Barclays Investment Banking Pitch Book

ETP / PennTex Transaction Overview

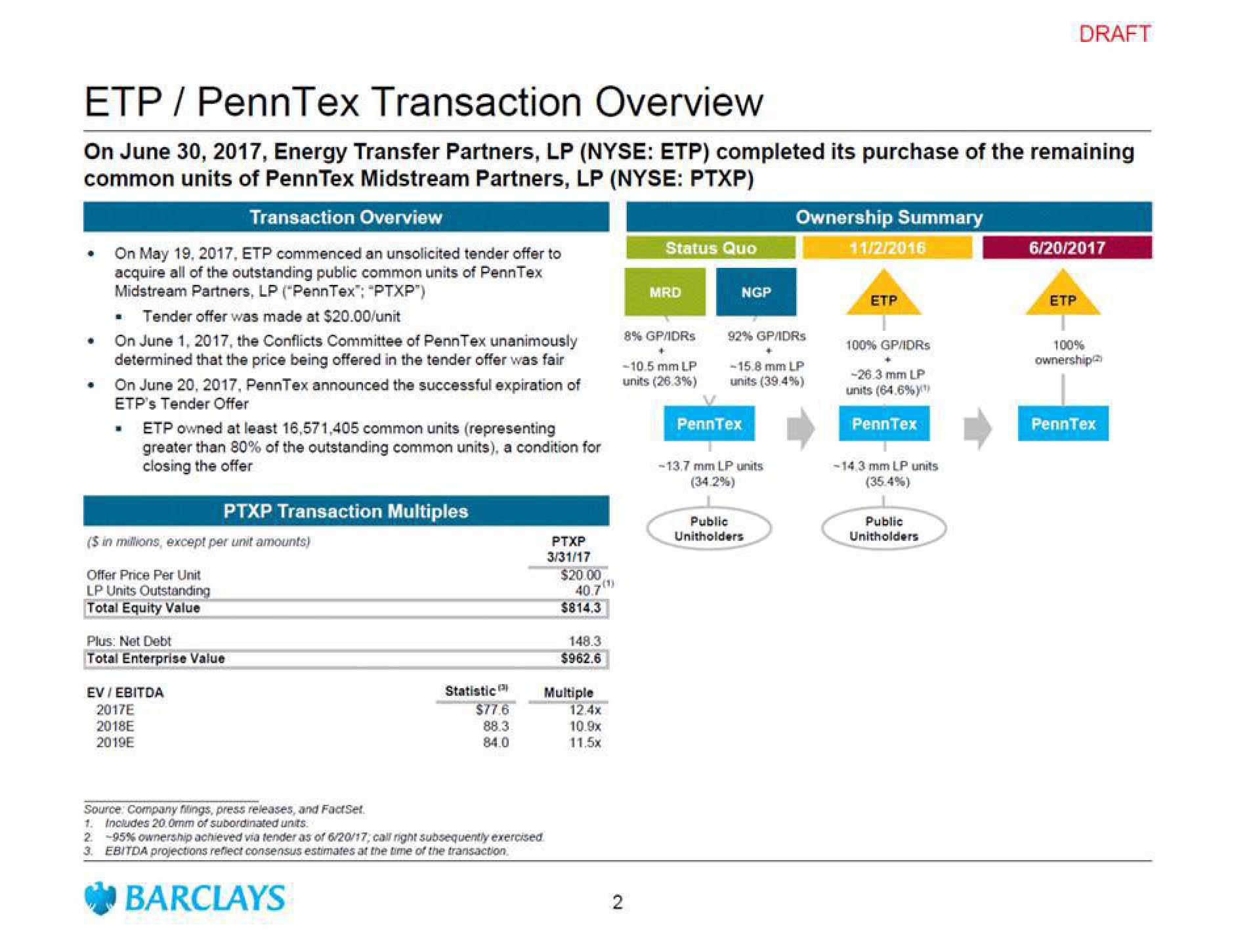

On June 30, 2017, Energy Transfer Partners, LP (NYSE: ETP) completed its purchase of the remaining

common units of PennTex Midstream Partners, LP (NYSE: PTXP)

Transaction Overview

On May 19, 2017, ETP commenced an unsolicited tender offer to

acquire all of the outstanding public common units of Penn Tex

Midstream Partners, LP ("PennTex":"PTXP")

■ Tender offer was made at $20.00/unit

On June 1, 2017, the Conflicts Committee of PennTex unanimously

determined that the price being offered in the tender offer was fair

On June 20, 2017, PennTex announced the successful expiration of

ETP's Tender Offer

ETP owned at least 16,571,405 common units (representing

greater than 80% of the outstanding common units), a condition for

closing the offer

($ in millions, except per unit amounts)

Offer Price Per Unit

LP Units Outstanding

Total Equity Value

PTXP Transaction Multiples

Plus: Net Debt

Total Enterprise Value

EV / EBITDA

2017E

2018E

2019E

Source Company filings, press releases, and FactSet.

1. Includes 20.0mm of subordinated units.

Statistic

BARCLAYS

$77.6

88.3

84.0

2. -95% ownership achieved via tender as of 6/20/17, call right subsequently exercised

3. EBITDA projections reflect consensus estimates at the time of the transaction.

PTXP

3/31/17

$20.00

40.7)

$814.3

148.3

$962.6

Multiple

12.4x

10.9x

11.5x

Status Quo

2

MRD

8% GP/IDRS

+

-10.5 mm LP

units (26.3%)

NGP

92% GP/IDRS

-15.8 mm LP

units (39.4%)

PennTex

Ownership Summary

-13.7 mm LP units

(34.2%)

Public

Unitholders

11/2/2016

ETP

100% GP/IDRs

-26.3 mm LP

units (64.6%)*

Penn Tex

-14.3 mm LP units

(35.4%)

Public

Unitholders

DRAFT

6/20/2017

ETP

100%

ownership

PennTexView entire presentation