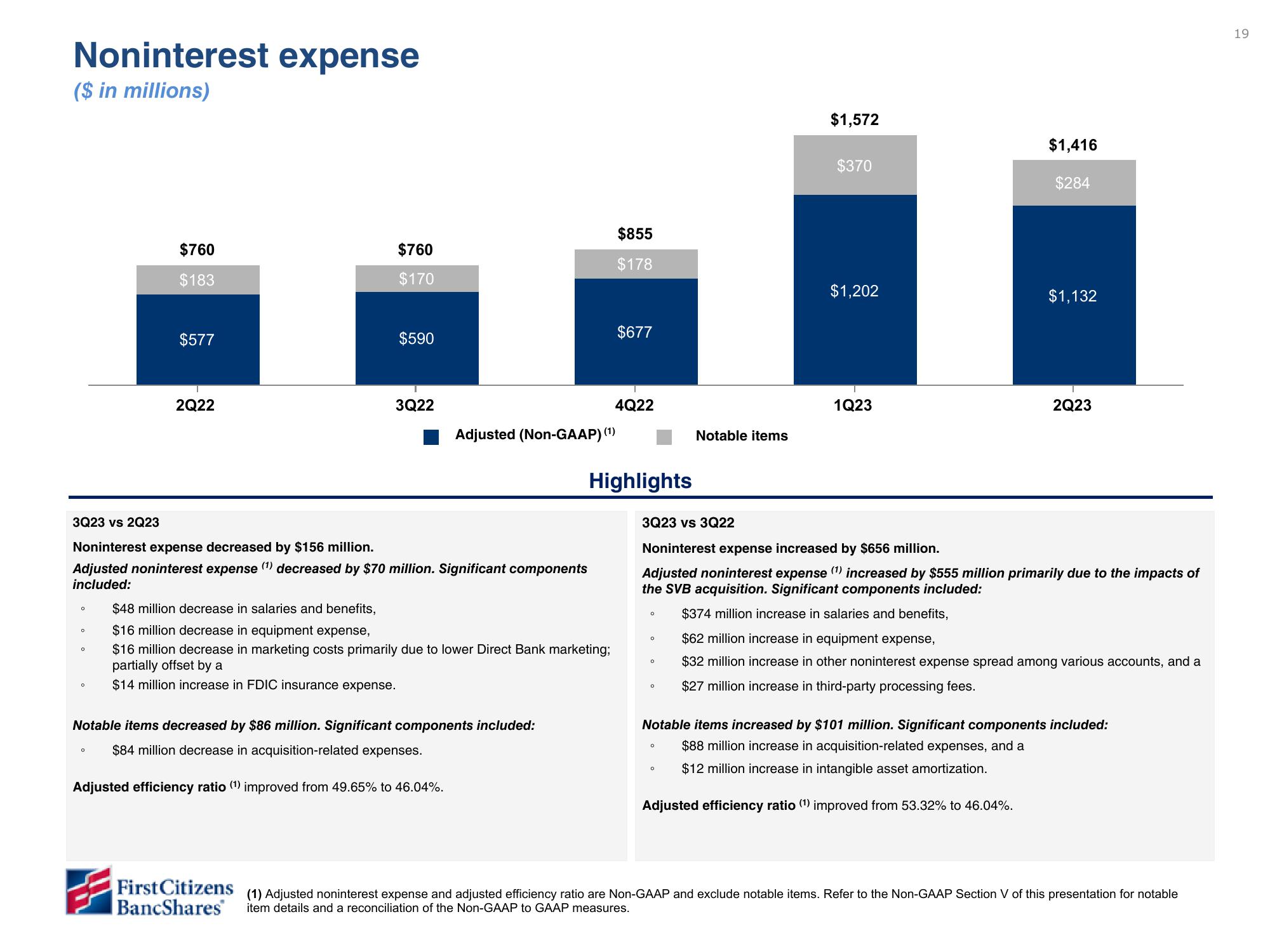

($ in millions)

O

o

O

$760

$183

$577

0

2Q22

3Q23 vs 2Q23

Noninterest expense decreased by $156 million.

Adjusted noninterest expense (¹) decreased by $70 million. Significant components

included:

$760

$170

$590

3Q22

First Citizens

BancShares

Adjusted (Non-GAAP) (¹)

Notable items decreased by $86 million. Significant components included:

$84 million decrease in acquisition-related expenses.

Adjusted efficiency ratio (¹) improved from 49.65% to 46.04%.

$48 million decrease in salaries and benefits,

$16 million decrease in equipment expense,

$16 million decrease in marketing costs primarily due to lower Direct Bank marketing;

partially offset by a

$14 million increase in FDIC insurance expense.

$855

$178

$677

4Q22

Highlights

O

O

0

O

Notable items

O

$1,572

0

$370

3Q23 vs 3Q22

Noninterest expense increased by $656 million.

Adjusted noninterest expense (¹) increased by $555 million primarily due to the impacts of

the SVB acquisition. Significant components included:

$374 million increase in salaries and benefits,

$62 million increase in equipment expense,

$32 million increase in other noninterest expense spread among various accounts, and a

$27 million increase in third-party processing fees.

$1,202

1Q23

$1,416

$284

$1,132

2Q23

Notable items increased by $101 million. Significant components included:

$88 million increase in acquisition-related expenses, and a

$12 million increase in intangible asset amortization.

Adjusted efficiency ratio (¹) improved from 53.32% to 46.04%.

(1) Adjusted noninterest expense and adjusted efficiency ratio are Non-GAAP and exclude notable items. Refer to the Non-GAAP Section V of this presentation for notable

item details and a reconciliation of the Non-GAAP to GAAP measures.

19View entire presentation