Dave Results Presentation Deck

Attractive variable

margin

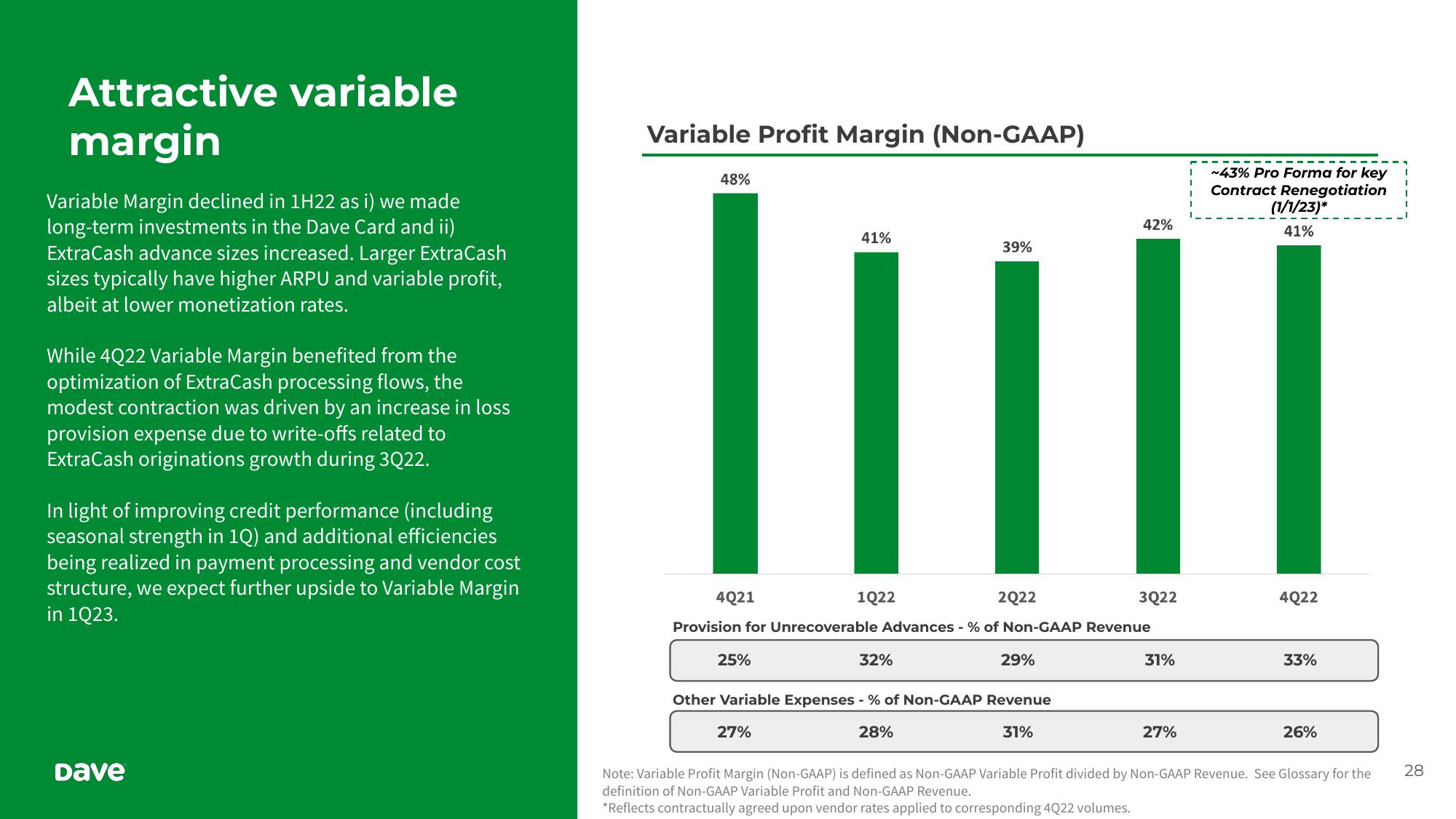

Variable Margin declined in 1H22 as i) we made

long-term investments in the Dave Card and ii)

ExtraCash advance sizes increased. Larger ExtraCash

sizes typically have higher ARPU and variable profit,

albeit at lower monetization rates.

While 4Q22 Variable Margin benefited from the

optimization of ExtraCash processing flows, the

modest contraction was driven by an increase in loss

provision expense due to write-offs related to

ExtraCash originations growth during 3Q22.

In light of improving credit performance (including

seasonal strength in 1Q) and additional efficiencies

being realized in payment processing and vendor cost

structure, we expect further upside to Variable Margin

in 1Q23.

Dave

Variable Profit Margin (Non-GAAP)

48%

41%

25%

1Q22

39%

32%

4Q21

Provision for Unrecoverable Advances - % of Non-GAAP Revenue

2Q22

29%

42%

Other Variable Expenses - % of Non-GAAP Revenue

27%

28%

31%

3Q22

31%

27%

~43% Pro Forma for key

Contract Renegotiation

(1/1/23)*

41%

4Q22

33%

26%

Note: Variable Profit Margin (Non-GAAP) is defined as Non-GAAP Variable Profit divided by Non-GAAP Revenue. See Glossary for the

definition of Non-GAAP Variable Profit and Non-GAAP Revenue.

*Reflects contractually agreed upon vendor rates applied to corresponding 4Q22 volumes.

28View entire presentation