Azerion SPAC Presentation Deck

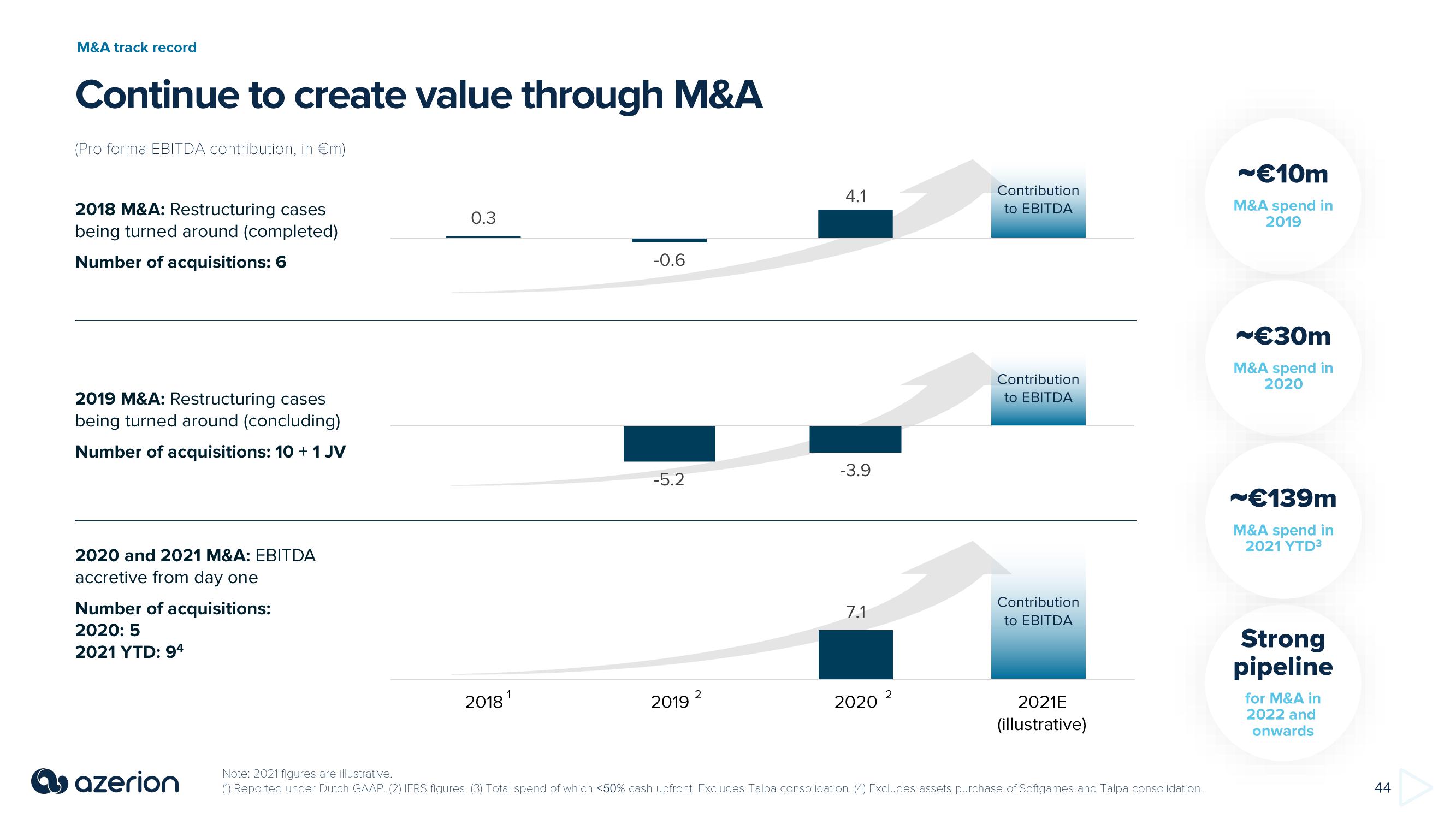

M&A track record

Continue to create value through M&A

(Pro forma EBITDA contribution, in €m)

2018 M&A: Restructuring cases

being turned around (completed)

Number of acquisitions: 6

2019 M&A: Restructuring cases

being turned around (concluding)

Number of acquisitions: 10 + 1 JV

2020 and 2021 M&A: EBITDA

accretive from day one

Number of acquisitions:

2020: 5

2021 YTD: 94

azerion

0.3

1

2018 ¹

-0.6

-5.2

2019

2

4.1

-3.9

7.1

2020

2

Contribution

to EBITDA

Contribution

to EBITDA

Contribution

to EBITDA

2021E

(illustrative)

Note: 2021 figures are illustrative.

(1) Reported under Dutch GAAP. (2) IFRS figures. (3) Total spend of which <50% cash upfront. Excludes Talpa consolidation. (4) Excludes assets purchase of Softgames and Talpa consolidation.

~€10m

M&A spend in

2019

~€30m

M&A spend in

2020

~€139m

M&A spend in

2021 YTD³

Strong

pipeline

for M&A in

2022 and

onwards

44View entire presentation