WeWork Restructuring Presentation Deck

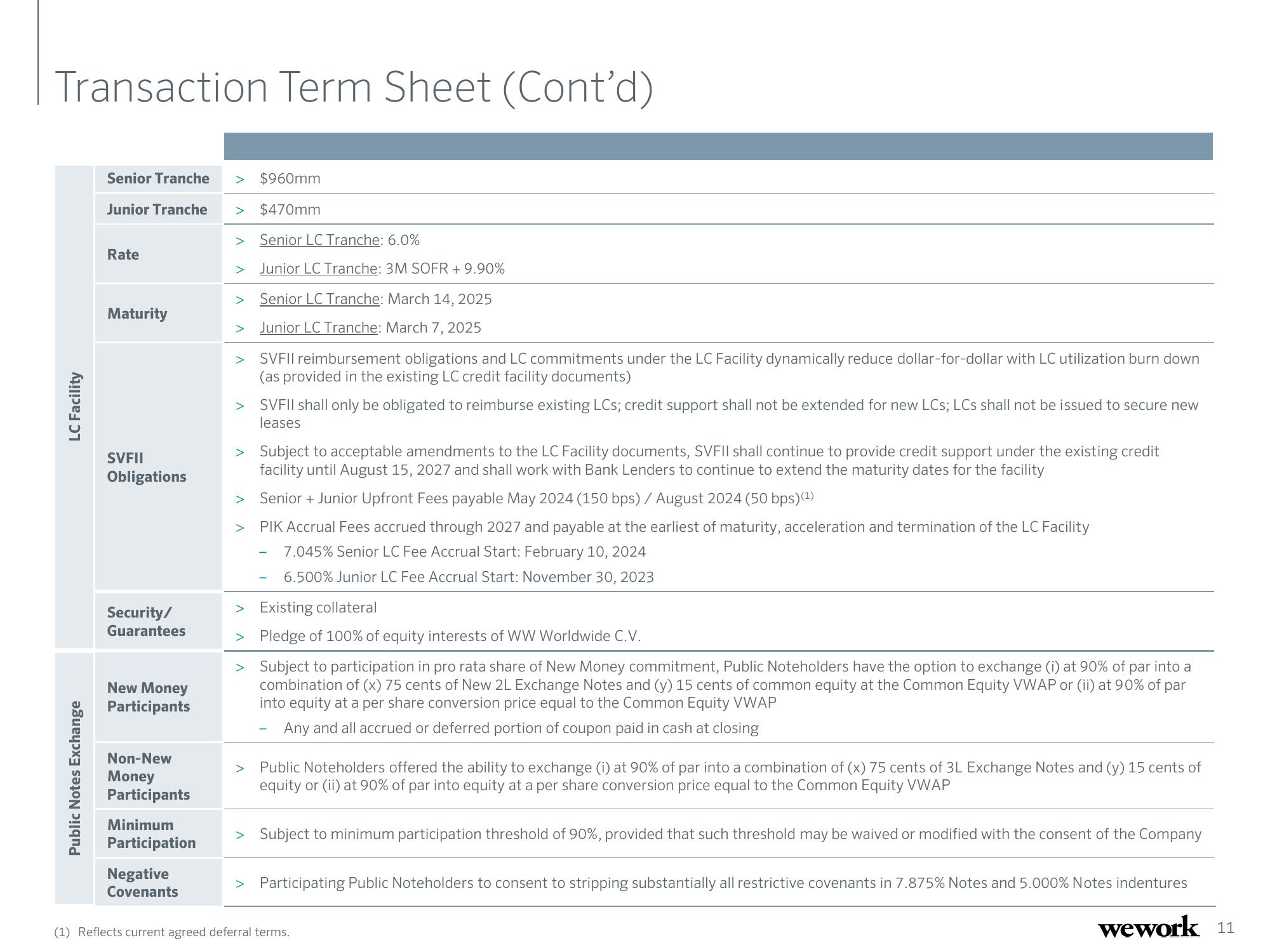

Transaction Term Sheet (Cont'd)

LC Facility

Public Notes Exchange

Senior Tranche > $960mm

Junior Tranche

$470mm

Senior LC Tranche: 6.0%

> Junior LC Tranche: 3M SOFR +9.90%

Rate

Maturity

SVFII

Obligations

Security/

Guarantees

New Money

Participants

Non-New

Money

Participants

Minimum

Participation

Negative

Covenants

Senior LC Tranche: March 14, 2025

Junior LC Tranche: March 7, 2025

SVFII reimbursement obligations and LC commitments under the LC Facility dynamically reduce dollar-for-dollar with LC utilization burn down

(as provided in the existing LC credit facility documents)

> SVFII shall only be obligated to reimburse existing LCs; credit support shall not be extended for new LCs; LCs shall not be issued to secure new

leases

>

>

> Subject to acceptable amendments to the LC Facility documents, SVFII shall continue to provide credit support under the existing credit

facility until August 15, 2027 and shall work with Bank Lenders to continue to extend the maturity dates for the facility

Senior + Junior Upfront Fees payable May 2024 (150 bps) / August 2024 (50 bps) (¹)

PIK Accrual Fees accrued through 2027 and payable at the earliest of maturity, acceleration and termination of the LC Facility

7.045% Senior LC Fee Accrual Start: February 10, 2024

6.500% Junior LC Fee Accrual Start: November 30, 2023

>

Existing collateral

> Pledge of 100% of equity interests of WW Worldwide C.V.

>

Subject to participation in pro rata share of New Money commitment, Public Noteholders have the option to exchange (i) at 90% of par into a

combination of (x) 75 cents of New 2L Exchange Notes and (y) 15 cents of common equity at the Common Equity VWAP or (ii) at 90% of par

into equity at a per share conversion price equal to the Common Equity VWAP

Any and all accrued or deferred portion of coupon paid in cash at closing

Public Noteholders offered the ability to exchange (i) at 90% of par into a combination of (x) 75 cents of 3L Exchange Notes and (y) 15 cents of

equity or (ii) at 90% of par into equity at a per share conversion price equal to the Common Equity VWAP

> Subject to minimum participation threshold of 90%, provided that such threshold may be waived or modified with the consent of the Company

> Participating Public Noteholders to consent to stripping substantially all restrictive covenants in 7.875% Notes and 5.000% Notes indentures

wework 11

(1) Reflects current agreed deferral terms.View entire presentation