Pathward Financial Results Presentation Deck

7.70%

$3.5

1Q23

$3.5

$0.3

$3.0

1Q23

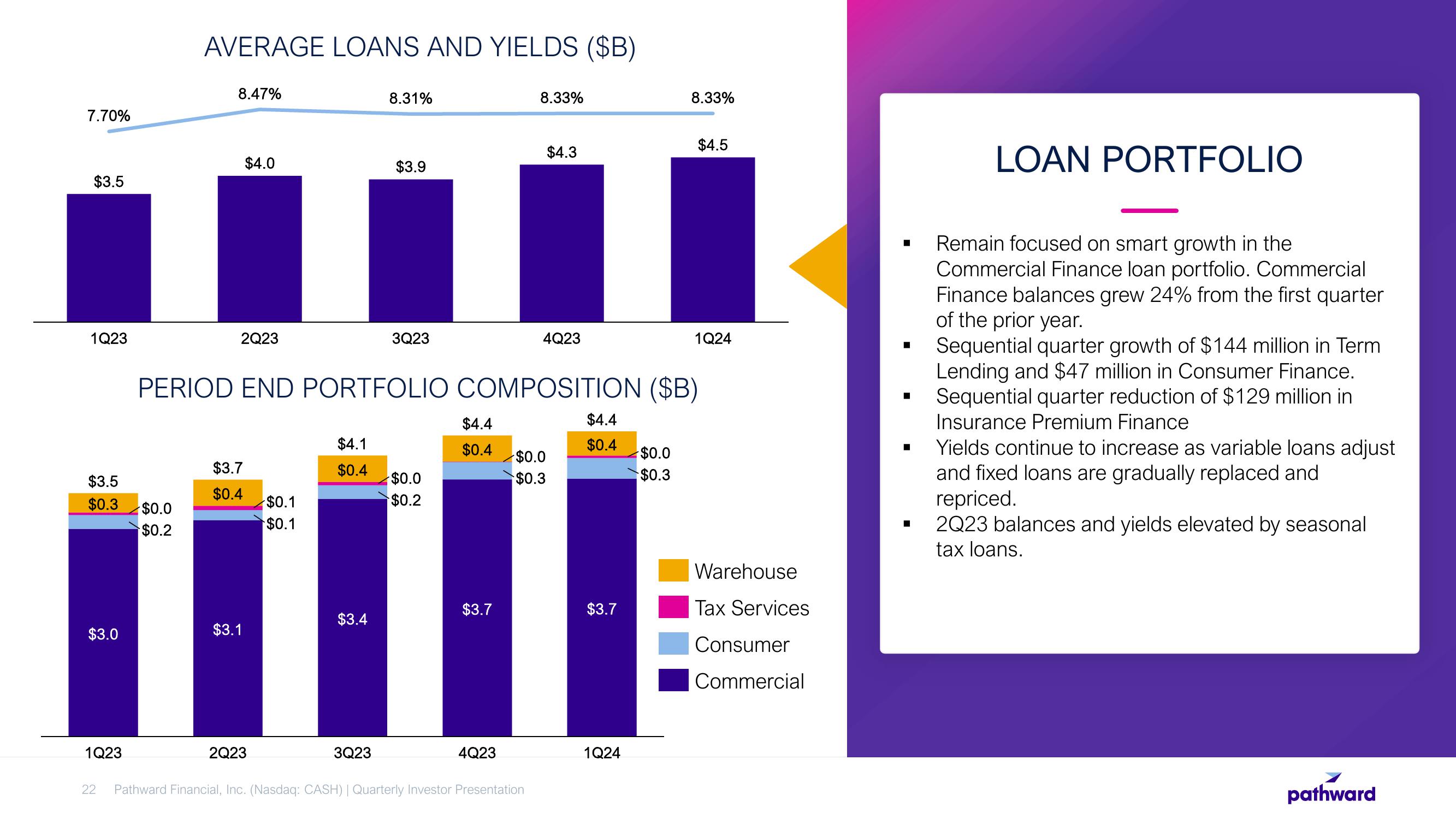

AVERAGE LOANS AND YIELDS ($B)

$0.0

$0.2

8.47%

2Q23

$4.0

$3.7

$0.4

$3.1

2Q23

$0.1

$0.1

$4.1

$0.4

$3.4

8.31%

3Q23

$3.9

PERIOD END PORTFOLIO COMPOSITION ($B)

3Q23

-$0.0

$0.2

$4.4

$0.4

$3.7

4Q23

8.33%

22 Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

$4.3

4Q23

$0.0

$0.3

$4.4

$0.4

$3.7

1Q24

8.33%

$0.0

$0.3

$4.5

1Q24

Warehouse

Tax Services

Consumer

Commercial

I

LOAN PORTFOLIO

Remain focused on smart growth in the

Commercial Finance loan portfolio. Commercial

Finance balances grew 24% from the first quarter

of the prior year.

Sequential quarter growth of $144 million in Term

Lending and $47 million in Consumer Finance.

Sequential quarter reduction of $129 million in

Insurance Premium Finance

Yields continue to increase as variable loans adjust

and fixed loans are gradually replaced and

repriced.

2Q23 balances and yields elevated by seasonal

tax loans.

pathwardView entire presentation